On August 17, Tilray (NASDAQ: TLRY) made the announcement that they formed a new limited partnership with other strategic investors, which then acquired U$165.8 million in MedMen Enterprises (CSE: MMEN) convertible debt and accompanying warrants from Gotham Green Partners. Tilray is expected to issue 9 million shares, as long as they receive stockholder approval to issue more shares, for 75% of the outstanding debt and 68% of the warrants in the limited partnership. This effectively allows Tilray to potentially own 21% of MedMen as a whole.

Concurrently, Medmen also announced that they sold approximately 416.66 million units to a syndicate of investors lead by Serruya Privat Equity for U$100 million. The units allow for 1 share and one-quarter warrant which has an expiry of 5 years and an exercise price of U$0.288.

Canaccord Genuity, who has a hold rating and U$17 price target on Tilray says that this gives Tilray a solid entry footprint into the U.S, but warns that “the MedMen turnaround story is far from over, the company’s potential need for additional capital and/or further debt relief could have a material impact on the eventual value Tilray is able to crystalize from this arrangement.”

Cantor Fitzgerald, who has a U$19 price target and overweight rating, meanwhile saw analyst Pablo Zuanic comment that this news adds “credence to the US optionality story.” Zuanic elects to not look at this agreement in a vacuum but rather argues that this is the start of a much larger acquisition spree. He says, with Tilray’s guidance of $1-$1.5 billion in US THC sales at some point, Medmen offers little at $120 million, therefore they will be looking for more option agreements to help bridge this gap.

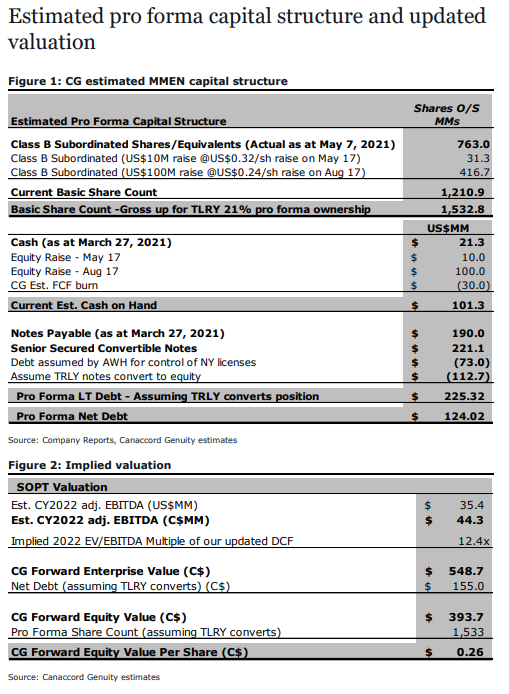

Now for MedMen, Canaccord Genuity raised their 12-month price target to C$0.25 from $0.00 but reiterated their sell rating, saying that Tilray now adds financial flexibility and a potential long-term partner. They believe between the $166 million debt extension and $100 million cash infusion, it provides management with more time to execute on its turnaround and growth objectives.

Although Cantor Fitzgerald reiterates many of the same points, they raised their 12-month price target to $0.30 from $0.00 and rating to neutral from underweight on Medmen.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

thank you for sharing this very interesting post with us i really enjoyed reading about it, it is very helpful with great information.where did you get this idea?