This morning Canaccord initiated coverage on Bragg Gaming (TSX: BRAG) with a C$3.00 12-month price target and Speculative buy rating. This is the first analyst to initiate coverage on Bragg.

Matthew Lee, Canaccord’s analyst, states that the investment thesis consists of, “the company offers an attractive combination of growth and profitability in the iGaming space while exposing investors to the rising tides of legalization worldwide.” Bragg’s business to business offering reaches online casinos that are primarily based in Europe and allows smaller operators to leverage the IP, so they do not have to spend money on tech.

Lee writes, “We believe Bragg will continue driving organic growth by adding new iGaming clients within its current footprint and by taking advantage of its scalable model to expand its presence in North America, South America, and Africa.”

Lee says that Braggs key differentiator is the high-quality content library and full-service model. He believes these products are positioned to do well as they have combined their own content alongside exclusive deals with suppliers to make an extensive library of games. Lee believes that this library is hard to replicate for competitors. The other thing Lee touches on is the turnaround process for when a company purchases the rights. He writes, “integration can occur in as little as three weeks, which allows its casino partners to quickly and effectively launch and maintain a full-scale iGaming platform.”

Lee believes that the iGaming market will grow to $7.1 billion and $1.03 billion in the US and Canada by 2025, making US and Canada a key market to expand in the medium term. This comes after COVID-19 shutdowns have led states to find new ways to get tax streams. Currently, only five states have passed iGaming laws legalizing it.

He points to Bragg’s signing with Seneca Gaming Corp. They currently own three casinos in New York, which is expected to legalize iGaming in 2021.

He believes that although the US space has a larger total addressable market, Canada may be more than 35% of that of the US. Which is based on, “the company’s robust network within the Canadian gambling industry and the large number of casino operators who will likely look to utilize their licenses to enter the iGaming space.” It could account for C$57 million in revenue for Bragg in 2025 and add roughly C$1 per share of enterprise value.

Lee writes about the next key idea that Bragg is positioned perfectly to take advantage of as being any consolidation. He writes, “In our view, Bragg’s current position in the market allows it to be both an acquirer that can drive significant growth, and a target for larger players that are looking to control their entire tech stack and utilize Bragg’s capabilities to progress their own iGaming operations.”

He adds that they view Bragg as both a takeout target and an acquirer in the space. Due to Braggs large C$46 million net cash position, it is able to make acquisitions. He states, “In our view, management will be looking to acquire assets that both complement its current organic growth and drive improved profitability and scale.”

Lee identifies sportsbooks as a key takeout target for Bragg. The acquisition would give Bragg the ability to offer clients online sports betting. Lee writes, “We believe that taking control of the full product suite would serve to open new avenues of revenue for the firm while also providing significant synergies on the cost side.”

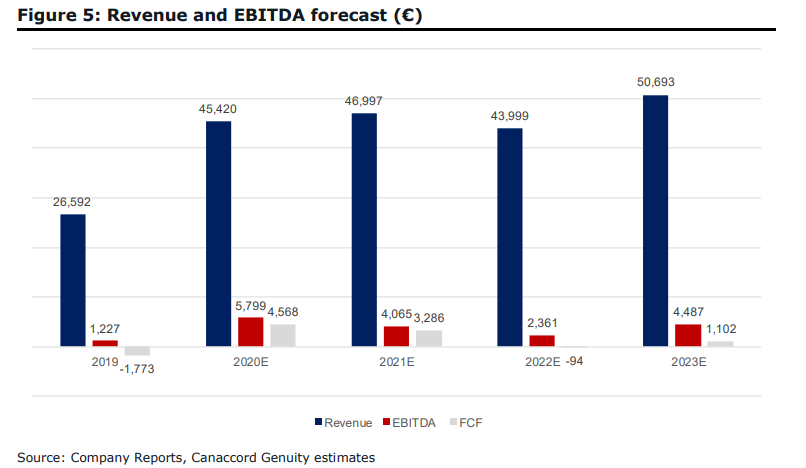

Below you can see Canaccord’s revenue and EBITDA forecast for 2021-2023.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Thank you for posting the revenue forecast. I wonder what upside potential may come from the Nasdaq relist catalyst and if that’s accounted for. perhaps in the multiples, in this valuation/price target. If anyone knows or has an opinion, do let me know.