On Friday, Else Nutrition (CSE: BABY) reported their fourth quarter and year end financials. The companies news release is very sparse with financial information, but the financials show that the fourth-quarter revenue was $600k, a ~58% increase quarter over quarter while the company lost $14 million during the quarter, bringing its yearly losses to $24.35 million

Else Nutrition currently has 1 analyst covering the company with a weighted 12-month price target of C$5.75. Canaccord Genuity lowered its 12-month price target from C$6.50 to C$5.75 and reiterating its speculative buy rating. Tania Gonsalves says that the results were mixed at best.

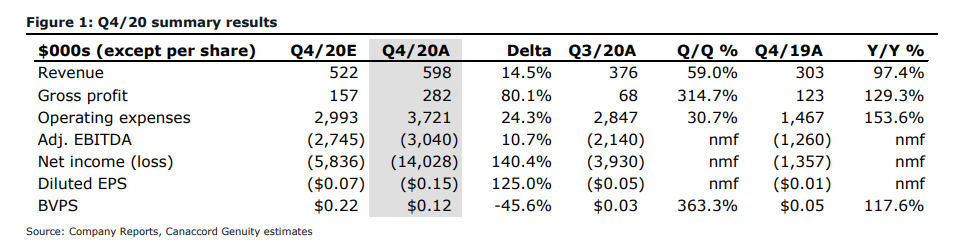

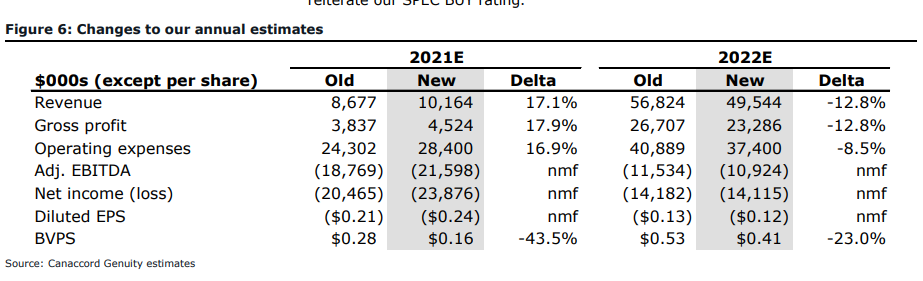

Below you can see Canaccord’s estimates, wherein Canaccord was expecting $520 thousand in revenue. Although revenue came in higher, earnings per share came in worse than estimates due to larger operating expenses. Gonsalves says that the companies $25.4 million in cash will be sufficient to fund operations through 2021.

Gonsalves also touches on the recent news around the companies rollout of its toddler complete nutrition product. She writes that since August 2020, “it has achieved strong traction with retailers/distributors and over 30% repeat sales.” The company now has distribution to over 750 brick and mortar locations with the company being in discussions to get its product into more than 5,000 stores. Additionally, the company sells its products via Amazon.com with its sales 20% month over month since December.

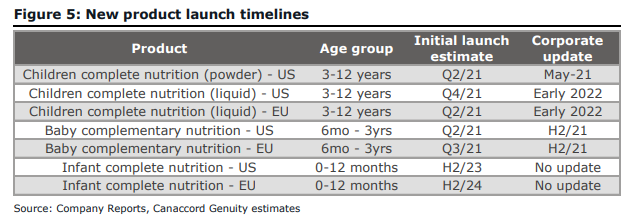

With Canaccord lowering their price target, Gonsalves says that they have made a number of changes to its financial models. They now expect toddler sales to reach $7.9 million, up from $4.7 million while updating their timeline for new products.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.