Camber Energy (NYSE: CEI) has become a bit of a meme stock as of late, a result of Twitter user @MrZackMorris pushing the name to his followers. An oil and gas name whom no doubt has enjoyed the recent excitement in the energy space, the company became the latest target this week of short sellers, with Kerrisdale Capital dropped a report on them Tuesday morning.

An operator of oil and gas fields across Texas, Louisiana, and Mississippi via a subsidiary, Camber bills itself as a “growth oriented organization” that is building a “diversified energy and power solutions company.” The firm reportedly has 145 active oil and gas wells, with the company identifying a number of target locations for further expansion via continued drilling.

According to Kerrisdale however, the firm is a “defunct oil producer,” as described in its report, “Camber Energy, Inc (CEI): What If They Made a Whole Company Out of Red Flags?“

The report itself starts off strong, with the opening paragraph identifying a number of major problems with Camber, including:

- The firm hasn’t filed financial statements with the SEC since September 2020, a full year ago.

- The firm fired its accounting firm just last month, meaning the likelihood of financials coming any time soon are slim to none.

- The company is at risk of delisting next month due to its disclosure failures.

On top of these issues, Kerrisdale also highlights that its main subsidiary, Viking Energy, is an OTC-traded firm which the company owns 73% of, which has its own set of red flags attached to it. But more on that later.

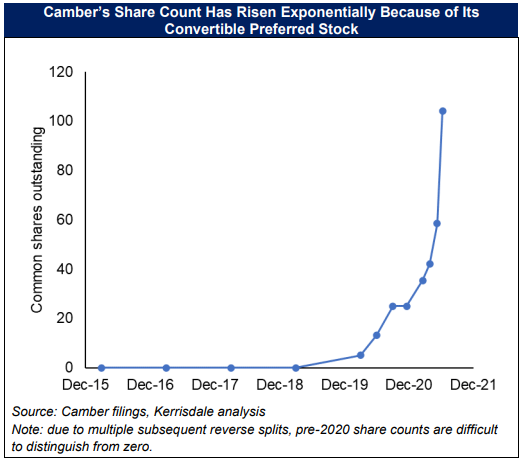

First, lets focus on the share structure of Camber. The firm, as per several trading platforms, reportedly has approximately 104.2 million shares outstanding, resulting in a market capitalization of roughly $322 million as of the time of the report being released. Kerrisdale however disputes this figure, as a result of dilutive Series C convertible preferred stock and convertible debt, the impact of which has been masked by the lack of financial filings made by the company over the last year.

Rather than get into the mechanics of the ridiculous 24.95% non-cash dividends due on an annual basis as a result of this debt and preferred share structure, lets just highlight this chart, provided courtesy of Kerrisdale.

