Last week, Mosaic Co (NYSE: MOC) released their full-year 2020 financial results. The company announced fourth-quarter results of $828 million and earnings per share of $2.17. EBITDA meanwhile came in at 508 million.

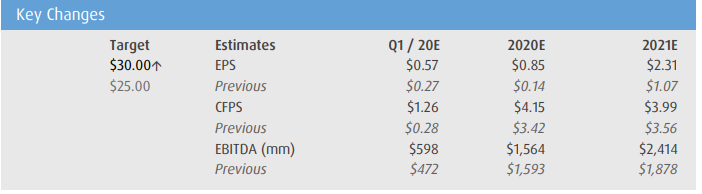

Three analysts have come out with price target upgrades. Stephens raised their price target to $36 from $32, while Credit Suisse raised their target to $37 from $35. Lastly, BMO Capital Markets raised their price target to $30 from $25.

Mosaic currently has 21 analysts covering the company with a weighted 12-month price target of $29.85. This is up from the average before the results, which was $27.75. Five analysts have a strong buy. Six have buy ratings, and the majority, ten have hold ratings.

BMO’s analyst Joel Jackson headlines, “Delivering on the Promise.” He believes that the company is progressing through peak phosphate prices now. He writes, “MOS has done a tremendous job to monetize the stronger phosphate dynamic, contain costs, and wring more growth out of Brazil.”

This note primarily focuses on the earnings call and not the actual earnings release, although BMO has updated their 2020 and 2021 estimates, which you can find below.

Jackson says that Mosaic most likely hit their peak potash production in 2020 but, “could be a little more to push in 2021 if demand is there.” He says that even if they grow production, there might not be any more room citing that China and India would be the main places new volume would come from.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.