On December 15th, Canacol Energy Ltd. (TSX: CNE) provided its 2022 sales and capital guidance. The company is now guiding for natural gas sales volume to be between 150 and 200 MMscfpd, with EBITDA being between $163 to $230 million in 2022.

The capital expenditures in 2022 are expected to total between $172 and $209 million, primarily due to field expenditures guided to come in between $154 and $191 million.

There are currently 9 analysts covering Canacol Energy, with an average 12-month price target of C$5.66, or an 80% upside to the current stock price. Out of the 9 analysts, 1 has a strong buy rating, 7 have buys and the last analyst has a hold rating. The street high sits at C$8.50 while the lowest comes in at C$4.25.

In BMO Capital Markets’ note, they reiterate their market perform rating and C$4.25 12-month price target, saying that managements guidance seems conservative. They also believe that investors should take caution from this guidance and that they believe Canacol will likely stick to the lower end of guidance.

For the 2022 budget guidance, BMO says that this is slightly higher than their $146 million estimates, but the main points that come out of the news release have to be $18 million related to the Medellin pipeline, which is expected to be reimbursed, and $19 million for facilities and infrastructure.

For the sales guidance, which is expected to be between 160 and 200mmcf per day, BMO believes that the company will be able to do better than the low end of guidance since it assumes no contributions from interruptible sales.

Lastly, BMO says that going into 2022, they are looking towards Canacol’s progress on the Medellin expansion and believes that the company will see sustainability metrics improve all the way into 2024.

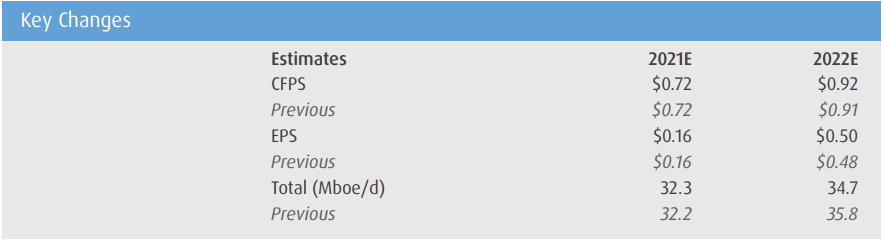

Below you can see BMO’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.