Can Trudeau tax the teeth out of these grocery gougers’ gobs?

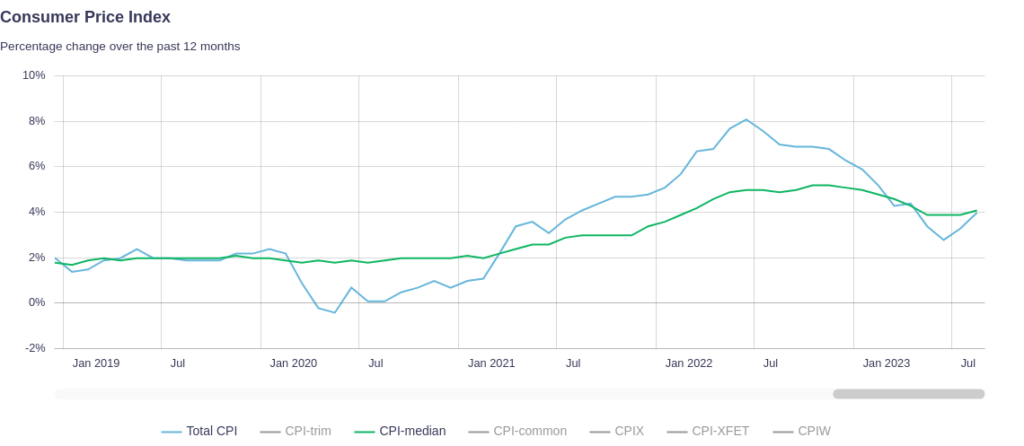

Inflation jumped in August, and anyone who’s been to a grocery store in 2023 didn’t need Stats Canada to tell them that. I just paid $23 for a chicken. On sale.

So Trudeau, along with key cabinet ministers and Deep Dive recurring characters Francois-Philippe Champagne and Chrystia Freeland, invited the CEOs of the country’s five relevant grocery competitors in for a little chat this past Monday.

The CBC reports that Freeland ducked out after a few minutes (probably late for a book burning), but Champagne stayed for the whole two hours, soaking up every minute he could get with actual real live CEOs.

After a couple hours chopping it up with Galen and Eric, the microphone-fiend of a minister practically ran to the podium to give the assembled press the good news: the CEOs have “agreed to work with the government to stabilize food prices!”

No stuffy commitments or contracts or anything. The minister prefers to work in a loose, fluid environment with his partners in industry. They’re all going to put together reports about what they might be able to do to keep the cost of regular old food from getting even more out of hand, and turn in their homework by Thanksgiving.

If none of the reports outline a cogent plan to make food cost less, the government might, possibly, perhaps, think about… maybe… t-t-taxing these grocery giants? Or planning to? In some way?

Typical!

The Liberals aren’t leveling this tax threat with any real conviction, but just saying the T-word is enough to send the amateur economists at the Fraser Institute over to their standing appointment in the Financial Post for a tirade about how misguided it is. Or, rather… would be. Government over-reach, can’t tax your way to prosperity… the usual.

All that money to bail out the entrepreneurs at Postmedia has to come from somewhere, of course, so this conceptual windfall tax that the government doesn’t have the guts to stick to the corporate asses they’re kissing isn’t such a bad idea from a revenue perspective. But this exercise isn’t about the government’s revenue, it’s about the consumer’s cost.

Since it isn’t practical to blame this notional, future tax for today’s runaway grocery costs, The Post and The Sun have to settle for blaming the carbon tax, which is equally misguided.

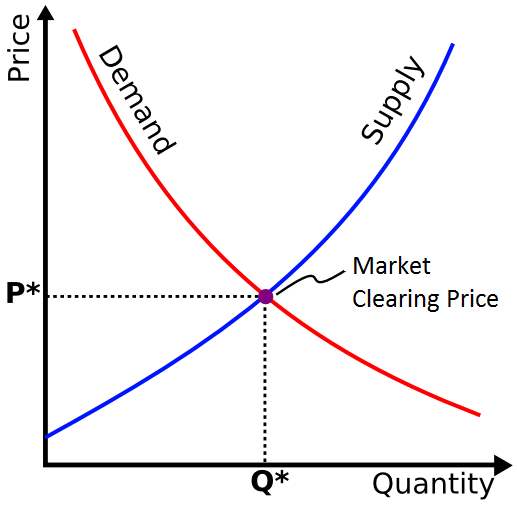

This column is fond of reminding the wannabe capitalists that price is not a function of cost, but rather a function of supply and demand. If $23 chilled chickens sell at a rate that turns over the inventory, then the store sells chilled chickens for $23, and that’s what they cost. The market has spoken.

