The recent run-up in the share price of Cameco Corp (TSX: CCO) has seemingly excited company insiders, with a number of them electing to sell into the open market this past week. Whether the transactions are related to covering tax bills or just to take some money off the table amid a heightened market is anyone’s guess.

The majority of selling over the past several days appears to have come from Tim Gitzel, whom registered seventeen insider sales transactions on December 24, with the transactions having taken place the day before. Currently the President and CEO of Cameco, his selling spree began with the exercise of options in two tranches, the first for 70,441 shares, and the second for an additional 244,592 shares, both at $11.32 per share.

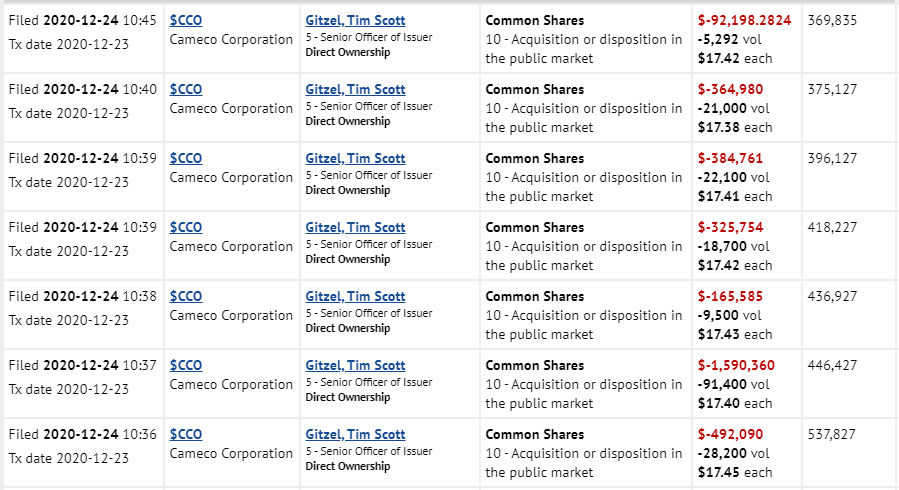

The vast majority of these converted shares were sold on the same day as exercise as per Sedi filings, with Gitzel ending his selling spree with 369,835 shares remaining, after the total exercise of 315,033 shares. The result, is that he ended up with slightly more common shares than he had prior to the option exercise, a net positive of 70,441 shares while pocketing $4.26 million in gross proceeds in the process. Shares were sold between a range of $17.38 to $17.55 throughout the process.

Also taking part in the sales transactions on Wednesday was Rachelle Girard, whom is Vice President of Investor Relations at the firm. Girard exercised a total of 7,360 options at a price of $11.32 per share, which she ultimately elected to sell in two tranches at $17.98 and $17.96, respectively. Total gross proceeds were marked as being $132,306.80.

Lynn McNally-Power, VP of Human Resources at Cameco also registered sales this week, having exercised 18,400 options at $11.32 on Tuesday, which she subsequently sold the same day at $17.30 per share, generating gross proceeds of $318,320.

Finally, honourable mention goes to Kelly Orr, whom is President of a subsidiary of the firm, whom began the selling spree exhibited this week by insiders on Monday. Orr sold a total of 2,000 shares of Cameco for gross proceeds of $35,800.

Cameco Corp last traded at $17.31 on the TSX.

.Information for this briefing was found via Sedar, Sedi and the companies mentioned. The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.