Beleave Inc (CSE: BE) has recently returned to several investor radars after their latest news release. Within, they indicated that Health Canada had served notification of a pre-sales inspection. The inspection, to be conducted February 8, 2018, is one of the few items that remains between Beleave and consistent operational revenues.

Investors have not taken this news lightly. Even with the market in an overall downtrend, Beleave has managed to remain somewhat afloat when compared to its peers. Being so close to operational revenues can do that to an equity. But how does it compare to it’s peers, and what makes the company so special? We’re here to find out.

Beleave Inc: A Three Point Snapshot

1. The current facility is small

Although Beleave Inc may currently have a cultivation license, make no mistake. Their current facility is quite small. Measuring up at 14,500 square feet, it’s a common size for a facility circa 2016. Two years later, that’s not exactly the same case.

As a result of this size, the facility can produce roughly 550 KG of dried cannabis flower per annum. In terms of dollars, at an average price of $7.00 that equates to approximately $3.85 million in revenues each year. It’s still more than you or I likely make in a year, but relative to the sector it’s a small figure.

The bright side to this however, is that the company recognizes the need for more grow space. As a direct result of this, they have two expansions currently underway. In total, these expansions will add roughly 266,000 square feet under their scope. More on that in a minute.

It should also be noted that Beleave has a license to produce concentrates such as cannabis oil for this facility. This license was received on December 4, 2017.

2. Beleave currently has two agreements with Cannabis Wheaton

If there is one thing that can be said about Beleave Inc, it’s that they not only care about their shareholder, but their share structure too. This fact is highly evident based on having not one, but two agreements with Cannabis Wheaton Income Corp. The idea behind these agreements is that while they provide funding to the company for expansion purposes, this money does not come at the expense of investors.

However with that being said, these agreements do not come without cost. While avoiding adding dilution to the share structure they effectively saddled their future revenues, resulting in a slight Catch-22 for investors. Would you rather the company take on dilution, or take on streaming agreements?

The jointly owned facility

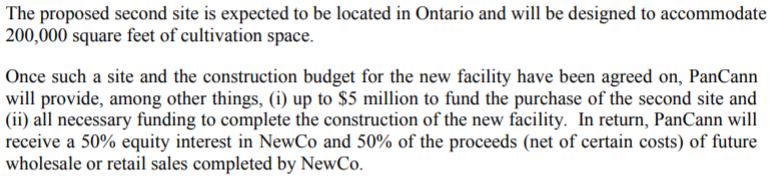

The first deal that Beleave signed with Cannabis Wheaton was for the expansion of an undetermined second facility. Essentially, Beleave would establish a new subsidiary, of which 50% ownership belonging to Cannabis Wheaton. Further details are outlined in the snipped below, from their May 5, 2017 press release.

Essentially, this deal is a way for Cannabis Wheaton to acquire a source of cannabis product. They will own 50% of the production at the facility, with Beleave remaining responsible for all crops produced in the facility. This in effect will result in Beleave collecting a small management fee for Wheaton’s portion of the facility. The benefit to Beleave in this scenario, is that they are not required to fund the construction of the second facility, and are responsible for only fifty percent of the operating expenses.

The D.O.P.E. Note

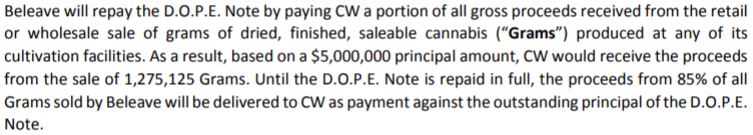

The second arrangement signed between Beleave Inc and Cannabis Wheaton, is what would come to be known as the “DOPE Note”. DOPE, as in “debt obligation repayable in product equivalents”, which also may or may not be a coincidental play on words.

Essentially, it’s an agreement wherein Cannabis Wheaton will advance funds to Beleave in exchange for the promise from Beleave that they’ll pay off the debt with dried cannabis flower revenues. There’s some stipulations to that though, as can be seen below.

Let’s examine this snippet of text from the news release for the deal a little closer. “Until the D.O.P.E. Note is repaid in full, the proceeds from 85% of all Grams sold by Beleave will be delivered to CW as payment against the outstanding prinicipal”. This inherently indicates that once the advancement of funds from Cannabis Wheaton to Beleave Inc occurs, Beleave will be on the hook to hand over 85% of its revenues – not profit – to Cannabis Wheaton until their debt is paid. It should also be noted that Beleave is obligated to pay this debt off in 24 months from the date of advancement, or interest charges of 10% will apply.

