Earlier this month Equinox Gold (TSX: EQX) revealed that they are temporarily suspending operations at their RDM Mine due to permit delays. The company has said that its permits for the tailing storage facility have been delayed and that they are in active discussions with regulatory authorities.

Equinox Gold says that the tailing storage facility raise contractor is “ready to mobilize and commence work,” and expects that full operations could restart “as soon as two months from the receipt of regulatory approval,” which is expected during the month.

Equinox Gold currently has 12 analysts covering the stock with an average 12-month price target of C$12.75, or an upside of 80%. Out of the 12 analysts, 1 has a strong buy rating, 6 have buy ratings and the last 5 analysts have hold ratings on Equinox’s stock. The street high sits at C$17, which is a 140% upside to the current stock price.

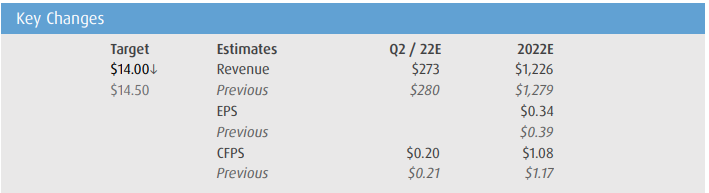

In BMO Capital Markets’ note on the results, they reiterate their outperform rating but cut their 12-month price target from C$14.50 to C$14.00, due to the removal of 105 days of production from the RDM mine. BMO says that the RDM mine was roughly 4% of their NAV and contributed to roughly 11% of their 2022 production.

BMO has reduced their 2022 RDM production by 40% as they incorporate a total downtime of 105 days of lost production. The downtime is estimated to consist of 45 days in the second quarter and 60 days in the third quarter. They have reduced their production estimate from 69koz to 41koz as a result.

Additionally, BMO says that they have lowered their full-year 2022 production as the previous RDM production guidance was 70-80k, which now has been suspended. They are now expecting the full-year production of Equinox Gold to be 645koz, roughly 4% lower than their previous guidance.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.