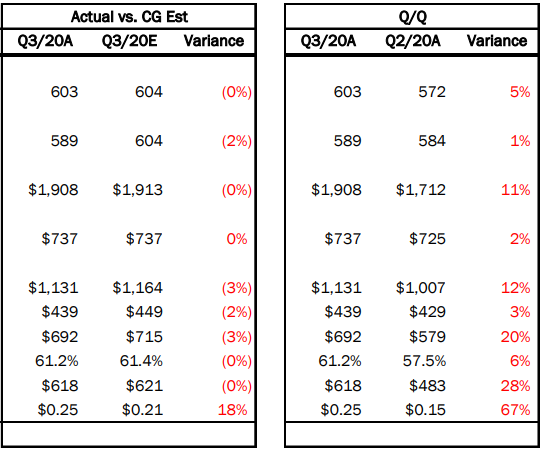

Yesterday, Kinross Gold (TSX: K) released its third quarter financial results. The company reported adjusted earnings per share of $0.25, production of 603,000 ounces, and adjusted EBITDA of $618 million. They also reported an all-in sustaining cost of $958 per gold ounce equivalent along with a production cost of $737 per ounce.

Carey MacRury, Canaccord’s mining analyst, headlined “Q3/20 first look: solid quarter, record FCF” in a note sent to investors this morning. He reiterated their buy rating and C$17 12-month price target. Kinross reported a better than expected earnings per share figure, with Canaccords estimate sitting at $0.21. The beat comes mainly from “adjustments for COVID-19 and Tasiast strike-related costs and lower taxes,” says MacRury. Adjusted EBITDA was basically in line with Canaccord’s estimate of $621 million.

Canaccord’s production and cash cost estimates were in line with actual numbers as well. Their production of 603,000 ounces was in line with the 604,000 ounces Canaccord had estimated. MacRury adds, “we note that Kinross sold 589koz, with the variance largely attributed to Bald Mountain and the timing of sales.”

He also says that Fort Knox had a strong quarter with production being up 17% more than their estimates and up 32% quarter over quarter. This strong production was offset by the lower production at Paracatu.

Canaccord’s MacRury says that the company is on track to meet its 2020 guidance as last night, the company maintained its 2020 guidance of 2.4 million ounces produced at cash costs of $720 an ounce and an all in sustaining cost of $970 an ounce. MacRury forecasts that 2020 production will be 2.39 million ounces at cash costs of $736 per ounce.

Kinross in the quarter reported a record free cash flow of $277 million, compared to $207 million in the previous quarter. MacRury commented, “we expect Kinross’s trailing 4Q FCF to surpass $800 million in Q4.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.