On October 4, Sandstorm Gold (TSX: SSL) announced the closing of their bought deal financing. The company said it had closed on US$92 million under the financing, issuing 18,055,000 shares for US$5.10 per share.

The company said it intends to use the proceeds, “for future acquisitions of streams and royalties, the repayment, from time to time, of amounts drawn under the Company’s revolving credit facility, and other general working capital purposes.”

There are currently ten analysts covering the stock with an average 12-month price target of C$12.18, or an upside of about 67%. Out of the ten analysts, two have strong buy ratings, seven have buy ratings, and one analyst has a hold rating. The street high price target sits at C$14.87, which represents an upside of 105%.

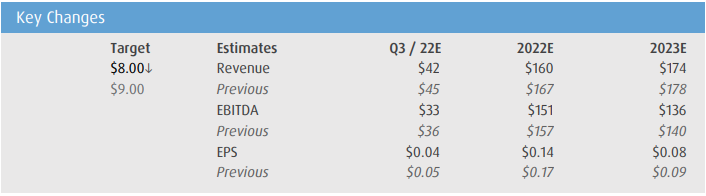

In BMO Capital Markets’ note on the news, they reiterate their outperform rating but lower their 12-month price target on the stock to US$8.00 from US$9.00, as they resume coverage after being restricted due to them being one of the underwriters on the name.

On the bought deal, BMO says that the issue price of US$5.10 was below their net asset value per share and therefore see this deal as dilutive to their estimates. They say that investors will start to question the timing of the financing, “in the context of where Sandstorm was trading.”

Additionally, BMO believes that Sandstorm Gold will mainly use the cash raised to deleverage through paying down their revolving credit facility, as deal flow timing can be unpredictable.

BMO has lowered their estimates on Sandstorm as a result of the dilutive issue, alongside updating the estimates to be in line with their commodity outlook. Recently, BMO lowered their 2023 gold price estimate by 6% due to ” tightening global monetary policy,” while they lowered their 2023 silver forecast by 11%.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.