It was announced last week wednesday that Jazz Pharmaceuticals (NASDAQ: JAZZ) would be acquiring GW Pharmaceuticals (NASDAQ: GWPH), a company discovering, developing, manufacturing and commercializing novel, regulatory approved therapeutics from its proprietary cannabinoid product, for $220 a share, a 50% premium. The total purchase price is U$7.2 billion. U$6.7 billion comes in the form of cash, while U$500 million comes in the form of Jazz Shares.

Jazz Pharmaceuticals currently has 17 analysts covering the company with a weighted 12-month price target of U$190.25. This is up from the average before the acquisition, which was U$181.67. Six analysts have strong buys while another ten have buy ratings, and one analyst has a hold rating.

Below are the recent analyst changes since the announcement.

- Piper Sandler raises to overweight from neutral; raises target price to $175 from $150

- RBC raises target price to $182 from $180

- Cowen and Company raises price target to $190 from $180

- H.C. Wainwright raises target price to $207 from $195

- SVB Leerink raises target price to $213 from $202

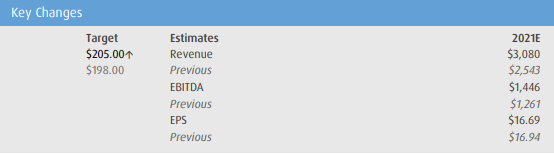

- BMO raises target price to $205 from $198

Yesterday, BMO released their note detailing their rundown of this acquisition. Gary Nachman, BMO’s analyst raised his 12-month price target to U$205 from U$198 and reiterated their outperform rating. Below you can see the key changes they have made to their 2021 estimates.

Nachman says that the deal has a “strong strategic/financial rationale by significantly accelerating diversification and growth profile,” due to GW’s flagship drug Epidiolex, and that it has potential “from the broader cannabinoid platform complementary to JAZZ’s neuroscience franchise.”

Nachman writes, “GWPH enhances diversification/growth profile at justifiable price.” As the bulk of the deal comes from new debt, Jazz believes their pro forma net leverage to go from 5.4x in the second quarter of 2021, will decline to sub 3.5x by the end of 2022. They also expect the deal to be accretive in the first full year and generate substantial free cash flow for the company. He comments, “We publish our pro forma model, raising 2021-24E revenue $537-1,410mm, EBITDA $185-790mm, and EPS $1.90-5.89 in 2022-24E ($0.25 dilution for 7-8 months in 2021).”

Nachman says that Epidiolex has great potential as its the only FDA-approved CBD medicine. He adds, “Much room remains for growth with US penetration <50% in target indications, and pursuing other refractory epilepsies could significantly expand the addressable market.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.