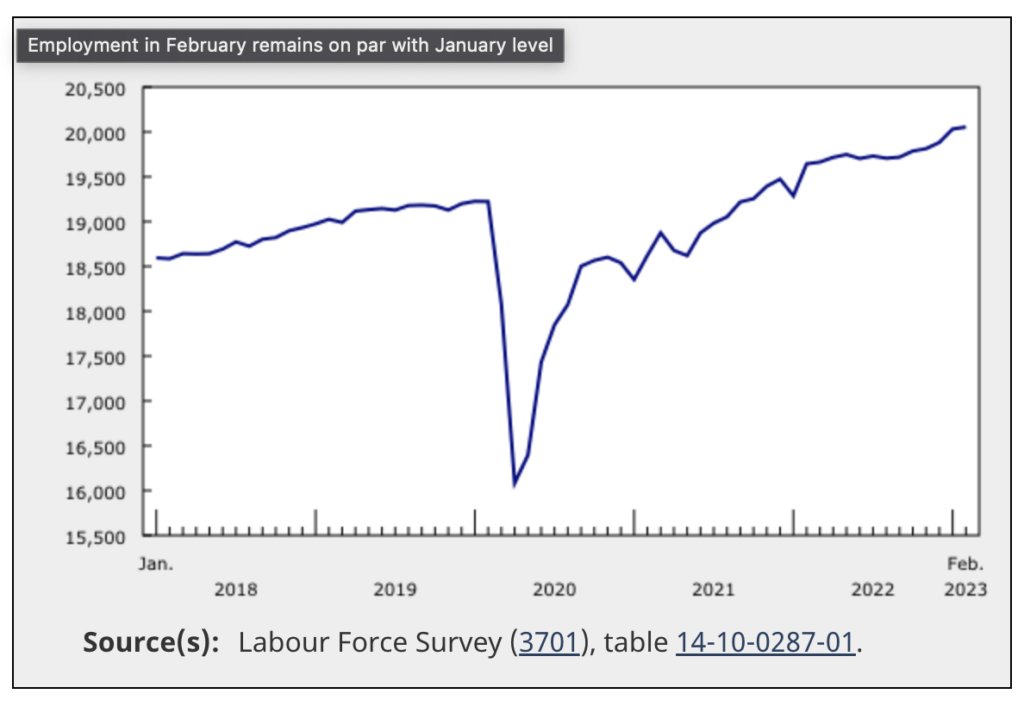

For the third consecutive month, Canada’s economy added more jobs than economists’ forecasts, solidifying an already-tight labour market that fails to show signs of easing despite rising interest rates.

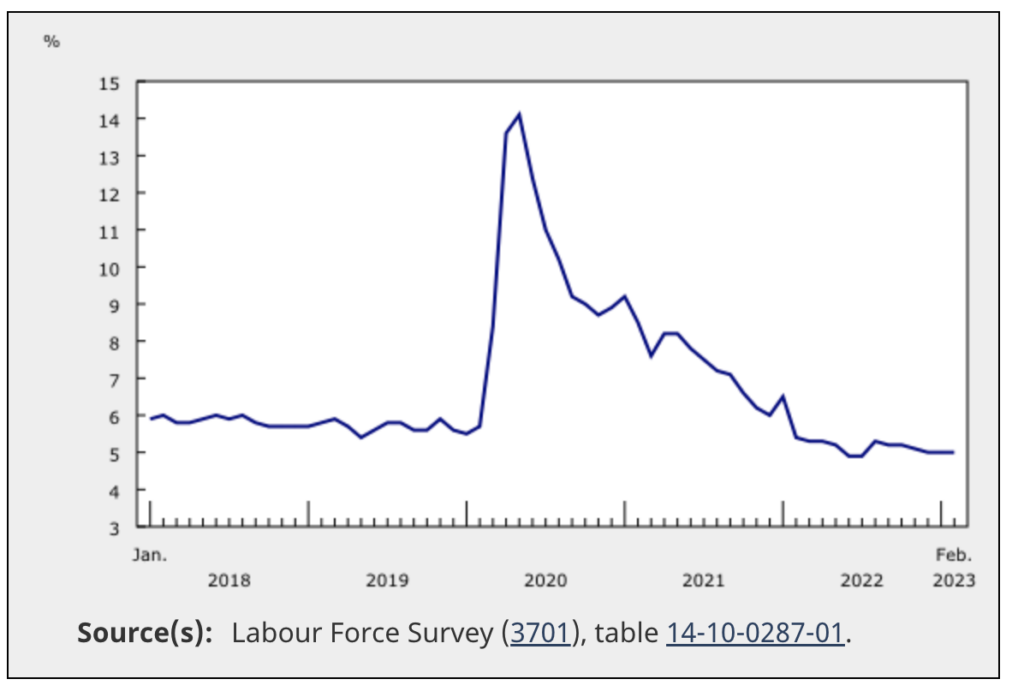

Latest figures from Statistics Canada showed that businesses hired another 22,000 workers in February, following increases of 69,000 and 150,000 in December and January, respectively. The unemployment rate remained steady at 5%, just slightly above the historic low of 4.9% recorded in June and July 2022. Economists polled by Bloomberg forecasted an employment increase of only 10,000 for last month, and a jobless rate of 5.1%.

The ongoing tightness in the labour market also continues to put upward pressure on wages, sparking concern among Bank of Canada policy makers. Statistics Canada reported that average hourly compensation rose 5.4% from February 2022 to $33.16, well above December’s and January’s annual growth of 4.8% and 4.5%, respectively. At the same time, total hours worked jumped 0.6% month-over-month, and were up 1.4% from one year ago, suggesting that Canada’s economy continues to gain momentum even in the face of adverse monetary policy tightening.

“Employment growth has been surprisingly strong, the unemployment rate remains near historic lows, and job vacancies are elevated,” the Bank of Canada said in a statement accompanying its rate decision on March 8. Still, Governor Tiff Macklem delivered on his conditional promise of a rate hike pause, but warned that the bank is prepared to raise borrowing costs should incoming economic data fail to show inflation returning to the 2% target range.

Information for this briefing was found via Statistics Canada and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.