As part of the COVID-19 relief effort, the US government created the Paycheck Protection Program (PPP), a federally funded $350 billion loan program specifically aimed at providing small businesses with cash flow amid nationwide lockdowns. The program was launched on April 2, and is scheduled to run through to June 30; however, it has only been two weeks into the program, and the available $350 billion in funds is all gone.

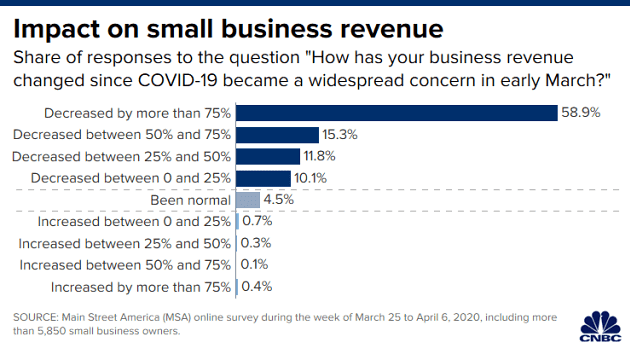

As of April 16, the entirety of the $350 billion available through the PPP program has been exhausted. Although over 1.6 million small business across the US have thus far applied for a portion of the funds to help offset the financial strain and drastic drops in revenue from the nation-wide pandemic lockdowns, there are still many more business owners awaiting for their loans to be processed. As a result, the Trump administration has put in a request for an additional $250 billion to add to the PPP, but approval is most likely going to be pending far longer than business owners are hoping.

To further add to the small business owner’s anxiety, lawmakers are still undecided on how they want to proceed with the PPP. Congress is unsure of whether or not it will extend the program as it is, or if to include additional provisions catered towards minority businesses. In the meantime, business owners are still continuing to apply for loans, aiming for their approval once or if the program get extended.

Information for this briefing was found via Global News, RT News, and CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Shocking.

Yet we keep reading that billionaires are drowning in relief cash…