If the chicken cost the grocery store $10 before the carbon tax, but $13 after the carbon tax, then the store’s chicken margin took a -$3 hit. If the store could adjust by charging $26 for the chicken, and still sell a volume that made it worth their while, the store would already be selling chickens for $26, and $26 would be what chicken costs.

Could taxing companies to bring grocery prices down actually work?

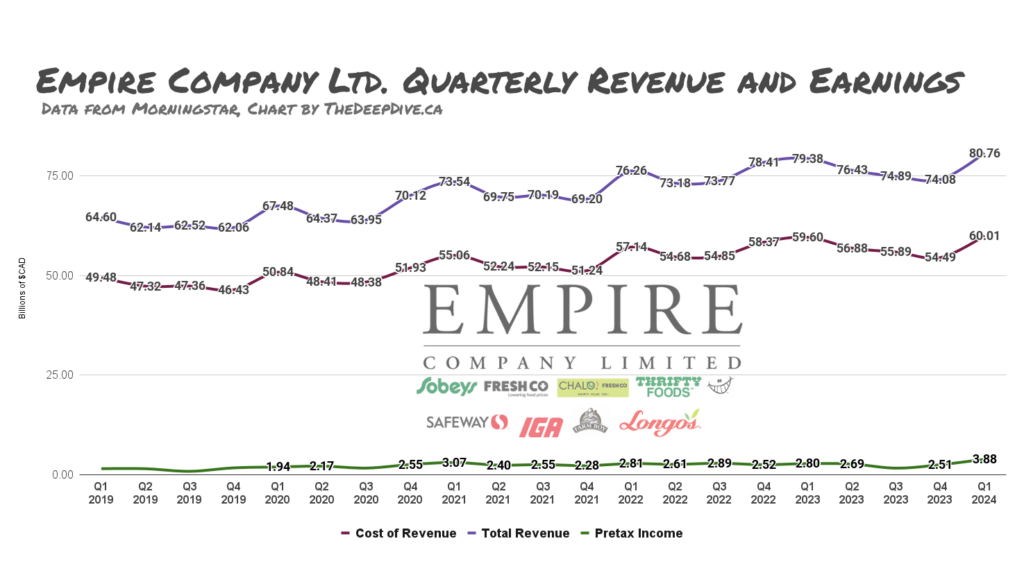

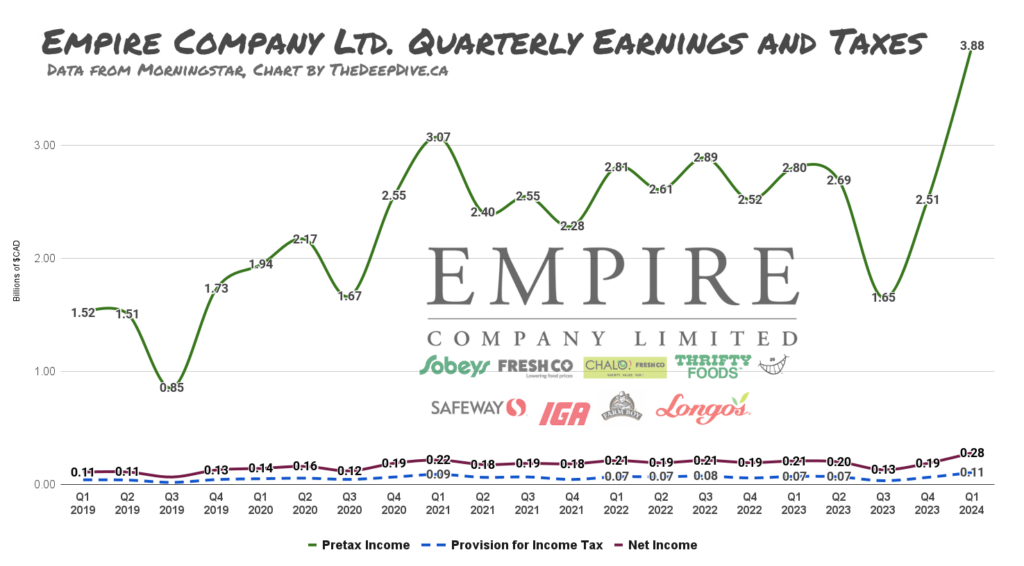

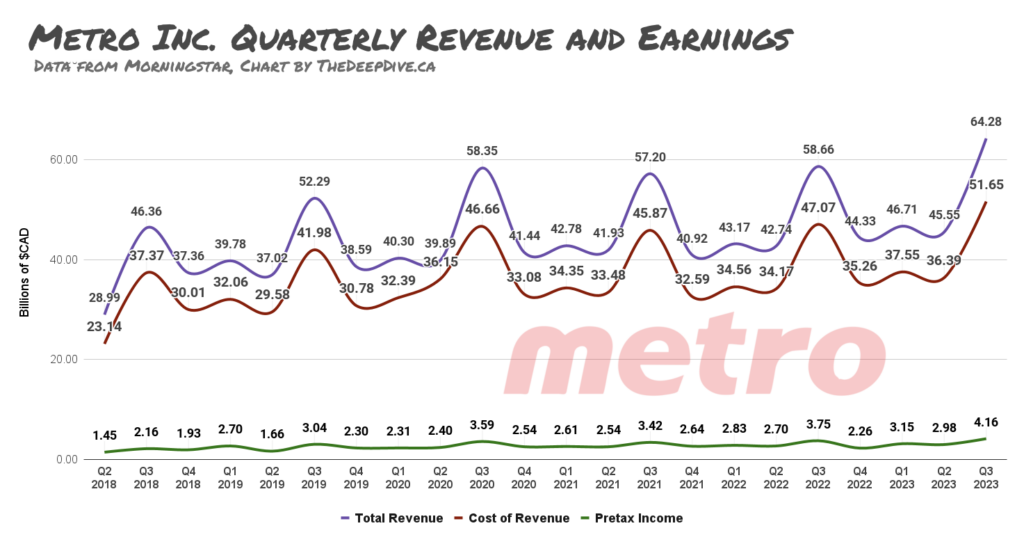

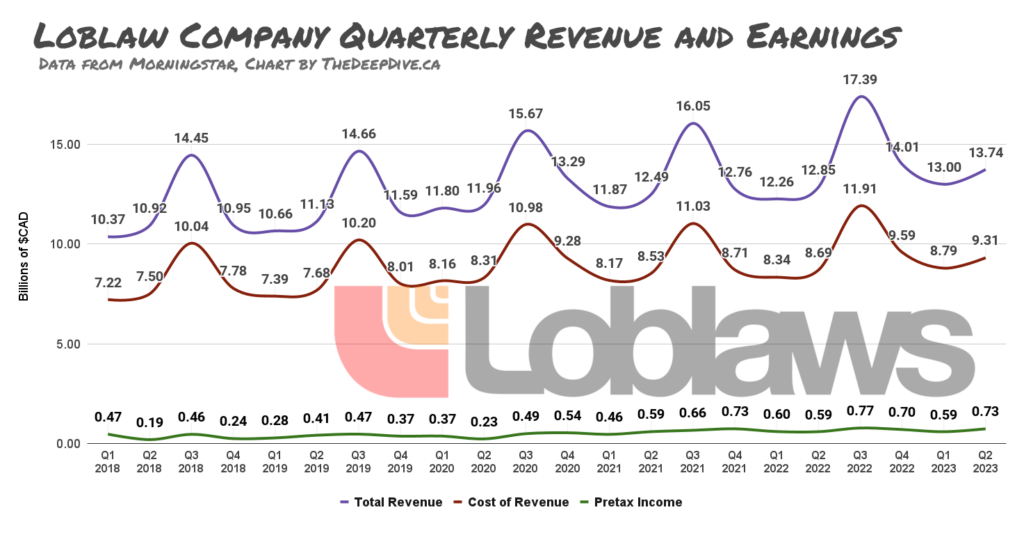

It could if they were serious about it. After-tax profit is the foundation upon which these grocery equity empires are built. They all book tremendous revenue, and show cost lines that put their margins in line with typical grocery businesses.

