Ottawa is set to tackle federal support for the critical minerals sector. Minister of Energy and Natural Resources Jonathan Wilkinson announced the Critical Minerals Infrastructure Fund (CMIF) will begin accepting applications when it opens its first call for proposals in late fall 2023.

The CMIF is poised to bridge critical infrastructure gaps, facilitating sustainable critical minerals production and connecting these valuable resources to the market. With an allocation of up to $1.5 billion over a seven-year period, this fund is set to push clean energy and transportation projects that will catalyze critical mineral development.

“Through the $1.5-billion Critical Minerals Infrastructure Fund, Canada will make strategic investments in projects to help enable and grow the sustainable development of these minerals, reinforcing Canada’s position as a global supplier of choice for clean technology, clean energy and the resources the world needs to build a prosperous net-zero economy,” Wilkinson said in a statement.

The ministry emphasized that the CMIF represents a pivotal element of the Canadian Critical Minerals Strategy (CMS), complementing existing support for clean energy and transportation that benefits the critical minerals sector.

Strategic priorities that will receive support from the CMIF include decarbonizing industrial mining operations, fortifying supply chains through transportation infrastructure, and advancing economic reconciliation by actively involving Indigenous Peoples in infrastructure and critical mineral projects.

“Canada has an opportunity to be a substantial global producer of critical minerals. We are pleased to play a role in unlocking critical mineral deposits, which are essential for Canada’s move to net zero and economic development in northern communities,” said Canada Infrastructure Bank CEO Ehren Cory in a statement.

In 2022, the government introduced the Regional Energy and Resource Tables, a collaborative effort involving provinces and territories aimed at identifying, prioritizing, and pursuing opportunities for sustainable job creation and economic growth. Through these tables, critical minerals emerged as a top-priority area of focus for provincial and territorial governments. They present an ideal platform to spotlight critical mineral infrastructure projects that could receive backing from the CMIF.

