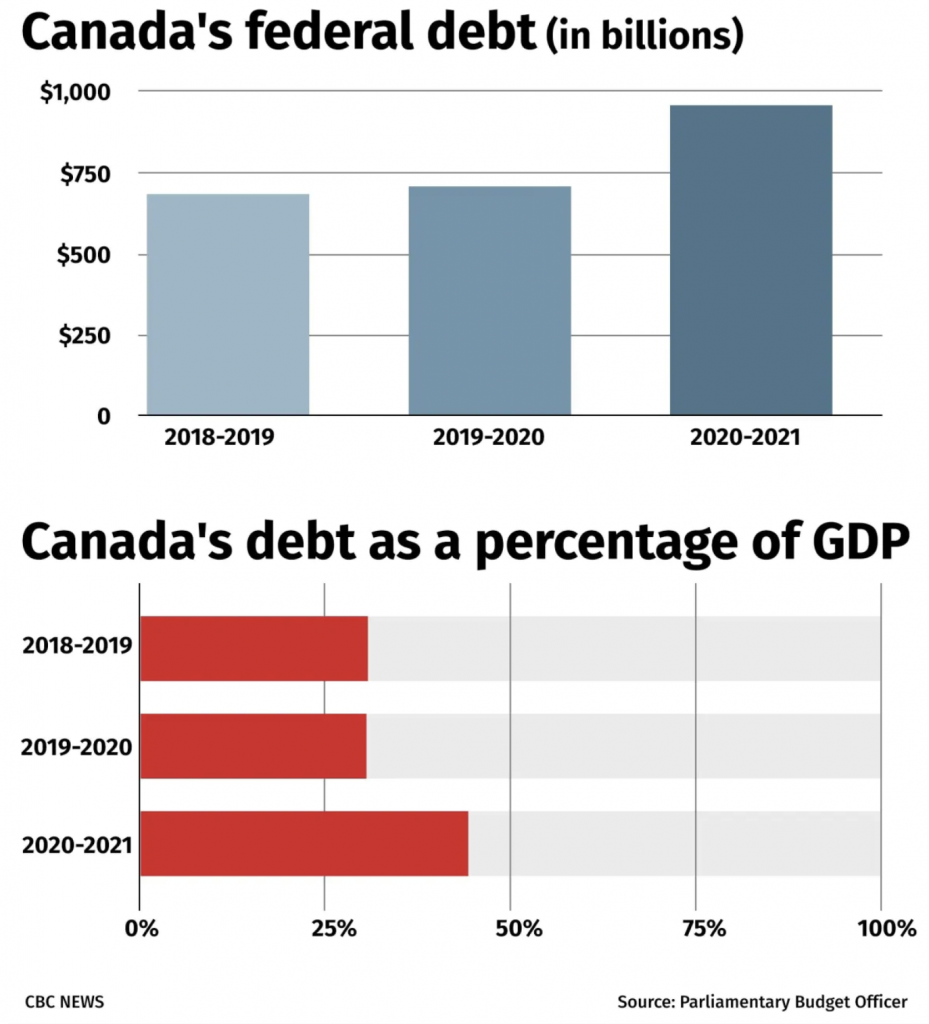

The coronavirus pandemic brought about significant changes to Canada’s economy, causing many Canadians to change their behaviour in terms of consumption. As a result, the Bank of Canada (BOC) is anticipating the country’s recovery to take place in two stages, as Canadians gradually begin to revert to pre-pandemic output.

According to Deputy Governor Lawrence Schembri, strict stay-at-home orders and the shutdown of non-essential businesses and services has caused consumers to change their behaviour as a means of adapting to a stark new reality. Many Canadians had lost their jobs during the pandemic, and became reliant on government financial aid as a means of income; as a result, they began buying less and opted out of non-essential consumption.

Although some restrictions are being lifted and people are beginning to return to work, the sudden change in consumer behaviour continues to dominate. Canadians have been purchasing more essential goods such as food, personal care products, and cleaning supplies, while reducing their consumption of non-essential goods and services such as clothing, cars, entertainment, dining, and travel. Online sales however, have been the predominant mode of retail shopping, and have increased 40% compared to the previous year.

In the meantime, the BOC is anticipating Canada’s economy to adapt to two stages of recovery, with the first phase reflecting a sudden economic uptake, followed by the second phase which will most likely reflect sporadic growth alongside some degree of uncertainty.

In the first stage, the gradual reopening of the economy will cause unemployment levels to decrease, and spending to increase. Some of the purchases that Canadians were putting off during the pandemic such as clothing, cars, and personal care services will be on rise. However, consumers will not be as reluctant to take on debt as before the pandemic, most likely because their level of income has changed.

According to the BOC, the second stage will be subject to some degree of uncertainty, given that the outcome of the virus is still unclear. The pandemic has caused many sectors of the economy to contract, causing the recovery in job growth to be sporadic. The sectors that are dominant in energy production will have a slow recovery, meanwhile the sectors that were hardest-hit such as retail stores and restaurants are expected to bounce back rather quickly. On the other hand, areas such as sporting events, travel, and in-restaurant dining will not be able to recover as quickly as hoped due to the lingering effects of the pandemic.

Information for this briefing was found via Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.