This morning Canaccord Genuity’s Katie Lachapelle initiated coverage on Uranium Royalty Corp (TSXV: URC) with a speculative buy rating and a C$1.60 12-month price target. She headlines, “Don’t stop ’til U get enough.” Lachapelle says she likes the business model for various reasons and list a few, which include the following.

- Uranium Royalty provides investors with potential returns while limiting risk factors associated with uranium mining operators. Their royalty model is structured, so it captures better margins in a rising price environment.

- There are no sustaining capital requirements because the operating cash flow is the cash flow used for new royalty opportunities and/or given to shareholders.

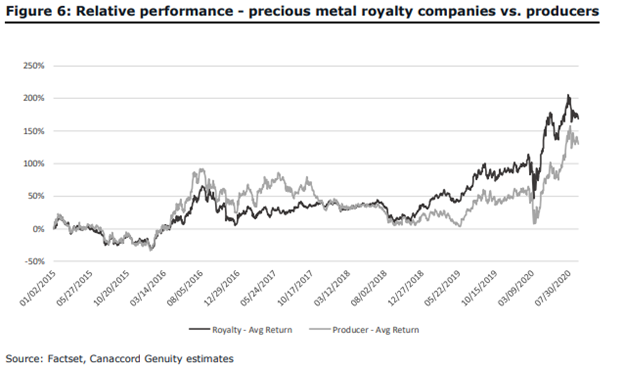

For this reason, royalty companies are well-positioned for both market uptrends and downtrends because when there is an uptrend, mining companies are more likely to deploy capital into exploration and to develop their mines. While in a downtrend, royalty companies are excellent alternative providers of capital. - Royalty companies are inherently diversified through their stakes in multiple assets, therefore having multiple cash flows and capital allocation decisions for royalty companies are also more straightforward.

Historically, royalty companies have outperformed their mine operating peers over the long run.

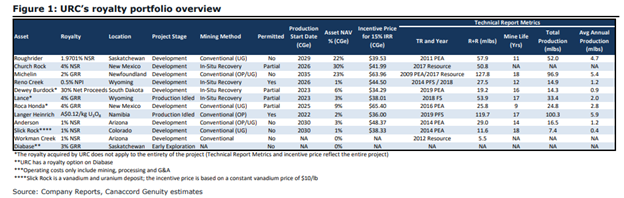

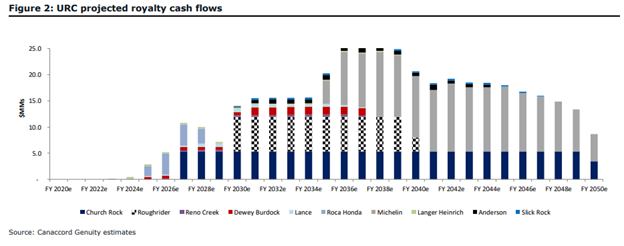

Lachapelle says the investment thesis is quite clear for Uranium Royalty Corp. Firstly, the Uranium Royalty portfolio will benefit from a near-term recovery in uranium prices as Uranium Royalty’s current portfolio is made up of 12 different royalties, which includes one royalty option.

Included in these agreements are assets that are partially and fully permitted development projects. Lachapelle says, “advanced projects, in our view, have the potential to produce royalty cash flows in the next uranium cycle.” She estimates that six out of the eleven royalties will produce cash flows with a recovery in uranium prices. Uranium Royalty also holds royalties on long term development assets, which will not produce royalty cash flows in the near term but have the potential to advance towards production later with the support of higher uranium prices.

Another positive for the company is that 98% of their royalties projects are located in Canada or the United States, safe jurisdictions. The last 2% is found in Langer Heinrich, Namibia.

The second key attribute to the investment thesis is that Uranium Royalty is one of the only pure uranium royalty firms and, “is well-positioned as an alternative provider of capital.” In a depressed price market where developers are cash strapped, alternative capital providers are the go-to, which will allow the company to negotiate royalties at attractive terms. Lachapelle estimates an average internal rate of return of 34% on the royalties to date, and the cost of capital to fund the royalty purchases is only roughly 20%.

The third and last key attribute to Lachapelle’s investment thesis is the “Experienced management team with the foresight to invest countercyclically to the commodity cycle.” The management team and board of directors have experience on over 90 uranium projects through different executive roles. She says that “management has leveraged its deep industry knowledge and strong relationships to build up URC’s current portfolio actively” and expects management to continue executing accretive transactions.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.