The eastern concern

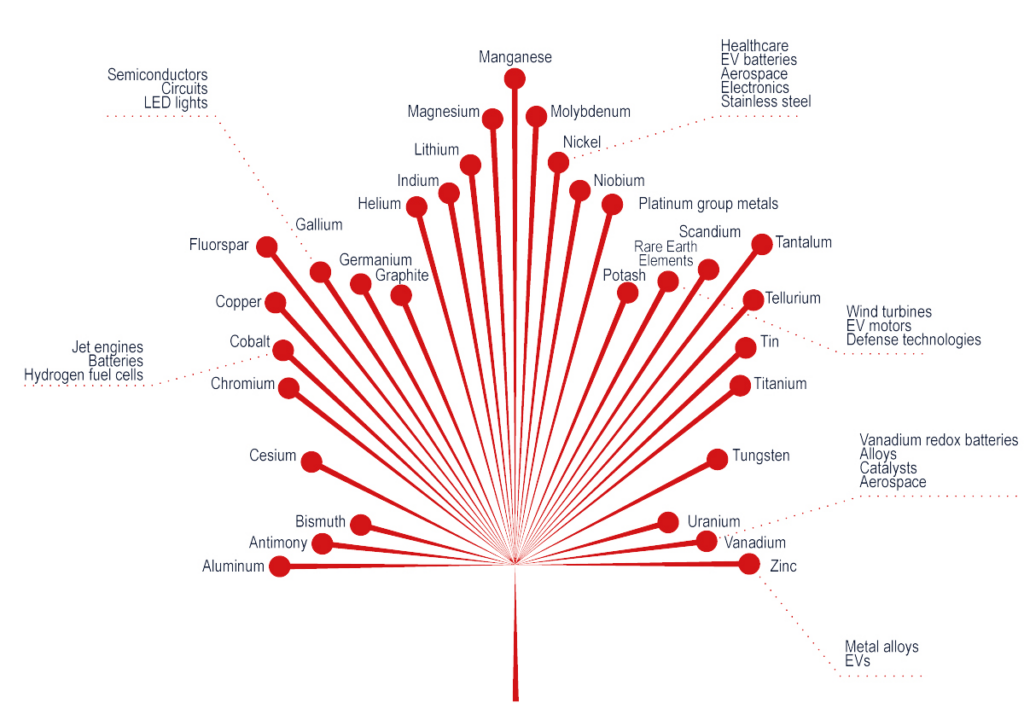

In December 2022, the Canadian government inaugurated the critical mineral strategy, targeting 31 critical minerals, including lithium, nickel, and graphite, vital components in the production of electric vehicles. According to the CMS, these critical minerals are deemed “essential to Canada’s economic security,” as they play a pivotal role in the country’s “transition to a low-carbon economy” and provide “a sustainable source of critical minerals for [Canadian] partners.”

In the Asia Pacific region, the CMS finds reinforcement through the Indo-Pacific Strategy (IPS), which was unveiled in November 2022. By harmonizing the CMS and IPS, Canada aims to diversify its investments and trade partnerships in critical minerals, leveraging international supply chains and collaborating with like-minded regional economies.

Both the CMS and IPS acknowledge the need for foreign investment to boost Canada’s critical minerals industry, while also recognizing national security concerns related to investments from state-owned enterprises (SOEs).

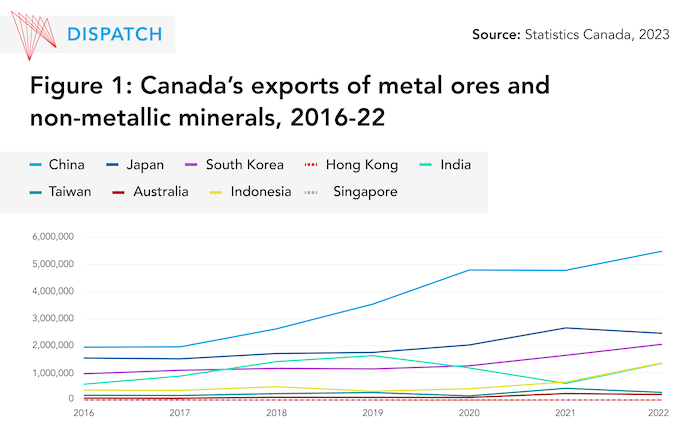

The IPS and CMS both highlight Japan and South Korea as regional allies and trustworthy trade partners. Statistics Canada data indicates that both economies escalated their imports of Canadian minerals between 2020 and 2022. Given recent political developments, including a new memorandum of understanding on critical minerals with South Korea and Canada’s renewed commitment to supply critical minerals to Japan in 2022, both economies are expected to further boost their imports of Canadian critical minerals.

A 2022 report from the Asia Pacific Foundation of Canada’s Investment Monitor reveals that from 2003 to 2021, state-owned enterprises (SOEs) were responsible for nearly one-quarter of all foreign direct investment (FDI) in critical minerals in the Asia Pacific, amounting to $4.7 billion. Most of these investments, approximately $4.3 billion, came from Chinese SOEs, with SOEs from Japan and South Korea accounting for the remainder of the investment value.

As SOEs are prevalent in the Asia Pacific, limiting foreign direct investment from SOEs may restrict capital inflow from friendly Asian Pacific nations, the report noted. Such restrictions could also affect investments made by SOEs with whom Canada partners in the region, such as Japan’s Tokyo Electric Power Co. In such a scenario, investments by SOEs in critical minerals might come to a standstill.

Furthermore, a blanket restriction on SOE investments might inadvertently shut the door to “patient capital,” investments not driven solely by quick profit, but rather by long-term commitment, even during economic downturns. Safeguarding national security is undoubtedly a top priority for Canada’s economy, but the decision to categorically block all SOE investments in critical minerals may dissuade investments from SOEs hailing from supportive economies.

“Ottawa’s recent decision to limit investment from state-owned and state-connected entities, which may not have Canada’s best interests at heart, will also restrict Canada’s ability to collaborate with like-minded regional business partners that are linked to any foreign government,” said the report from Asia Pacific Foundation of Canada.

Information for this briefing was found via the Canada.ca and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.