Earlier this month, Tricon Residential (TSX: TCN) announced that they closed their U.S. IPO selling 46,248,746 shares for total proceeds of US$570 million, and completed their listing on the NYSE under the ticker “TCN”. Additionally, Tricon offered a private placement of shares to Blackstone Real Estate Investment Trust.

After the news, many analysts raised their 12-month price targets. The new 12-month price target sits at C$17.38. There are 8 analysts covering the stock with 2 having strong buy ratings and the other 6 have buys. The street high sits at C$19 from BMO Capital Markets while the lowest comes in at C$15.25.

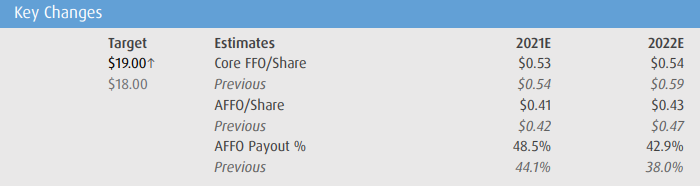

BMO Capital Markets resumed their coverage with an outperform rating on Tricon Residential after the IPO and raised their 12-month price target to C$19 from C$18. They write, “We believe Tricon has a multi-year opportunity for FFO and BVPS growth while leveraging third-party fee-bearing equity capital and reducing leverage.”

BMO says that the net proceeds will be used to repay the amount outstanding under its pass-through certificates and the leftover money will be used to purchase future SFR JV-2 homes.

Below you can see BMO’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.