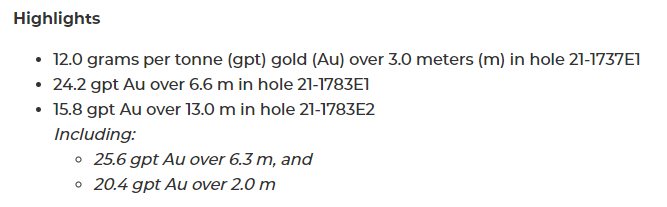

On July 6, Canagold Resources Ltd. (TSX: CCM) announced high-grade assay results from the first three drill holes of a 47-hole, 24,000-meter drilling program at the company’s flagship, 100%-owned, New Polaris Gold project in British Columbia. The drilling program commenced in late May. Specifically, one hole intersected a 6.6-meter span which had a gold composition of 24.2 grams per tonne of resources (g/t). Another hole encountered 15.8 g/t of gold over a 13-meter stretch.

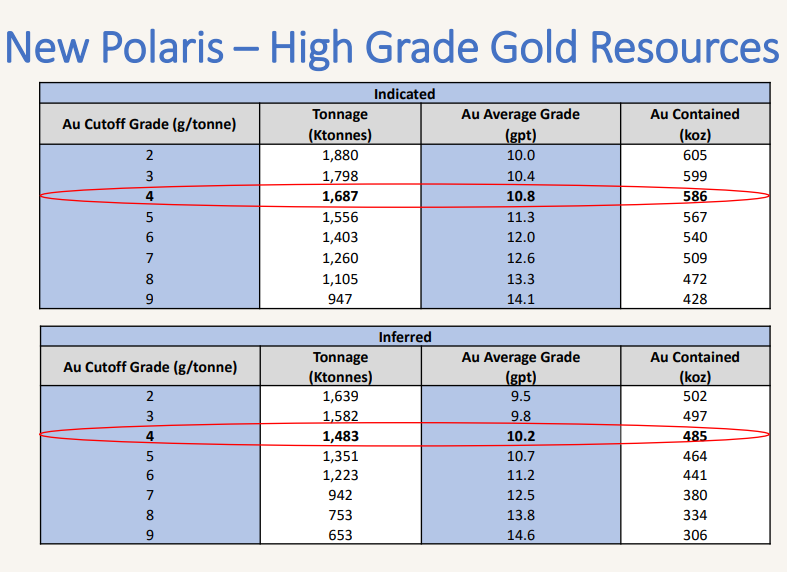

According to a 2019 Preliminary Economic Assessment (PEA), based on a 4 g/t gold cutoff grade New Polaris contains on an indicated basis 586,000 ounces of high-grade gold at an average gold grade of 10.8 g/t. The project has a further 485,000 ounces of gold at a 10.2 g/t gold grade on an inferred basis.

The key implication from the initial intercepts, which contained gold grades much higher than the average compositions outlined in the 2019 PEA, is that New Polaris could potentially be a significantly larger and higher-grade resource than contemplated two years ago.

Fondaway Canyon

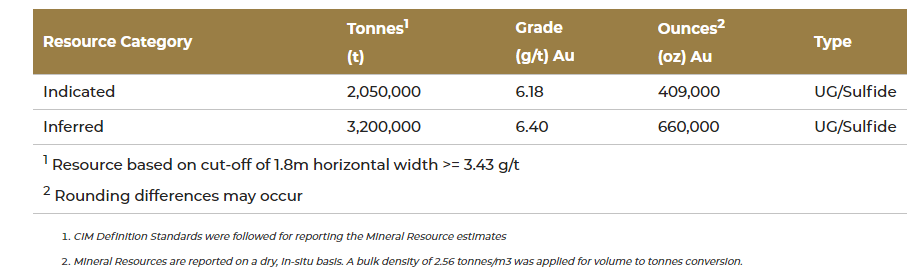

Canagold’s other principal asset is the Fondaway Canyon Gold Project in Churchill County, Nevada. Like New Polaris, Fondaway Canyon contains more than one million ounces of high-grade gold on a combined basis, although not quite as high grade as New Polaris.

In early 2000, Canagold entered into an option agreement with Getchell Gold Corp. whereby Getchell could acquire 100% of Fondaway Canyon if it pays Canagold US$2.1 million in cash and issues Canagold US$2.1 million of Getchell shares over a four-year period.

Solid Balance Sheet

Canagold has controlled its costs well over the last five reported quarters. Its operating loss and operating cash flow shortfall have averaged US$375,000 and US$340,000 per quarter, respectively, over this period.

As of March 31, 2021, Canagold had cash and marketable securities of around US$6.7 million and negligible debt. The company’s cash balance equates to about 21% of its stock market capitalization.

| (in thousands of U.S. $, except for shares outstanding) | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| Operating Income | ($297) | ($628) | ($503) | ($265) | ($186) |

| Operating Cash Flow | ($314) | ($588) | ($350) | ($164) | ($305) |

| Cash & Securities – Period End | $6,743 | $7,440 | $2,351 | $1,799 | $1,762 |

| Debt – Period End | $45 | $51 | $56 | $61 | $64 |

| Shares Outstanding (Millions) | 70.4 | 70.3 | 48.8 | 48.5 | 48.5 |

If future assay results from Canagold’s drilling program at New Polaris were to diverge from the constructive results just reported, its stock could suffer. New Polaris represents Canagold’s key source of value.

Based on the just-reported drilling results, New Polaris could prove to contain significantly more high-grade gold than previously estimated. In turn, Canagold, with a total enterprise value of just over C$30 million (C$38.7 million of stock market capitalization less C$8.3 million of net cash and marketable securities), appears to be an interesting junior miner speculation.

Canagold Resources Ltd. last traded at $0.52 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.