In a note BofA Securities released last week, the firm discussed the global cannabis market. Within, they provided an estimate of the total addressable market for the sector as a whole, while further breaking down the estimates in to specific regions while providing color on operators in the space.

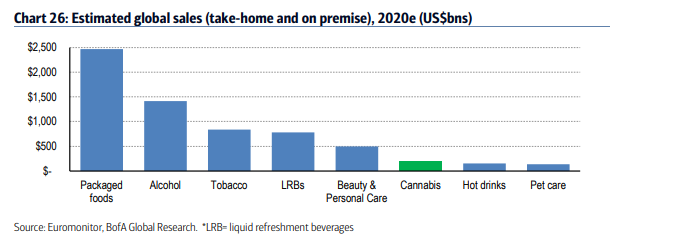

With respect to the global market, the firm had this to say. “We estimate that the global (illicit + legal) cannabis market will reach some $186bn in 2020, with marijuana sales at US$176.5bn and CBD at approaching US$9.5bn.” They forecast that by 2030 the global cannabis market could reach $300 billion as more countries legalize or ease restrictions.

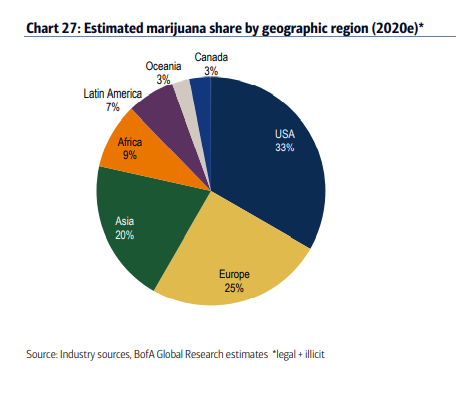

BofA states that today’s total addressable market (TAM) for all cannabis products is roughly $186 billion. The United States is classified as being the market leader with 34% of the total market, or $62.568 billion. Europe is the second highest region with an estimated 25% of the total market or $49.473 billion. Canada meanwhile is said to account for only 3% of the market, or $5.808 billion.

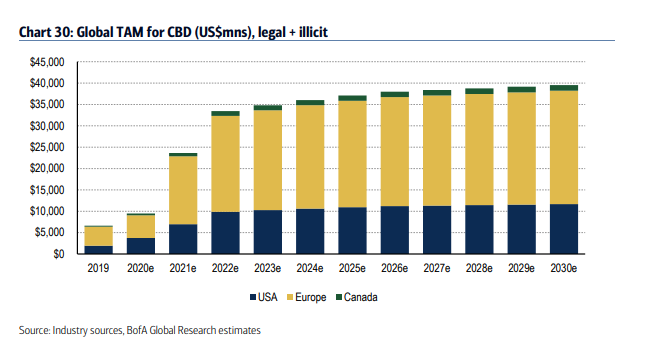

The firm meanwhile estimates that the global TAM for CBD is currently $9 billion and will rise to roughly $39 billion in 2030. Europe currently makes up most global CBD intake and is forecasted to remain as the major consumer of CBD.

Doug Spillane, BofA’s analyst, says, “The global legal cannabis market recorded growth of 45% in 2019 to US$14.9bn. The category was split between Medical (US$6.1bn, +54% YoY) and Adult Use ($8.7bn, +41%),” and forecasts that between 2019-2025 there will be a 24% compound annual growth rate.

Citing BDSA, he says that by 2025, they will be more than double the number of medical markets, with medical markets growing from 35 to 85. He adds, “increasing product form options and lifting licensing caps on cannabis businesses appear to be aiding medical marijuana sales.”

Spillane offers a few drivers for growth in Canada. He first says that there is still a lot of people consuming from the illegal market, stating “Less than 40% of Canadian cannabis consumers say they buy cannabis in legal dispensaries.” The next driver he discusses, which goes hand in hand with the first, is recruiting new customers, primary through 2.0 products. He says, “safer legal products will likely drive people (who hesitated to purchase of the illicit market) to try cannabis.” In 2020 roughly 17% of Canadians said that they intend to use recreational 2.0 products.

The last driver he mentions is the need for producers to lower prices, saying the Canadian government’s tax regime has created a price gap between legal and illegal sources.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.