On January 10th, Osisko Gold Royalties (TSX: OR) reported its preliminary fourth-quarter deliveries and portfolio update. Osisko received 19,830 gold equivalent ounces for a total of 80,000 equivalent ounces in 2021. This is at the higher end of their 78,000 – 82,000 guidance. The company says that preliminary revenue for the fourth quarter is C$50.7 million and cost of sales came in at C$3.7 million.

Osisko Gold currently has 13 analysts covering the stock with an average 12-month price target of C$22.88 or a 51% upside to the current stock price. Out of the 13 analysts, 4 have strong buy ratings, 8 have buy ratings and 1 analyst has a hold rating on the stock. The street high sits at C$27, representing 78% upside, coming from Haywood Securities. While the lowest price target sits at C$19, representing a 26% upside to the current stock price.

In BMO Capital Markets’ note, they reiterate their C$20 12-month price target and market perform rating saying that the preliminary results were consistent with consensus expectations.

On the results, BMO says that all the results came in line with consensus expectations. The consensus estimates were 19,700 equivalent ounces, C$53.3 million in revenue, and C$4.2 million in cost of sales.

BMO says that in the news release, the company outlined a number of expected 2022 catalysts which include further expansion to Mantos Blancos, ‘imminent production’ at Santana, Ermitaño, and advancing Tocantinzinho under new ownership.

BMO says that they have not updated their estimates for the companies outlook and keep their estimates tied to their models of the mine operators under their coverage so there is a potential upside to their price target.

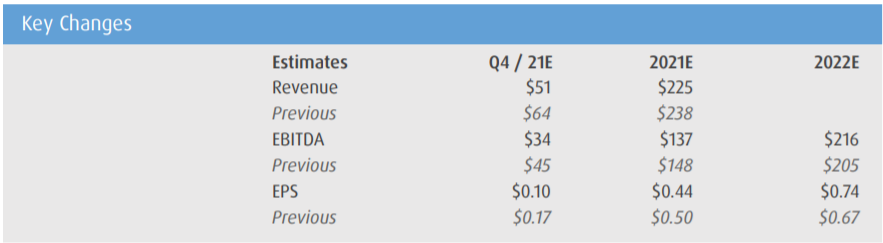

Below you can see BMO’s updated fourth quarter, full year 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.