Last week, after the WSJ announced that Blackstone Inc (NYSE: BX) would be selling its 49.9% stake in two Las Vegas Hotels for a total consideration of $1.27 billion, the company said it was limiting withdrawals. Stating they would make the move “after receiving too many redemption requests,” from their $69 billion real estate income trust (REIT).

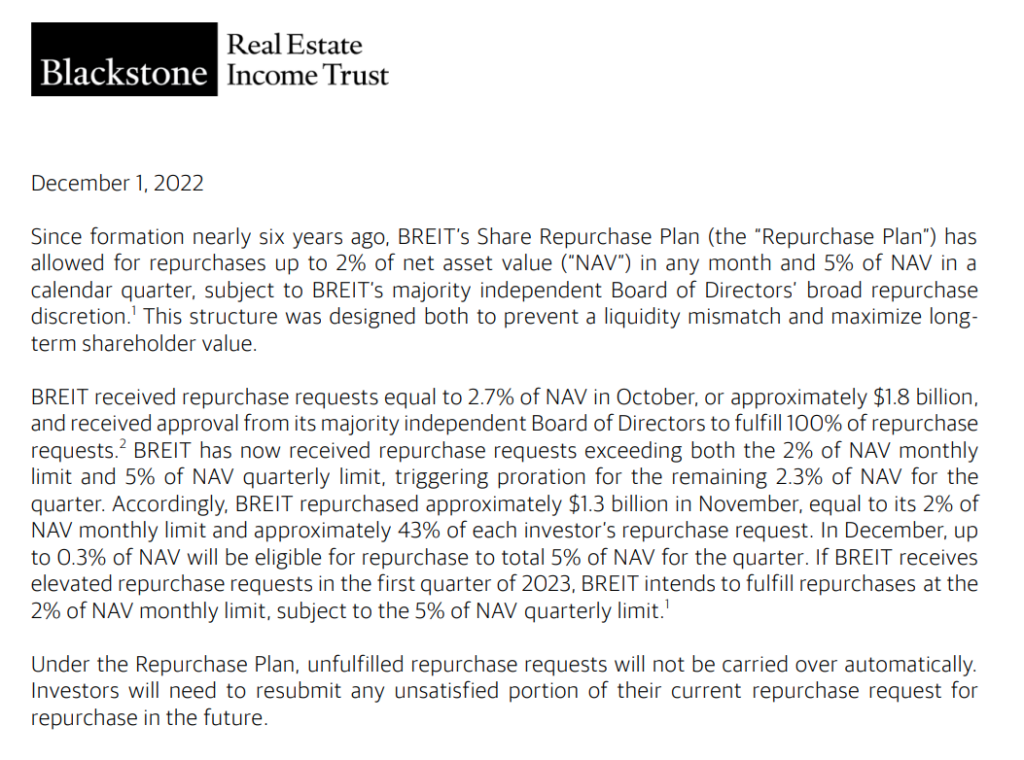

Blackstone has a redemption cap on its REIT where redemptions cannot exceed monthly requests greater than 2% of its monthly net asset value and 5% of its quarterly net asset value. The company said this structure “was designed both to prevent a liquidity mismatch and maximize long-term shareholder value.”

A Note to Shareholders

The company, in a note to shareholders on December 1st, stated that the REIT saw redemptions in October equal to 2.7% of its NAV in October or approximately $1.8 billion. Subsequent to that, in November, the company saw additional redemptions “exceeding both the 2% of NAV monthly limit and 5% of NAV quarterly limit.” As a result, the company only honored 43% of the redemption requests or $1.3 billion dollars worth of shares, and only 0.3% of the company’s NAV is eligible to be redeemed in December.

It’s Not Meant to Be Liquid, I Swear

At an industry conference on Wednesday, Chief Executive Stephen Schwarzman said, “The idea that there is something going wrong with this product because people are redeeming is conflating completely incorrect assumptions. This was not meant to be a mutual fund with daily liquidity. These are pieces of real estate.”

Schwarzman said that many of the redemption requests came from Asia, where investor appetite for backing positions with debt tends to be higher. Given the recent downturn, it has led to margin calls. for investors who face “excruciating financial pressure.”

What About BlackStone’s Common Stock?

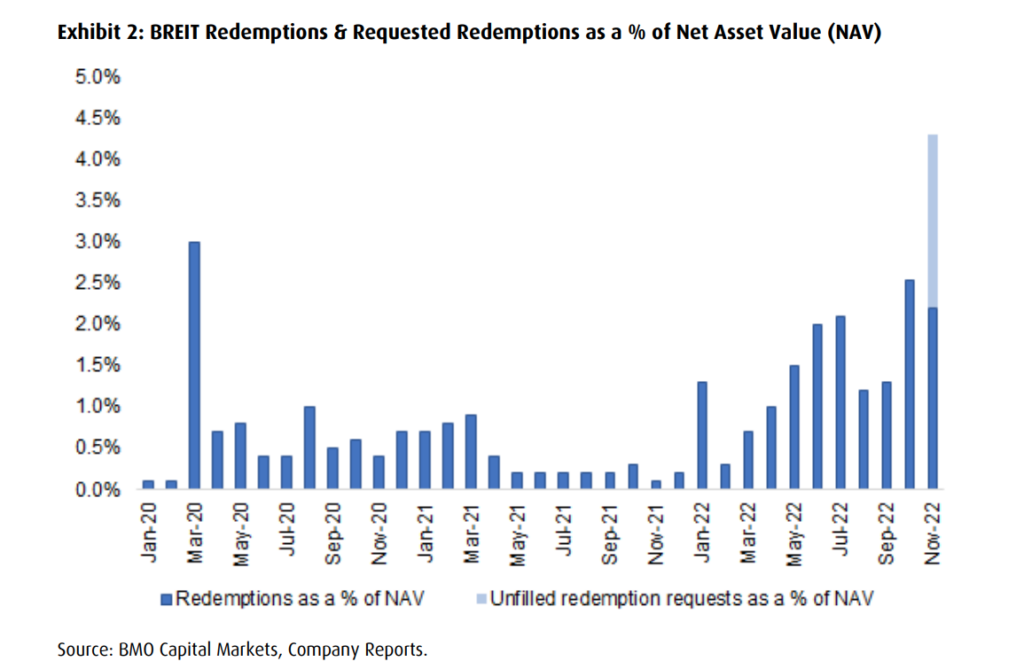

In BMO Capital Markets’ note on the news, they reiterate their market perform rating but cut their 12-month price target to $90, down from $109, saying that the news “will prove a significant headwind for BX’s medium-term growth.” As a result, the analysts have lowered their estimates for the fourth quarter, and full-year 2022 and 2023.

Though BMO does not believe that this news will “derail the longer-term shift of Retail into Alternatives.” However, they anticipate that investors and advisors will reweight their allocation to semi-liquid structures. BMO does expect the negative sentiment to remain a cloud over the company but believes that any potential large-scale, multi-month redemption is already priced into the stock price.

As expected, BMO’s analysts do believe that redemption requests will remain elevated for much of 2023, only to turn flat in 2024. They expect the REITs’ NAV to go from $70 billion to $47 billion by the end of 2024.

BMO has lowered their estimates on Blackstone as they say that from the fourth quarter of 2018 through the third quarter of 2022, the REIT accounted for almost 18% of their FPAuM growth, peaking around 25% of fee-related revenues.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.