On November 19th, Bank Of America terminated coverage on Tilray and Aurora Cannabis citing a reallocation of resources, this left Cronos Group (TSX: CRON) and Canopy Growth (TSX: WEED) as their only two cannabis plays, in which they slashed both their price targets on. They cut Canopy’s 12-month price target down to C$19 from C$22 saying that Canopy Growth is now a “show-me story” and remain neutral, “given a rapidly evolving Canadian cannabis market and mgmt’s slower than originally planned goals for profitability.”

Canopy currently has 17 analysts covering their stock with an average 12-month price target of C$16.6,4 or a 10% upside to the current stock price. Out of the 17 analysts, 1 has a buy rating, 12 have hold ratings, 2 have sell ratings and the last 2 have strong sell ratings. The street high sits at C$28 from MKM Partners while the lowest price target sits at C$11.

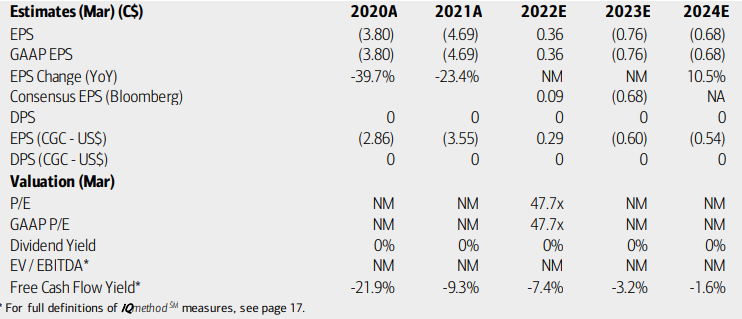

BofA has now readjusted their estimates, lowering them as they believe Canopy will not reach its positive adjusted EBITDA by fiscal year-end. They believe the company has to stabilize its Canadian market share somehow and expects BioSteels US distribution to have a slower ramp time than expected. The company’s German store chain, Storz & Bickel, meanwhile “is facing input shortages/ delivery issues related to the global supply chain.”

Although the analysts have downplayed Canopy’s guidance and projections, they do believe that the company could reach some of its smaller/medium-term goals as long as a few items occur, such as the Canadian market downtrading eases, the US continues at a snail pace towards legalization, consumers become less price-driven and Canopy completes its cost-saving plan.

Lastly, BofA says that they view Canopy as having “an enviable cash position,” as Constellation Brands owns 38% of the company and is a believer in the long-term potential of the company, primarily by way of US Federal legalization. They attribute Canopy’s cash position of almost C$2 billion as a way to navigate the slower-than-anticipated legal cannabis rollout in Canada and the ever so slow US government movement on legalization.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.