On August 25, NG Energy (TSXV: GASX) reported its second quarter financial results. Although there is not too much to them as they are still pre-production, the company had a net loss of $0.9 million or ($0.01) per share. The company additionally ended the quarter with $3.43 million in cash on hand and $0.56 million in accounts receivables.

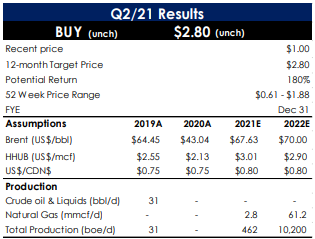

Beacon Securities is the only firm to cover the stock. They currently have a buy rating and a C$2.80 12-month price target which represents a 180% upside.

Beacon’s analyst, Kirk Wilson, says that the results came in line and the big question this quarter was the company’s debt profile. The company ended the quarter with net debt of $1.9 million, this is down from the net cash position they held last quarter. Wilson comments that this quarter there was a $4 million capital expense related to the Istanbul-1 re-entry and testing.

Wilson says that the next step is to watch for approvals as the companies Maria Conchita and Sinu-9 Blocks have been delayed due to COVID-19 headwinds and social unrests within Colombia. They believe that the environmental approvals at the Maria Conchita block should come by the end of the third quarter. This will allow the Aruchara-1 and Istanbul-1 wells to commence production.

The company is also waiting for environmental approvals at its Sinu-9 Block, which Beacon believes they will get soon. They say, “Once that box is checked, GASX can begin its exploration drilling. Each of the four wells in the initial drilling phase at Sinu-9 has the potential for 15-30 mmcf/d gross (72% WI).”

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive has been compensated to provide coverage on this company. The company has been compensated to cover this story on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.