As many provinces across Canada are well underway in their recovery plans, it appears that some sectors are facing even more tougher obstacles on the path to reopening.

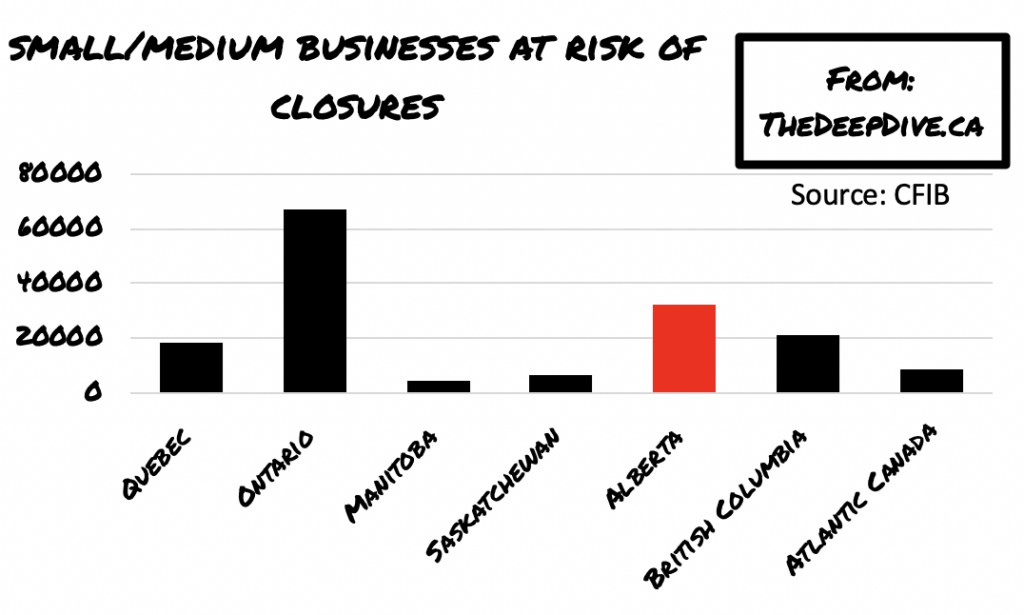

According to a recent survey released by the Canadian Federation of Independent Business (CFIB), over 14% of all Canadian small and medium sized businesses are at risk of filing for bankruptcy or reducing their operations due to the significant implications posed by the coronavirus pandemic. The alarming rise in potential business closures would affect nearly 158,000 small companies across the country, in addition to those that have already shut their doors.

The CFIB also noted that their survey results lean towards the conservative scenario, given that many of the survey’s respondents were already well-established well before the pandemic, and as a result more resilient to volatility. Therefore, anywhere between 218,000 and 55,000 businesses could close in the foreseeable future, depending on the progress of Canada’s economic recovery.

However, some regions face a higher risk of business closures than others. CFIB noted that up to 19% of Alberta’s small businesses may have to file for bankruptcy, given that the province has been hit significantly harder by the pandemic following the collapse of the oil industry. In the meantime, the recreation and arts sector, as well as the hospitality sector are undoubtedly facing up to a 30% and 27% risk of closures, respectively. Many companies in these sectors have been mandated to shut their doors for an extended period of time in order to mitigate the spread of the deadly virus.

Information for this briefing was found via CFIB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.