This morning, Canaccord Genuity raised its 12-month price target on Mind Medicine (NEO: MMED) from C$1.75 to C$2.00 while reiterating its speculative buy rating after the company closed its C$28.8 million financing. The financing saw the issuing of 27.4 million units, with each unit consisting of one common share and one half warrant at C$1.05 per unit.

Mind Medicine is expected to allocate the proceeds to a number of different initiatives, including:

- $14.3 million to its four core development programs (18-MC for OUD and LSD for ADHD, anxiety, and cluster headaches)

- $2.3 million to discovery

- $3.3 million to general corporate purposes and working capital

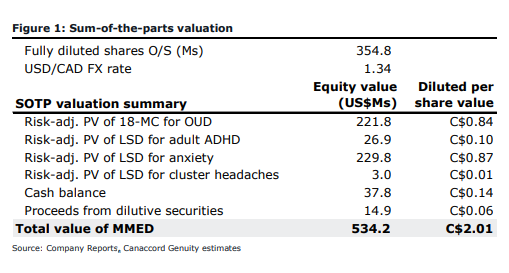

Tania Gonsalves, Canaccord’s analyst, says that they are, “taking our R&D estimates up.” As last month during their roadshow, management guided that the 2021 budget is $30-$40 million, which is higher than the $25 million forecasted by Canaccord. She says that knowing the $14.3 million spent on its core programs is in line with its $15.3 million estimate, they are merely adding $10 million to research and development costs for preclinical and discovery work.

The main reason for the price target increase is, “MMED’s ending fully diluted share count is lower than anticipated. Together, this has the effect of increasing our target price from $1.75/ sh to C$2.00/sh.” Canaccord prior forecast was under the assumption that Mind Medicine would have had to raise at $0.31 per share versus the $1.05 per unit that they actually managed to conduct the financing at.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

that would be great, eager to know as well

Since Mindmef has applied for uplisting on the Nasdaq can you detail the implications for the IPO price and date? Typically 6 weeks if a longer time which we are now approaching. Thanks so much.