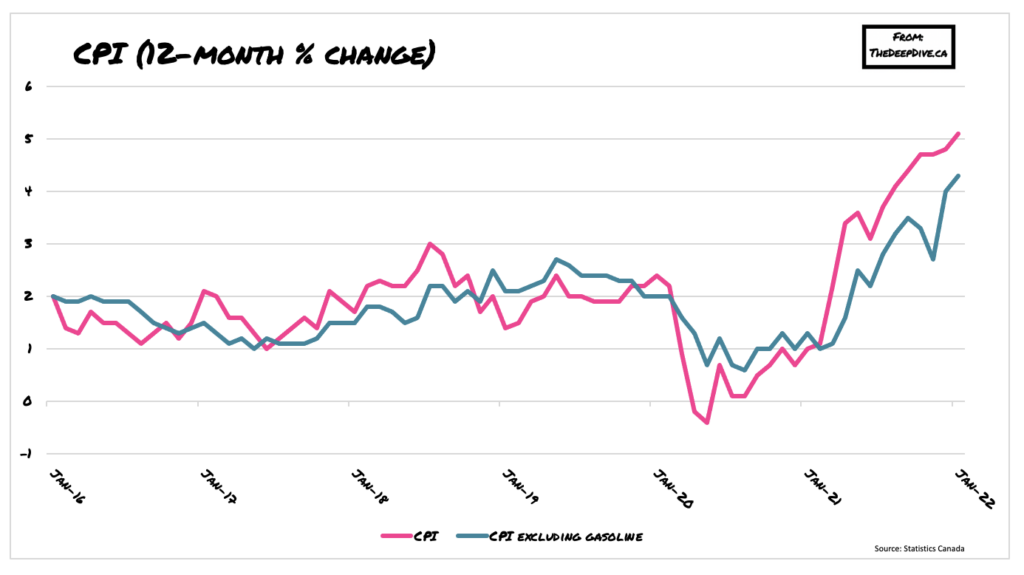

For the first time in over 30 years, consumer inflation across Canada exceeded 5%, as unprecedented quantitative easing, snarled supply chains, and product shortages contributed to broad price increases across all major components.

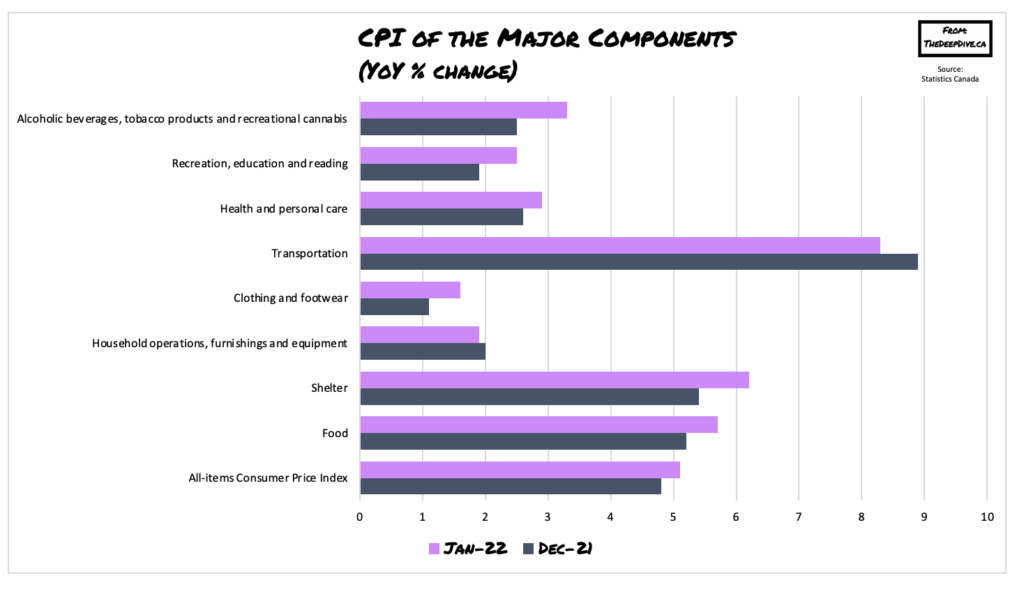

Following a monthly decline of 0.1%, consumer prices jumped 0.9% between December and January, registering the sharpest gain since 2017. The fresh CPI print for January came in at an aggressive 5.1% annual gain, up from 4.8% the month before, sitting at the highest since September 1991. To make matters worse, core CPI, which does not account for gasoline, was also flashing red-hot last month, rising 4.3% year-over-year— the biggest gain on records dating back to 1999!

Among the largest contributors to last month’s eye-watering price gains were shelter costs, which skyrocketed 6.2% from January 2021— the quickest pace since February 1990. Canadians also continued to pay substantially more for groceries, as food purchased from stores was up from an annual 5.7% in December to 6.5% in January. If you are already having a hard time processing the staggering price gains and are ready to whip up a stiff drink, do worry, because that has gone up too. Material shortages and rising shipping costs caused alcoholic beverages to increase 2.9%, up from a 1.6% gain in December.

Of course we cannot forget about gasoline prices, which were sent soaring by another 4.8% in January, as rising geopolitical tensions and tight global crude supplies contributed to annual gains of 31.7% at pumps across Canada.

Last month’s rip-your-face-off inflation reading also finally throws out the narrative that rising prices are somehow good for you, me and the economy. As January’s Labour Force Survey showed, wages rose a paltry 2.4%, meaning that prices accelerated significantly faster than wages, sending Canadians’ purchasing power plummeting sharply.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.