The value of building permits fell by the most on record in September, as rapidly rising mortgage rates send shivers across Canada’s real estate market and prompt would-be homeowners to shy away from purchasing a home.

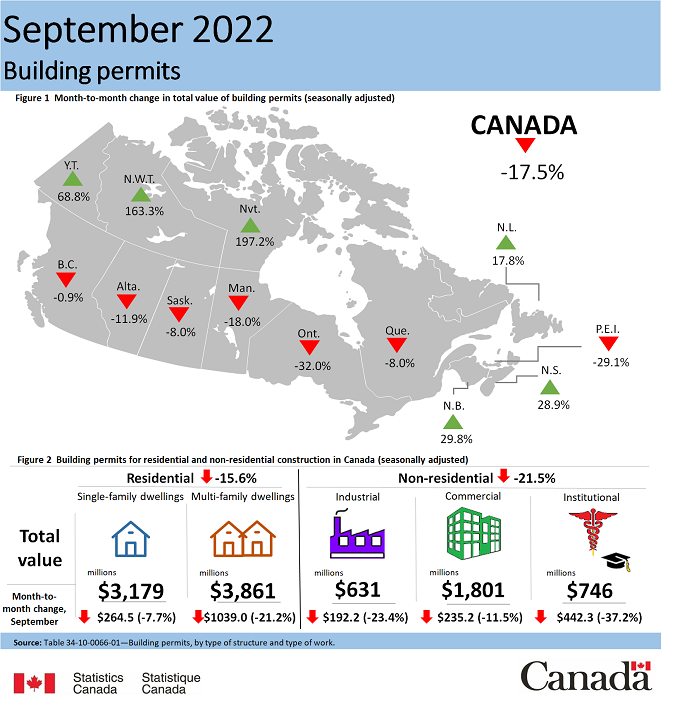

Latest Statistics Canada data showed that the total value of building permits for the month of September plummeted 17.5% from August to $10.2 billion, marking the sharpest monthly decline on record. In fact, this was the first time since September 2019 that both residential and non-residential sectors posted declines. On a quarterly basis, building permits were down 6.3% between July and September to $33.7 billion, following three straight quarters of increases.

The value of residential permits fell 15.6% month-over-month to $7 billion, as the multi-family sector collapsed 21.2% largely due to Ontario, where this component dropped 39.6% from August. Builders’ intentions to construct single-family homes decreased 7.7%, with seven provinces posting declines. The non-residential sector slumped 21.5% to $3.2 billion, with both the institutional and commercial components falling by 37.2% and 11.5%, respectively.

Building permits tend to provide an early snapshot of construction activity in Canada; the Statistics Canada survey is comprised of 2,400 municipalities across the country, and represents about 95% of the population. September’s sharp decline in construction intentions coincides with a broader slump in the housing market, as an increasing number of Canadians delay home purchases over fears of rapidly-escalating mortgage rates.

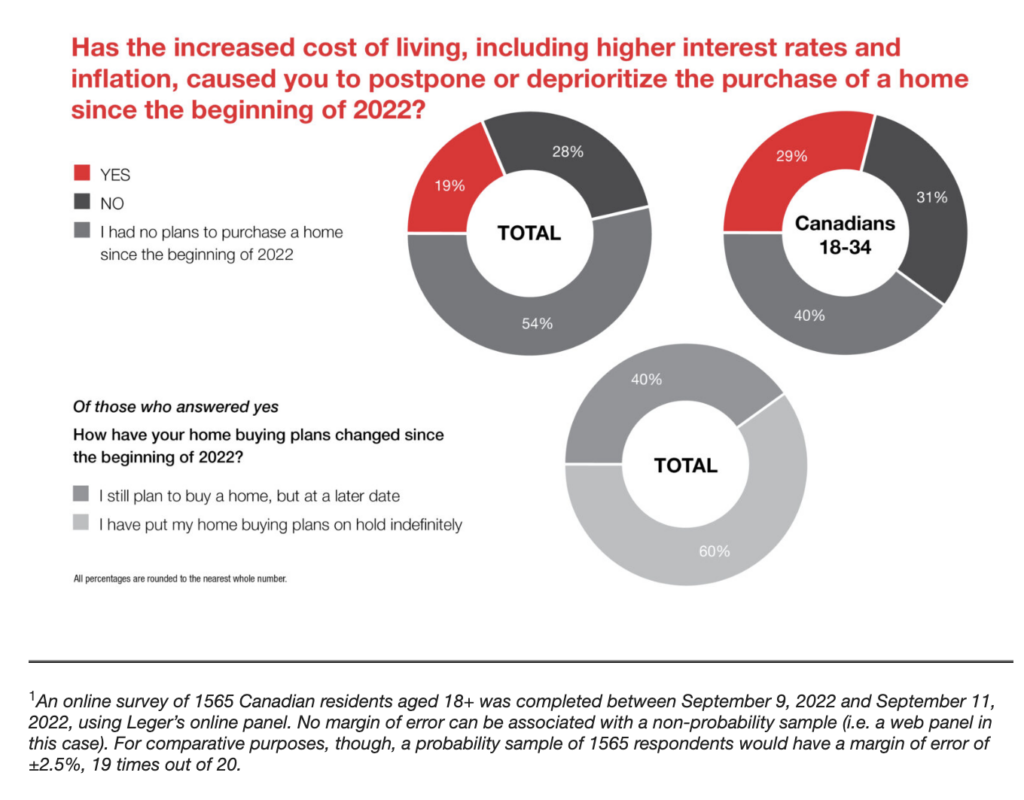

A recent online survey conducted by Royal LePage found that 19% Canadians are postponing purchasing a property due to the rising cost of living and higher interest rates. “We feel that those buyers are simply stepping back and seeing what’s going to happen in the market, reassessing their affordability and their financials to ensure that they get the property that they can afford, that they feel comfortable in, in terms of their monthly payments,” explained Royal LePage COO Karen Yolevski, as cited by CTV News.

Information for this briefing was found via Statistics Canada, Royal LePage, and CTV News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Choke Points: The War on Inflation is Getting Pretty Selective

Inflation is too high, so central banks are raising interest rates to try and bring...