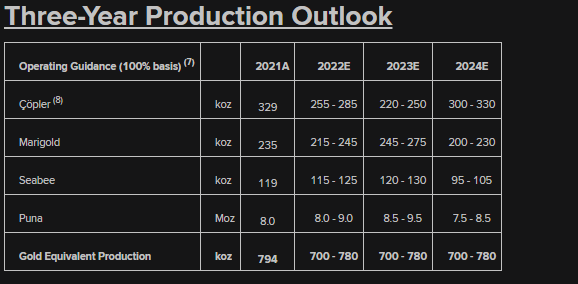

Recently, SSR Mining Inc. (TSX: SSRM) announced full-year 2021 production results, a three-year outlook, and a 40% increase to the current dividend. First, the company produced 794,456 gold equivalent ounces for the full year, almost beating their high-end 800,000-ounce guidance. The company had all-in sustaining costs of $982 per ounce, below their $1,000 low-end estimate.

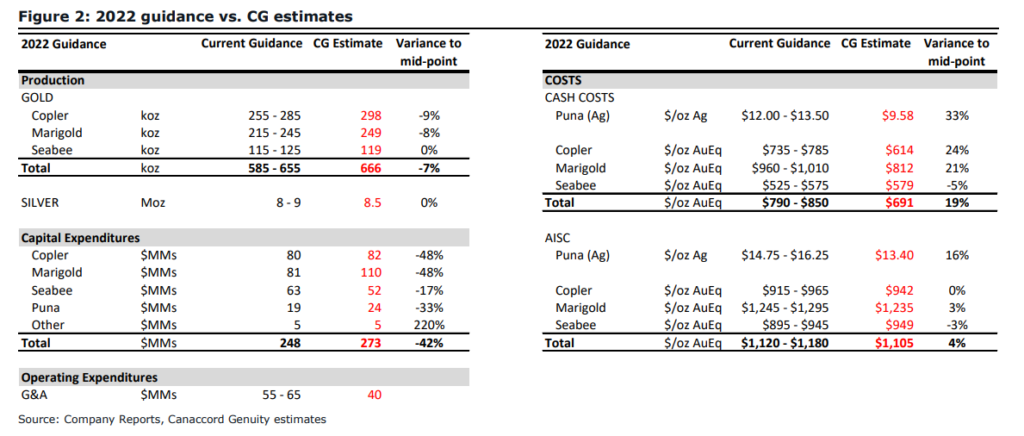

For the 2022 guidance, the company expects gold production to come in at 585,000 to 655,000 ounces and 8,000,000 to 9,000,000 million ounces of silver. This would bring the total gold equivalent ounces produced to between 700,000 and 780,000 ounces, with a cash cost of $790 to $850 per ounce and an all-in sustaining cost of $1,120 to $1,180 per ounce. The company also expects to spend a total of $76 million, with $22 million earmarked for growth CAPEX and the other $54 million for exploration and development.

You can see SSR’s three-year production outlook below.

SSR Mining currently has 4 analysts covering the stock with an average 12-month price target of US$25.44, or a 52% upside to the current stock price. All four analysts have buy ratings on the stock. The street high sits at US$29.75, or a 78% upside, while the lowest price target comes in at US$21.

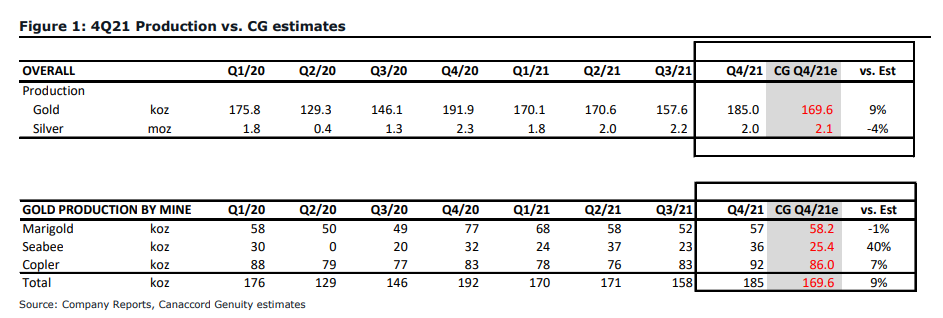

Canaccord Genuity lowered their 12-month price target from C$28 to C$27 and reiterated their buy rating, saying that this puts a solid ending to 2021. They say that the production results came in mixed, with gold production being roughly 9% higher than estimates while silver came in 4% lower than estimates.

Gold production by mine, Marigold was the only mine to not beat Canaccord estimates, only by 1%, while Seabee beat their estimates by 40% and Copler by 7%. The companies all-in sustaining costs came in lower than Canaccord expected, though they believe this is only being deferred into 2022.

Commenting on 2022 guidance, Canaccord stated that it “appears modestly weaker than our estimates.” With Copler and Marigold being 9% and 8% below Canaccord’s estimates. The big miss was in the CAPEX, the average CAPEX spend on each mine is 42% below what Canaccord expected. Additionally, the companies all-in sustaining costs are roughly 19% higher than Canaccord previously estimated.

Lastly, Canaccord says that the increased dividend brings the companies yield to roughly 1.7%. In 2021, the company returned roughly $200 million to shareholders which put the yield to 5%.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.