Canada’s central bank embarked on yet another hawkish tightening cycle, this time raising its overnight policy rate by 50 basis points for the second time in a row.

Policy makers led by Governor Tiff Macklem brought borrowing costs to 1.5% on Wednesday morning, acknowledging that inflation is a lot more entrenched and persistent than its April forecasts indicated. In fact, the bank warned that price pressures will likely intensify even more in the coming months, with the risk of becoming ingrained at high levels across all sectors of the economy.

As a result, the Bank of Canada said it “is prepared to act more forcefully if needed to meet its commitment to achieve the two per cent inflation target,” fuelling speculation that policy makers may adopt a more sharper pace of monetary tightening. Markets are anticipating another 50 basis-point increase come the July 13 policy meeting, after which the bank may reduce its pace of monetary tightening in the second half of 2022.

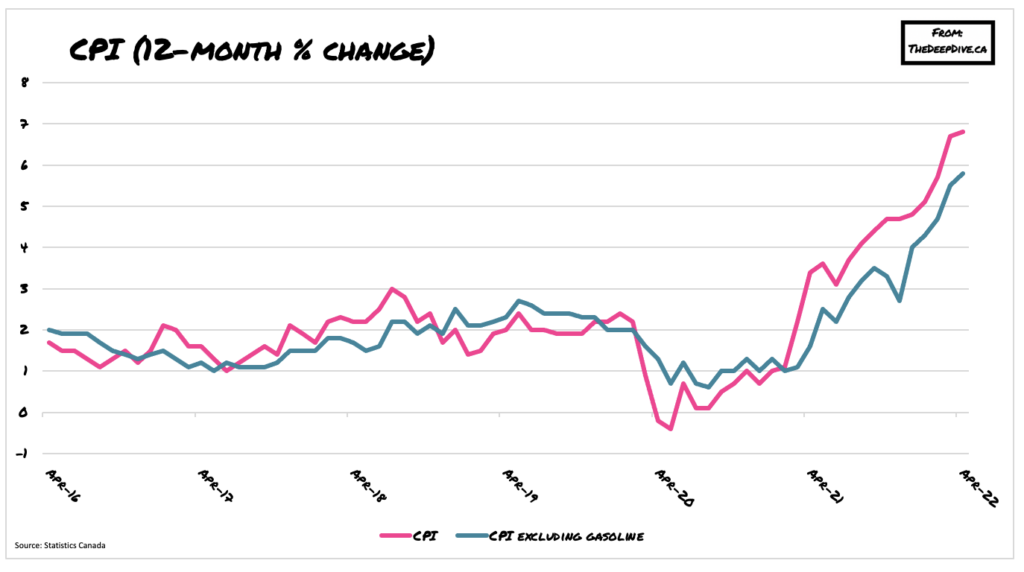

Such consecutive massive interest rate hikes are unorthodox for the Bank of Canada, but given that inflation currently sits at an unprecedented 6.8%, Macklem estimates that borrowing costs will need to hit anywhere between 2% to 3% in order to noticeably cool the economy.

Information for this briefing was found via the Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.