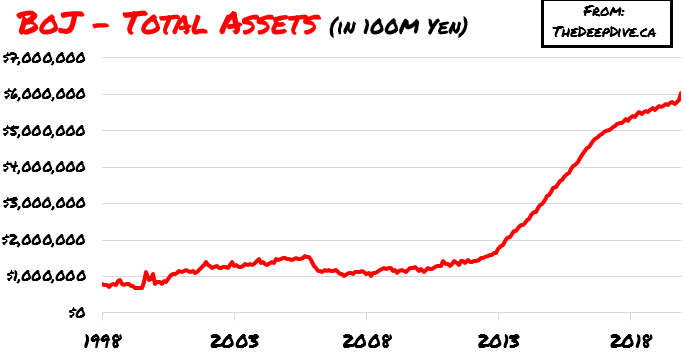

This morning the Bank of Japan cranked up their new stimulus with government measures aimed at supporting their economy through the pandemic. The BOJ’s program has three primary goals:

- Increasing Commercial Paper and Corporate Bond Buying

- Unlimited Government Bond Buying

- New Corporate Funding Measures

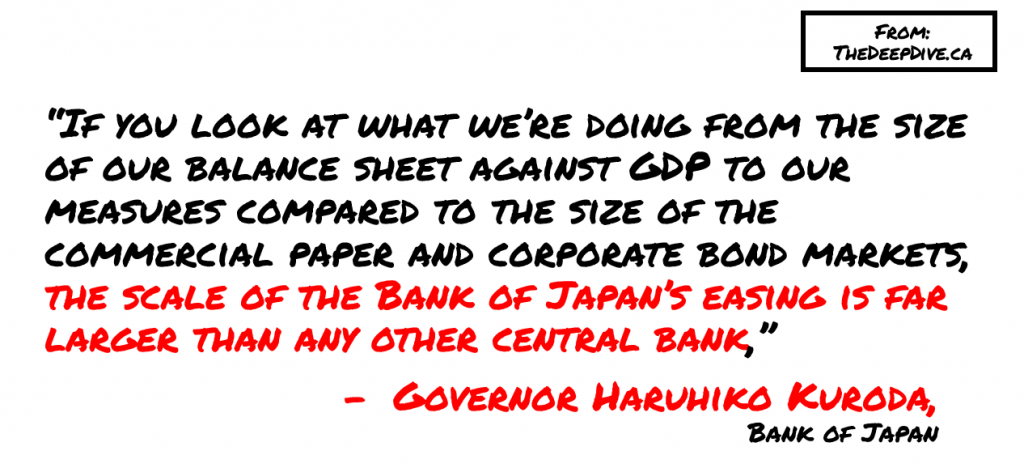

Kuroda defended his efforts during a briefing after the decision. He acknowledged that achieving 2% inflation would no longer be a part of his legacy; but made it clear they still plan to ‘out print’ the Western world.

Corporate Bonds: Buying Longer Durations and Larger Amounts

The bank increased their total corporate bond program to buy upto 20T yen ($186US). They extended the maturity rules of this program from a maximum duration of 3 years to 5 years. And they changed a rule increasing the maximum amount of corporate bonds and commercial paper for a single entity to 50%; previously 30% for CBs and 25% for CP.

That’s not all on the corporate side, the BOJ also decided to pay financial institutions for borrowing money from the central bank. Under this new loan program, the BOJ will now pay 0.1% interest to financial institutions that tap the loan program.

Government Bonds: QE Unlimited, No For Real

The BOJ also removed their guidance to buy 80T yen per year of government bonds, increasing the program to unlimited purchases; with a pledge to buy as much as need. These additional measures will support the fiscal side, where Prime Minister Shinzo Abe’s announced a program in excess of $1 trillion.

The Nikkei 225 stock index finished the day up 2.71% closing at 19,783.22.

Information for this analysis was found via the Bank of Japan and St Louis Fed. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

2 Responses

Japan prints more money than the rest of the world. Inflation goes to 0.7%. Yippeee!

The simply can’t get an velocity going on this thing.