Magna International (TSX: MG) reported earnings on May 6th pre market, with the results surprising investors. The company ended the day up 2.23%, showing revenues of $10.18 million with a gross margin of only 15%, while net margin came in at 6%, or $615 million.

A few analysts changed their price targets on Magna after their earnings, with the company now having a consensus 12-month price target of $111.69, up from the $102.85 from last month. Accountability Research Copr has the highest price target at $132 while the lowest sits at $94.83.

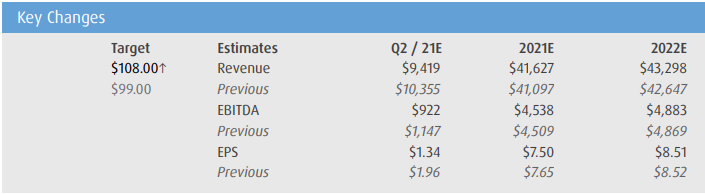

Below you can see the most recent analyst changes:

- CFRA raises target price by $10 to $120

- JP Morgan raises target price to $114 from $110

- BMO raises target price to $108 from $99

- Scotiabank raises target price to $115 from $105

- Citigroup raises price target to $116 from $101

In BMO’s note, their analyst Peter Sklar reiterated his outperform rating and raised his 12-month price target to $108, up from $99, while upping their EBITDA multiple to 6.5x from 6x. Sklar writes that the increase is, “due to Magna’s strong operational performance in Q1/21 and expanding exposure to vehicle electrification and autonomous features.” They also changed their 2021 and 2022 estimates slightly, with them now forecasting second-quarter revenue of $9.42 billion, down from $10.355 billion. BMO then raises their full-year 2021 and 2022 estimates which you can find below.

With every car company right now, Magna’s management reported that the global semiconductor shortage could be prolonged into 2022 which is longer than previously expected, while adding that resin prices are remaining sticky and could be a headwind for the company. Sklar says between these two headwinds, “the resulting negative commodities impact could be as high as US$80M, despite the positive effect of rising scrap prices.”

With Magna reporting better than expected earnings all around, which Sklar attributes to an “outperformance in all segments,” with the company sales growth driven by higher vehicle production, the launch of new programs and the Canadian dollar having a good quarter. Higher than expected EBIT margins were attributed to cost reductions and operating efficiencies from the companies restructuring efforts.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.