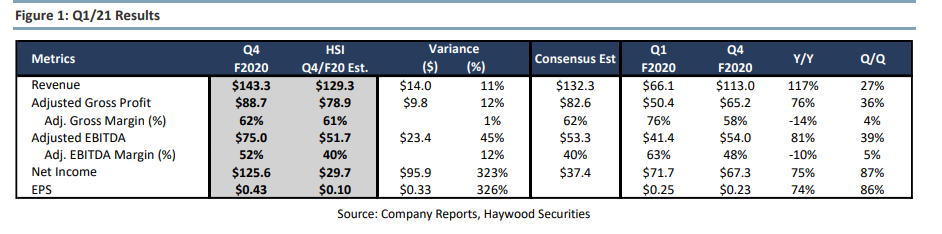

Earlier this week, Verano Holdings (CSE: VRNO) reported its first-quarter financial results. The company reported its numbers on a pro-forma consolidated basis, indicating revenue of $143 million, with gross profit coming in at $89 million, or a 62% margin. They had an adjusted EBITDA of $75 million or 52%, the highest in the industry.

The company currently has five analysts who have a weighted 12-month price target of C$40, a 68% upside. One analyst has a strong buy rating, while the other four have buy ratings. Beacon Securities has the highest price target at C$47, while the lowest currently sits at C$35

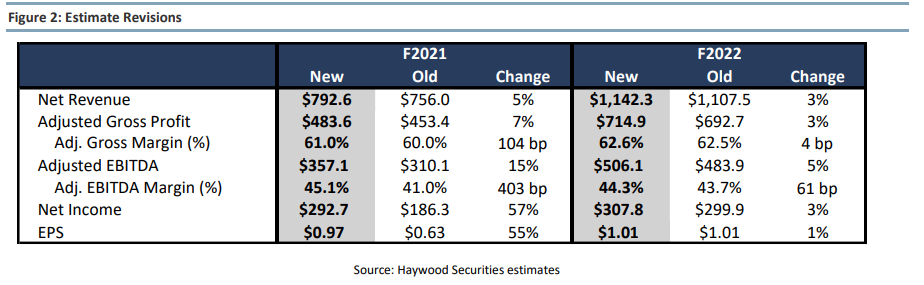

In Haywood’s note on the earnings, they reiterated their C$36 price target and buy rating on Verano. Neal Gilmer, their analyst, calls this quarter an impressive and strong quarter and writes, “management continues to deliver on operational efficiency.”

Verano beat all of Haywood’s estimates, which you can find below. Gilmer says that the company generated ~69% of its revenue from retail and ~31% from wholesale, with Florida making the mix more heavily weighted towards retail. Wholesale sales were up 28% year over year, with same-store sales being up 90% year over year. Daily visits increased to 10k, up from 4k, while daily transactions were up 71% year over year.

Gilmer says that Verano exceeded all financial expectations for the second consecutive quarter and expects the company to continue on its M&A spree.

Below you can see the updated 2021 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.