Dollarama Inc (TSX: DOL) is expected to report its second quarter financial results on September 9 before the markets open. The company currently has 15 analysts covering the stock with an average 12-month price target of $61.79, or a 8% upside. The street high sits at $70 from Wells Fargo and the lowest comes in at $51. The consensus revenue estimate for the quarter sits at $1.05 billion with 8 analysts having estimates.

Ahead of the results, Canaccord Genuity raised their 12-month price target on Dollarama to $57 from $53 and reiterated their hold rating on the stock, saying that they expect early quarter restrictions to weigh on the results.

The company fiscal second quarter is for the months from April to June, which is when Ontario banned non-essential retail sales, which were later lifted in June. Shortly after that, Ontario also eased restriction and increased store capacity but Dollarama’s second quarter results will show the months Ontario was in lockdown.

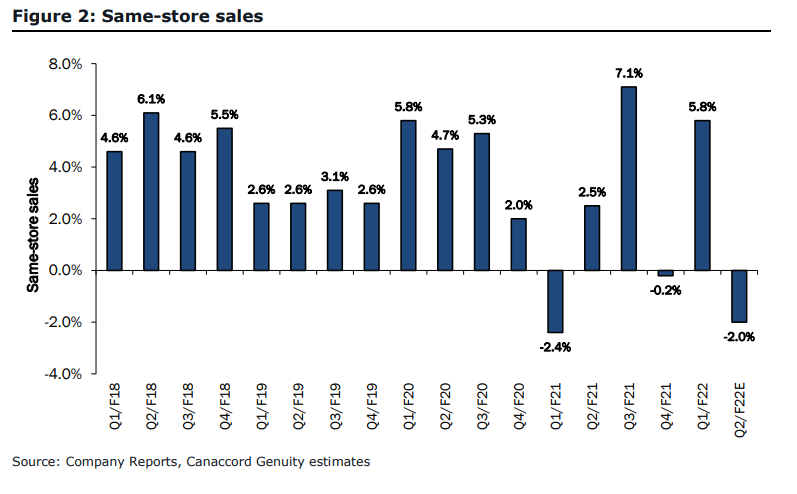

Due to this, Canaccord is forecasting same-store sales being down 2% year over year, bringing the decline to 15% for the first half of the year. For their revenue estimate, they are right in line with the consensus at $1.05 billion and EBITDA of $292 million for the quarter.

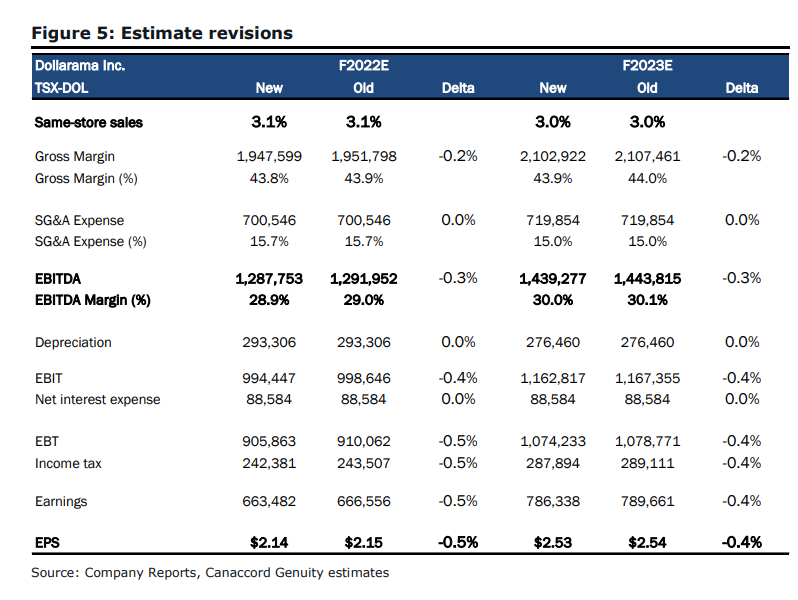

Canaccord says, “The relaxation on non-essential retail likely helped shift the product mix towards the company’s higher-margin regular seasonal and discretionary offerings.” But, they believe that this will be offset by any cost inflation, specifically shipping and freight costs rising. For these reasons, they are forecasting gross margins to come in at 43.4%, down 0.5% from a year ago but up 1.1% from last quarter.

Below you can see Canaccord’s updated fiscal 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.