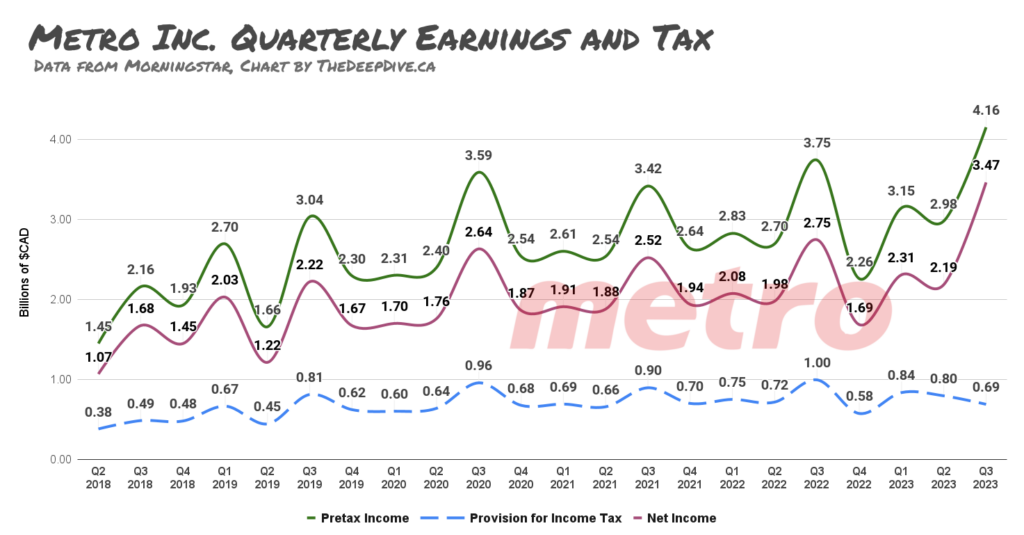

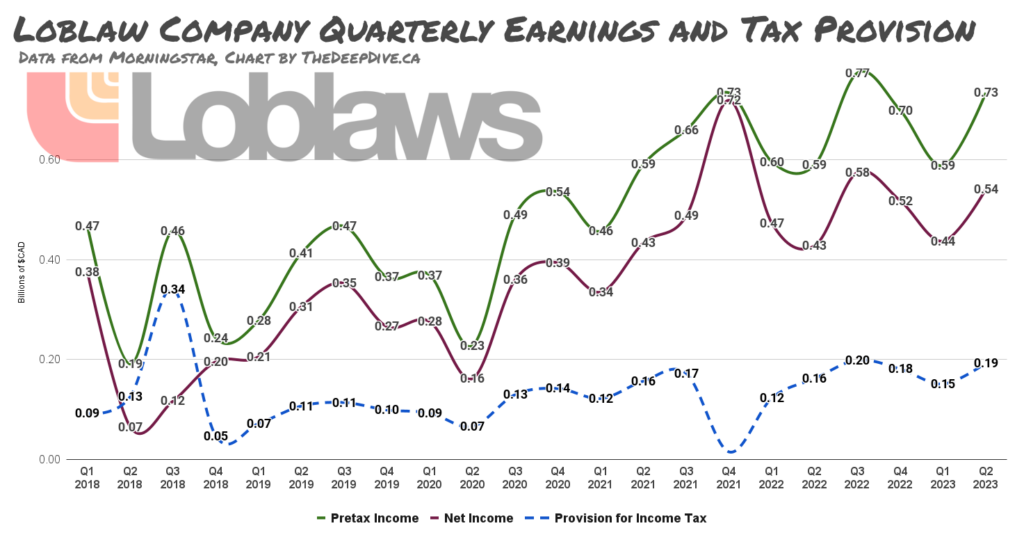

The after-tax net is what these enterprises are made of. Shaving it down with a bigger tax would affect the well-oiled machines that these companies have built in the capital markets like sugar in their gas tanks. It is absolutely not something they want to have to adjust to.

If the grocery companies take this threat seriously, they might pretend to compete for a while, freeze prices and find an accounting path to preserving the margins and supporting the dividends. But a serious, credible threat wouldn’t be a threat at all; it would be a tax. Besides: it’s the long way around.

Price caps would be easier to understand

If the government wants to stabilize or even reduce grocery prices, it doesn’t have to threaten a tax or even follow through with one. It can just put a legal ceiling on grocery prices. The people elected them to a legislature that is perfectly suitable for making laws that cap grocery prices, the same way they make laws that govern the maximum rent increases, maximum interest rates on credit cards, etc.

Opposition leader Pierre Poliverre, who’s been having a grand old time getting indignant over the price of lettuce, and NDP caucus leader Jagmeet Singh, who’s still working the kinks out of his impression of a populist firebrand, would have a tough time explaining themselves if they voted against a bill that puts direct controls on the price of groceries.

When there’s a glut of cash in the system, consumers are able to pay more, so stores charge more, and prices go up. That’s what inflation… is. With this much money floating around, there’s no practical way to keep inflation out of food costs except for a price cap.

Such a measure would force the grocery chains to either live with a smaller margin, or turn around and put the squeeze further up the supply line. The producers and suppliers need the grocery stores just as much as the grocery stores need them. When they’re done fighting, they’ll split the difference and send the Fraser Institute back to the Financial Post to tell everyone how cheaper groceries are actually bad for the economy, and the Post will keep pretending anyone who can count still takes it seriously.

Thanks for reading. There’s more coming on the companies themselves and an actual, tangible path to cheaper groceries in Canada, so stay tuned.

Information for this briefing was found via Sedar+, Reuters, Globe and Mail, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Why doesn’t the government just administer food allocations? Party members get to be first in line.

If you’d prefer that to price controls, write your MP.

Thanks for reading. Plenty to come, so stick around.

B