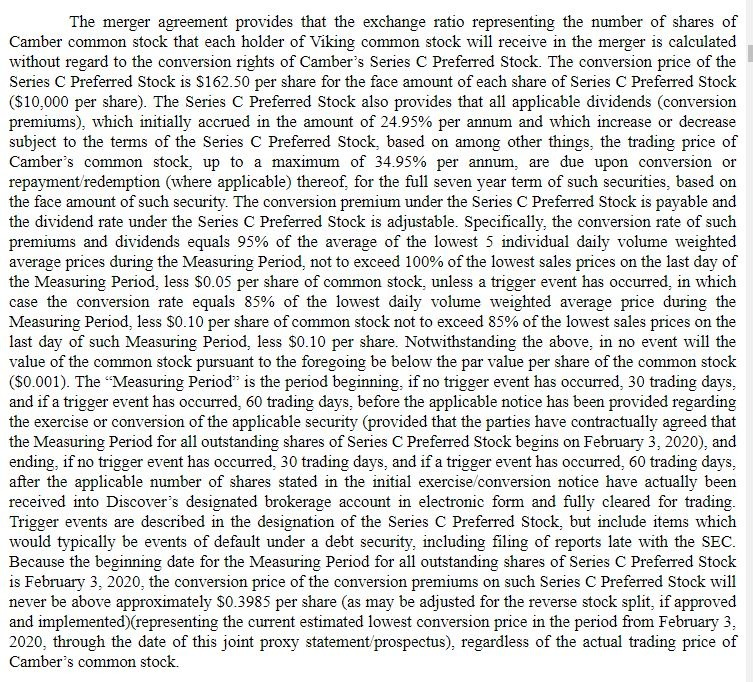

In short, the convertible debt and Series C preferred shares reportedly have mechanisms in place that limit the conversion price to never be higher than $0.3985 per share, with one Series C preferred share said to be convertible into 43,885 common shares of the company, based on the Kerrisdale analysis.

The shares themselves are held by Discover Growth Fund, with the company itself stating that “the continued sale of shares issuable upon successive conversions will likely create significant downward pressure on the price of its common stock.” The debt is so terrible that Camber allegedly sued Discover for fraud, with court case being thrown out by the Judge on the effective basis of “you signed it, its your problem.”

To be fair here, the debt truly is terrible. Here’s a snippet from recent merger documents filed by Camber as it relates to the debt, which in simple terms indicates Discover owns this ship, despite what Camber or its shareholders may attempt to do to get away from the debt.

In other words, those of whom that have been hitting the bid on Camber Energy for the last several weeks (an average of $1.9 billion of shares traded hands on a daily basis last week), appear to have been effectively funding Discover Growth Fund’s credit card.

Of course, these Series C shares will run out eventually – 2,093 shares were said to be held as of February 2021, which of course will convert into many, many more common shares, and the recent volatility likely played a large role in doing just that. However, another block of preferred shares were issued in July, for which details are slim, while $20.5 million in convertible debt has been issued over the course of the last year, also impacting the firms share structure.

The remainder of the report largely focuses on the red flags over at Viking, the firms 73% owned subsidiary that also trades publicly on the OTC markets. A number of flags here are also highlighted:

- The company has negative shareholder equity of $15 million.

- 48% of the firms $101.3 million in debt matures over the next 12 months.

- A subsidiary of Viking, Elysium Energy, is in violation of a secured debt covenant, meaning its debt is likely now due and current.

- Viking entered into an IP license arrangement for a carbon capture system for natural gas electrical generators, however the IP is exclusive only in Canada and in 25 locations in the US, with the IP created by reported fraudsters.

The nail in the coffin here however is a financial advisor to Viking whom, in relation to a merger that wills see Viking become a wholly owned entity of Camber, provided a fairness opinion on the all-stock transaction originally proposed between the two firms. Scalar, LLC, the advisor, reportedly provided a valuation in October of last year for Viking of somewhere between $0 and $20 million, with a full discounted cash flow model showing a value between $0 and $1 million – a figure quite hilarious considering Camber right now with only partial ownership is trading at a market capitalization of at least $322 million, if not many multiples more.

The last tidbit, is that Viking apparently had a fictitious CFO for a number of years. Reportedly in the role from December 2014 to July 2016 was that of Cecile Yang, whom lives in Shanghai, China. The founder of the company, as per the SEC, apparently used her as a placeholder for the role, forging documents to grant himself power of attorney to use her signature wherever required to file appropriate documents. What’s more, is the CEO, James Doris, whom is also CEO of Camber Energy, evidently never had a problem with this arrangement, despite never having actually even talked or communicated with Yang, and despite her on paper being the lead financial employee at the firm.

Suffice to say, Kerrisdale appears to have been rather effective in its latest short report. Camber Energy closed the market down 50.49% in regular hours at $1.53 on the NYSE, while falling a further 17.65% in after hours trading to $1.26, after hitting a high of $3.22 in early morning trading – leaving Zack Morris and his band of followers to pick up the remaining pieces.

The pump will never stop.

— Zack Morris (@MrZackMorris) October 5, 2021

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Which hedge funds paid for these lies