Bill Ackman, the founder of Pershing Square Capital and an American billionaire investor, believes the US Federal Reserve should temporarily pause its policies in order to strengthen the local banking system and prevent contagion.

“We have had a number of major shocks to the system. Three US bank closures in a week wiping out equity and bond holders… Notably, bondholders bearing losses is a new phenomenon as they were protected in the GFC,” said Ackman in a tweet.

The @federalreserve should pause on Wednesday. We have had a number of major shocks to the system. Three US bank closures in a week wiping out equity and bond holders. The demise of Credit Suisse and the zeroing of its junior bondholders. Notably, bondholders bearing losses is a… https://t.co/rcksilgXYR

— Bill Ackman (@BillAckman) March 20, 2023

Several financial firms have had substantial challenges, in addition to the already-closed Silvergate Capital, Silicon Valley Bank, and Signature Bank. Among the examples is San Francisco-based First Republic Bank, whose stock has dropped by more than 85% in the last month.

“[First Republic Bank] depositors that haven’t left already will not be comforted by today’s stock price performance. This banking crisis remains unresolved and higher rates won’t help,” Ackman added.

Ackman believes the turmoil remains “unsolved,” and that raising interest rates for the ninth time in a row could result in greater investor losses and a domino effect of collapsing banks.

“Inflation is still a problem and the Fed needs to continue to show resolve. Powell can do this by pausing and making very clear that this is a temporary pause so that the impact of recent events can be assessed,” he reasoned.

The billionaire recognized that the US inflation rate is a concern that the Fed must address. But, the Fed should prioritize alternative monetary instruments, such as “an FDIC deposit guarantee until an updated insurance regime is introduced.”

Ackman’s call for interest rate hike pause is a turnaround from his position less than a year ago when the hedge fund manager clamored multiple times for the agency to raise “rates aggressively” to “protect equity markets.”

“By raising rates aggressively now, the Fed can protect and enhance equity markets and the strength of the economy for all, while stymieing inflation that destroys livelihoods, particularly that of the least fortunate,” Ackman tweeted in May.

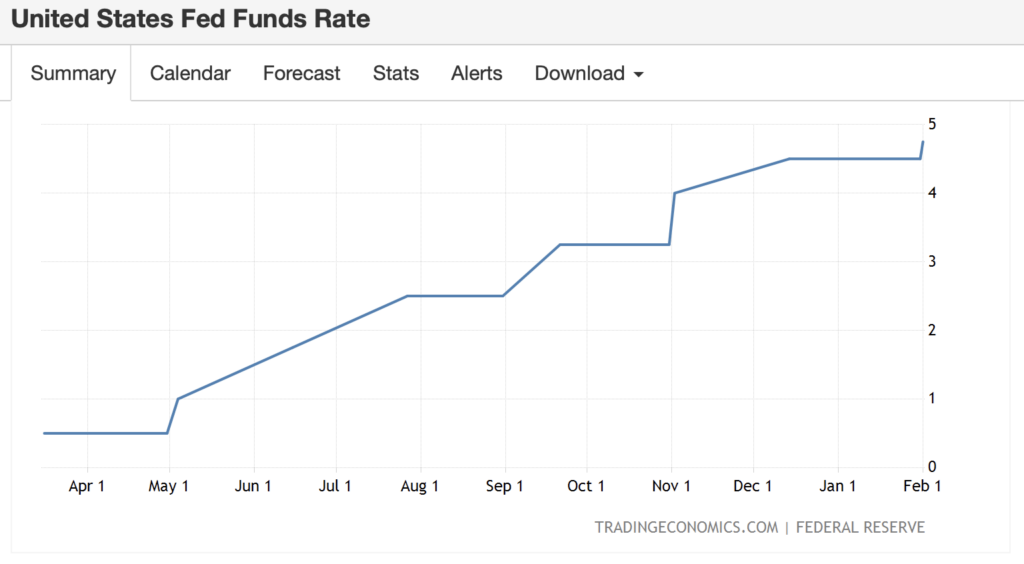

After rising 6.4% year-over-year in January, US consumer prices continued their descent last month, increasing 0.4% to an annualized 6%— in line with forecasts. Prior to this, as widely expected, the Fed hiked borrowing costs another 25 basis points, wrapping up its two-day policy meeting and bringing the fed funds rate to 4.75%, with hints of future raises.

“Given our outlook, I don’t see us cutting rates this year, if our outlook comes true,” Fed Chair Jerome Powell said. “If we do see inflation coming down much more quickly, that will play into our policy setting, of course.”

A decision is set to be handed down at the Federal Open Market Committee meeting on Wednesday.

“Welfare Boy”

Observers noted Ackman’s push for a rate hike pause, with some highlighting his firm’s current position following the heated interest rate climate he himself was previously calling for.

Twitter user RJR Capital highlighted how Pershing Square recorded nearly $3 billion in losses for fiscal year 2022 compared to a net income of $658 million in the year prior.

C'mon. Tell them the real reason you want the Fed to back off, Welfare Boy.

— RJR Capital (@RJRCapital) March 20, 2023

Ok. I will. https://t.co/cstEX5VEvG pic.twitter.com/wyRfAesCaP

jesus bill you're a billionaire, don't you have anything better to do

— DIRTY BUBBLE MEDIA 🪓 (@MikeBurgersburg) March 21, 2023

leave us plebs to die from hyperinflation in peace https://t.co/86CBNsb2K7

Economist Peter Schiff instead said that a pause on rate hikes “will send the dollar tanking and inflation soaring to new highs,” adding that a hypothetical soaring inflation following a pause would cause a financial crisis far worse “than the one the pause was meant to prevent.”

A pause will send the dollar tanking and inflation soaring to new highs. If the Fed tried to aggressively raise rates to contain inflation, the financial crisis that would ensue would be far worse than the one the pause was meant to prevent. Better to swallow the medicine now.

— Peter Schiff (@PeterSchiff) March 21, 2023

Ackman, however, isn’t the only one seeing a pause this week. According to Goldman Sachs, there is no longer a rationale for the Federal Reserve to raise interest rates at its meeting tomorrow, citing “recent stress” in the financial industry.

Information for this briefing was found via CryptoPotato and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.