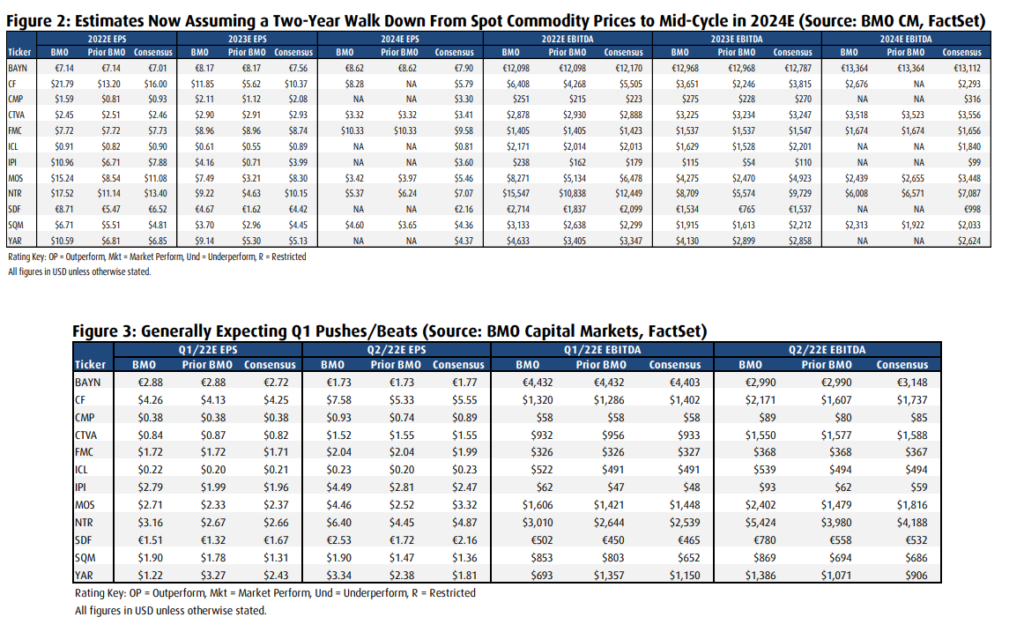

Earlier this month, BMO Capital Markets raised their 12-month price targets on a number of their fertilizer and chemical companies that they cover. The upgrades were included within a note that, “serves to, amid challenging forecast conditions, update models and commodity views under a base case framework that fertilizer and European gas prices peak by mid-year and walk back down to mid-cycle levels by 2024.”

They comment that they are raising their price targets due to the “high-level windfall 2022-2024E free cash flow,” and say that the current valuations are at least supported by these numbers. BMO believes that Corteva (NYSE: CTVA) currently has the best setup, saying that they see the stock having “the best multi-year set-up from share/margin gains.”

They add that they would not be surprised to see funds flow into names such as Corteva, FMC Corp (NYSE: FMC), or Bayer AG (ETR: BAYN) if the trade starts to get popular.

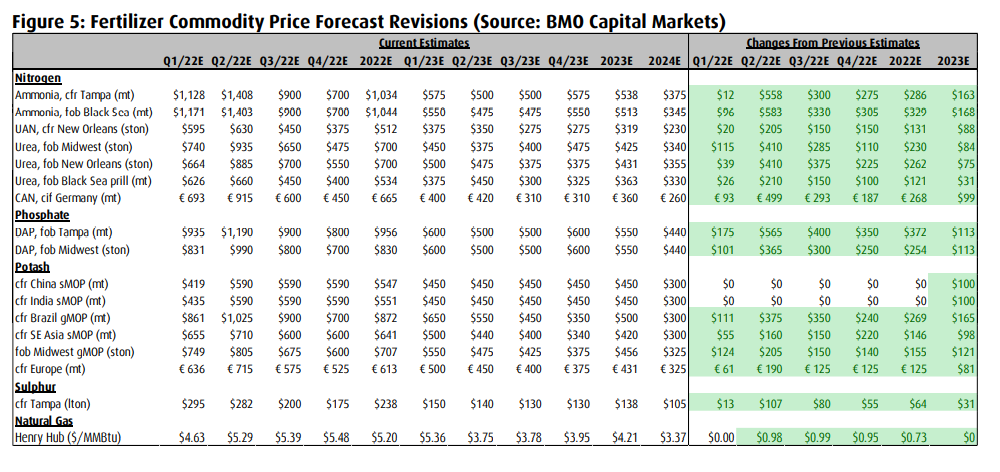

Within BMO’s note, they comment that having confidence in any forecast “now seems silly,” and that they are just providing a “reasonable” base case and will go from there. Because of this, they are expecting spot prices to moderate starting later in the second quarter and slide down to “slightly mid-cycle pricing” for 2024.

In terms of spot prices, corn and soybeans remain above their 10 year average prices. While they say that these elevated prices will support high farmer income, they believe that fertilizer prices, which have risen so much “to the point where there are real issues around demand destruction,” are starting to erode those same farmers’ profitability and affordability.

For the demand side, BMO says that Chinese demand for corn and soybeans underpins the U.S crop price outlook in 2022, while a sharp cut in Ukrainian corn exports has also helped support prices.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.