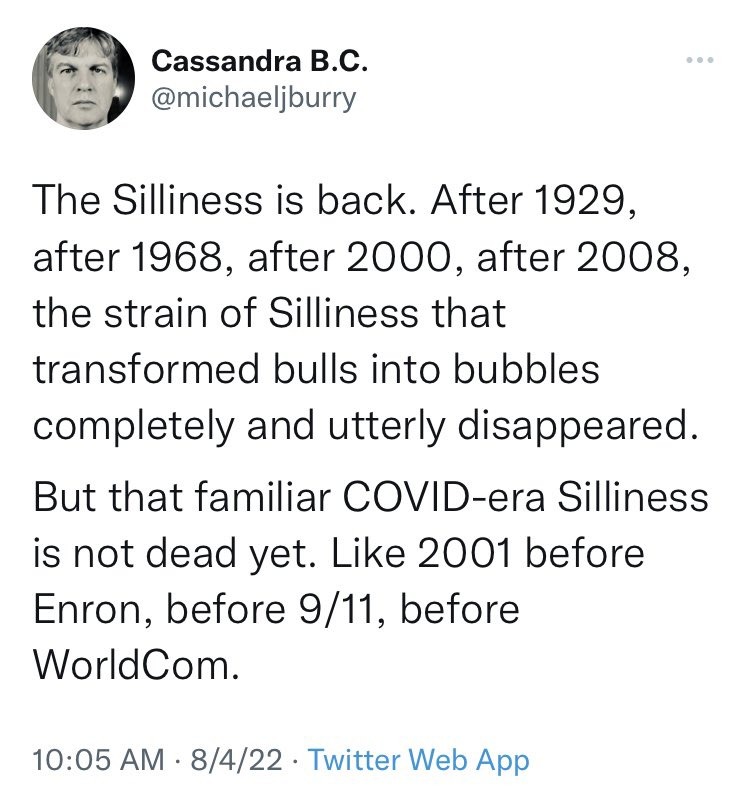

It’s not yet time to breathe a sigh of relief. “Silliness is back,” according to Michael Burry.

The investor and hedge fund manager took to Twitter on Thursday to caution people about “silliness” in the markets as stocks rally and rebound from 2022 lows.

The investor compares today’s COVID-era markets to 2001 before the September 11 attacks, and also refers to the dot-com bubble period before the Enron and WorldCom scandals. In the past few months, Burry has been talking about how the surge in asset prices from the pandemic will lead up to a historic crash. In June, Burry said that the market was just halfway through its plunge, only for stocks to rebound just over a month after.

“But that familiar COVID-era silliness is not dead yet,” Burry said. And as he is wont to do, he deleted the tweet shortly after.

Burry is the founder and CEO of Scion Asset Management. He is best known for betting against the housing bubble in the mid-2000s, a story that was turned into the book “The Big Short” by Michael Lewis, which was then adapted into a film starring Christian Bale and directed by Adam McKay.

More recently, he’s known for inciting the meme-stock frenzy when he bought a stake in GameStop in 2019, for betting against Tesla and Ark Innovation ETF in 2021, and for tweeting distressing market predictions and then deleting them shortly after.

Information for this briefing was found via Twitter and the companies and sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.