The cash was forwarded on October 17, 2017. As of yet, the company does not have a sales license and thus cannot incur revenues.

Lastly, one more item needs to be noted on this topic. CW is to receive proceeds from the sale of 1,275,125 grams of dried cannabis flower. As it stands, Beleave only has the capacity to produce 550,000 grams on an annual basis. Based on the terms of the loan, the company must get a second facility online and licensed within roughly a years time in order to prevent an interest charge from occurring.

That’s an awful lot of headache in exchange for an additional 66,000 square foot facility.

3. Beleave’s Share Structure

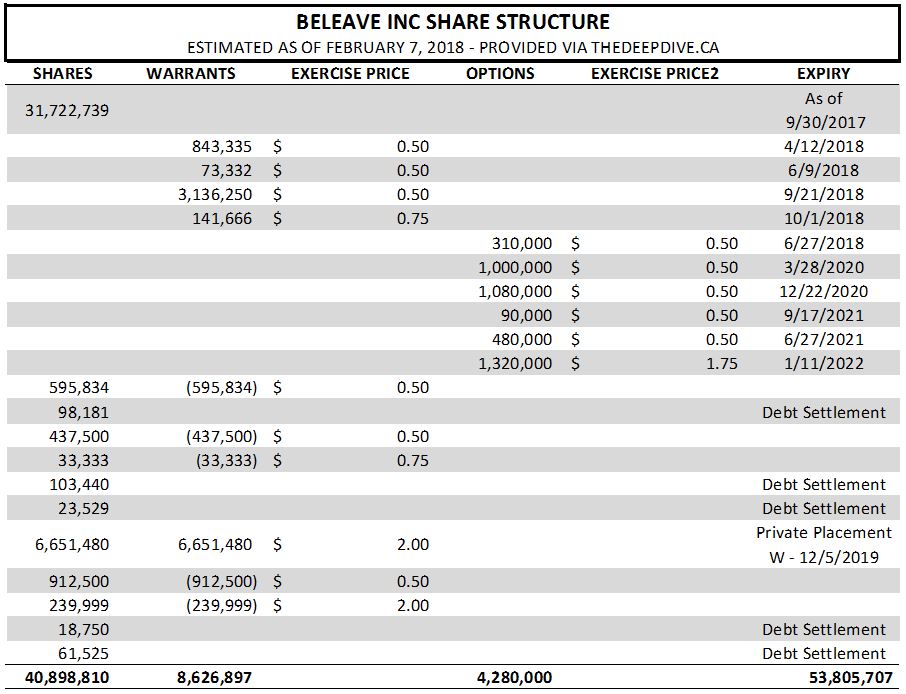

As we previously identified, Beleave has gone through leaps and bounds so as to not erode its current share structure. While they’re pinching pennies in order to achieve two facility expansions, it has truly paid off when examining their share structure.

Overall, as of today Beleave Inc is estimated to have a tiny 40,898,810 shares outstanding. As of the closing price of $2.25 on February 6, this gives the company a market valuation of $92.02 million. On a fully diluted basis, the valuation jumps a bit to $121.06 million. Not bad for a company that currently only has the capacity to produce $3.85 million worth of product on an annual basis.

Closing Remarks

The lengths that management at Beleave has gone through in order to preserve the companies share structure is certainly admirable. However, this is not without its costs. By receiving only 15% of the revenue from the sale of dried cannabis product until Cannabis Wheaton is paid back, they are placing themselves at a major disadvantage. At an average sale price of $7 per gram, that means production costs have to be at $1.05 or lower just to break even. This doesn’t take in to account the associated business expenses either.

As a result of this, we view Beleave as a slightly risky play. Even if they are to receive their sales license in short order, it doesn’t change the current viability. It’s likely that in the end they’ll have to perform a private placement in order to cover the costs of the Cannabis Wheaton deal anyways. And if that occurs, this was a lot of wasted effort by management.

Do the math. Check to see if the numbers make sense. Dive Deep.

Information for this analysis was found via The CSE, SEDAR, and Beleave Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

Understanding Cheque Swaps

If you are investing in cannabis stocks or stocks in general in Canada, a term...