Yesterday, Aurora Cannabis (TSX: ACB) (NYSE: ACB) provided a business update. The firm announced that they have found a permanent CEO, appointing Miguel Martin, while Michael Singer, the interim CEO, is now the Executive Chairman. Alongside Aurora announcing that they have found a new permanent CEO, they reported preliminary fourth-quarter revenue and gross margin results.

Fourth-quarter revenue has been guided to come in between $70 to $72 million, of which $66 to $68 million is Cannabis net revenue, and gross margins will be between 46% to 50%. They also announced a significant write-down on several line items, including up to $90 million in impairments on production facilities, $140 million in inventory impairments, and a $1.6 to $1.8 billion impairment on goodwill and intangibles.

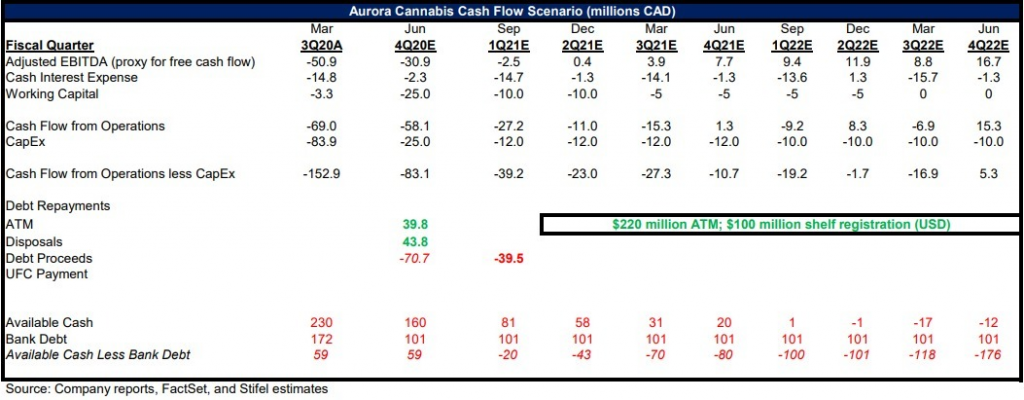

In an update note this morning, Stifel’s W. Andrew Carter downgraded Aurora Cannabis to a Hold and lowered their 12-month price target to C$10.50 from C$16 as a result of the material change. He says that obviously, the business update was viewed negatively with softer fundamentals. Still, the reduced near-term balance sheet risk is underappreciated. It could possibly position Aurora well if they can show more robust and more consistent execution in the Canadian adult-use market.

With Aurora providing preliminary fourth-quarter revenue and gross margins, Stifel has revised not only their fourth-quarter estimates but also their full-year 2021 and 2022 estimates. Carter now estimates Aurora to generate $72 million in sales with an adjusted EBITDA loss of $31 million in the fourth quarter, compared to the previous estimate of $76 million in sales and a $17 million loss. As for their full-year revenue estimates for 2021, Carter now estimates that they will hit $458 million, down from $490 million, with $47 million in EBITDA for 2020. 2022 revenue estimates have also been revised, with Stifel now estimating $458.1 million compared to the previous estimate of $490 million.

As said above, Stifel believes that with the announced amended covenants for their debt load it makes the near-term balance sheet flexible, which he says is “underappreciated with the debt a key risk.” With the updated cash balance and what’s left in the at-the-market financing, it “suggests Aurora reduced a significant portion of its debt during the quarter,” he said.

In the last paragraph, Carter states, “our revised outlook requires Aurora to keep pace with the Canadian adult-use market’s growth from the lower near-term base. And while this outlook is less demanding, it will be difficult to take a more positive approach to the shares without demonstrated sustainable growth.” Which perfectly encapsulates the very weak bull thesis on Aurora.

Information for this briefing was found via Sedar and Aurora Cannabis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.