On February 2nd, Canaccord Genuity Capital Markets’ put out a note on the uranium sector. In their look back at how 2021 played out, they say that “financial players clearly accelerated price discovery in a relatively thinly

traded spot market,” helping push the spot price up 40%.

The largest of these financial players, the Sprott Physical Uranium Trust (TSX: U.u) purchased 23 million lbs of U3O8 in 2021, or roughly 13% of the annual demand. Although, Canaccord says that the impact of Sprott’s constant underlying bid in the spot market would not have occurred if there wasn’t a fundamental supply deficit. Although Sprott’s purchases helped uranium spot prices to go higher than $50 per pound in September, the ability for the spot market to hold above $40 per pound is very encouraging.

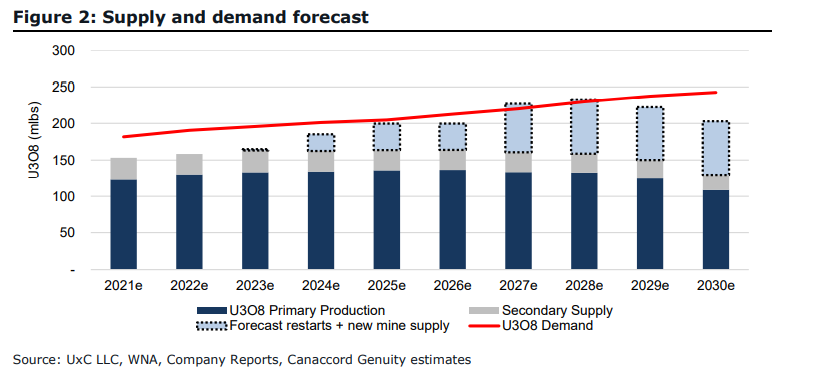

Looking forward to 2021, Canaccord remains cautious for the near term, as things such as COVID-19 and geopolitical headwinds continue to bring uncertainty to the market. Even with this, they say that the fundamentals around the trade remain very robust, as there is a global transition to clean energy and mine suppliers are sitting at 12-year lows. They note that the spot price has not gotten high enough to bring idled mines back into production.

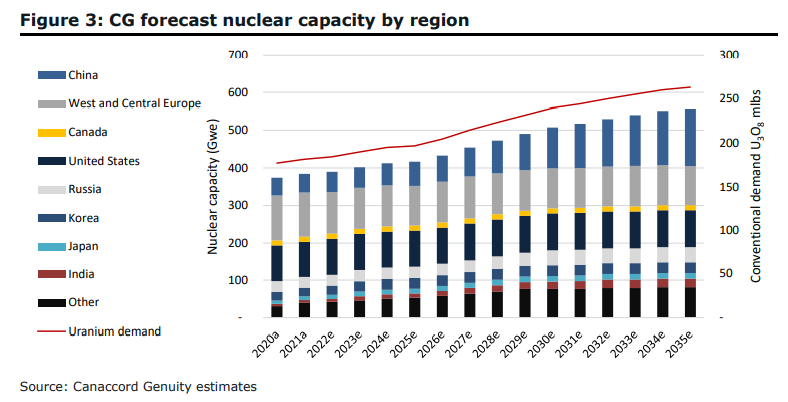

They add that the conventional demand remains very high as there are 440 operable reactors with another 55 under construction. They expect global demand for uranium to grow 2.8% per year through 2035.

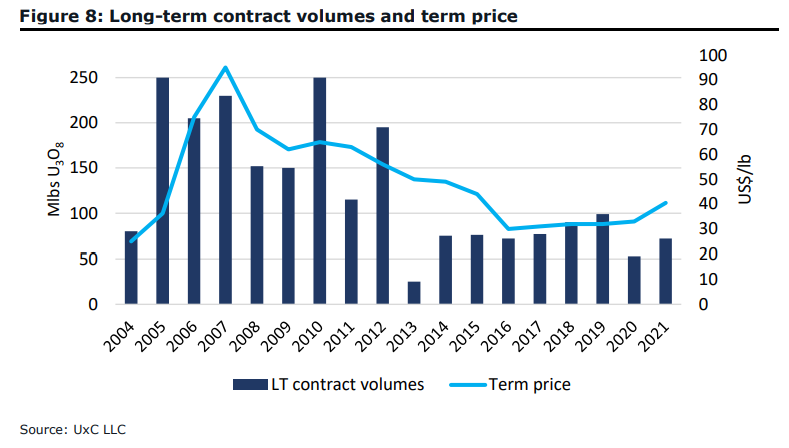

Canaccord reminds investors that the spot market is not the fundamental market, as a good portion of uranium is bought and sold under long-term contracts. Because of this, they believe that 2022 is the year utilities return to the long-term market. It had already started to pick up in 2021, with some alt data which indicated contracted volume increased to 72mlbs, up from 53mlbs in 2020.

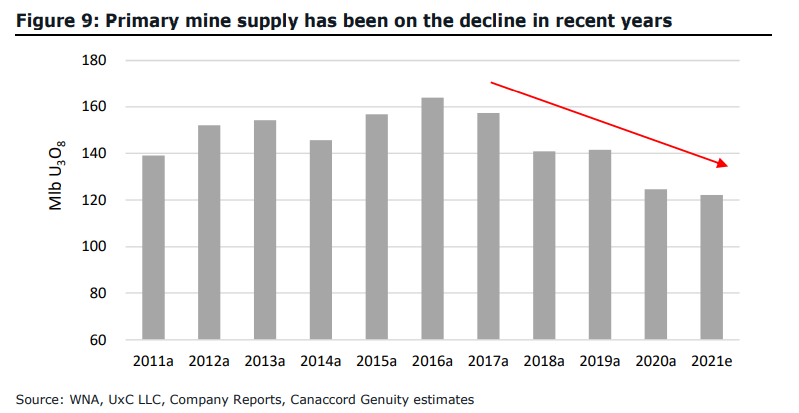

Lastly, Canaccord expects that supply will not front-run demand, primarily due to COVID-19 disruptions and supply chain issues. Uranium supply actually declined by 24% to 123mlbs, which is the lowest level in 12 years.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.