Central Banks bought more gold than ever last quarter, according to the World Gold Council’s Q3 report released on Tuesday. But a huge chunk of these purchases is from anonymous buyers.

“The level of official sector demand in Q3 is the combination of steady reported purchases by central banks and a substantial estimate for unreported buying,” reveals the WGC report. Notably, the biggest known buyers were from emerging markets: Turkey with 31 tons, Uzbekistan with 26 tons, and Qatar with 15 tons.

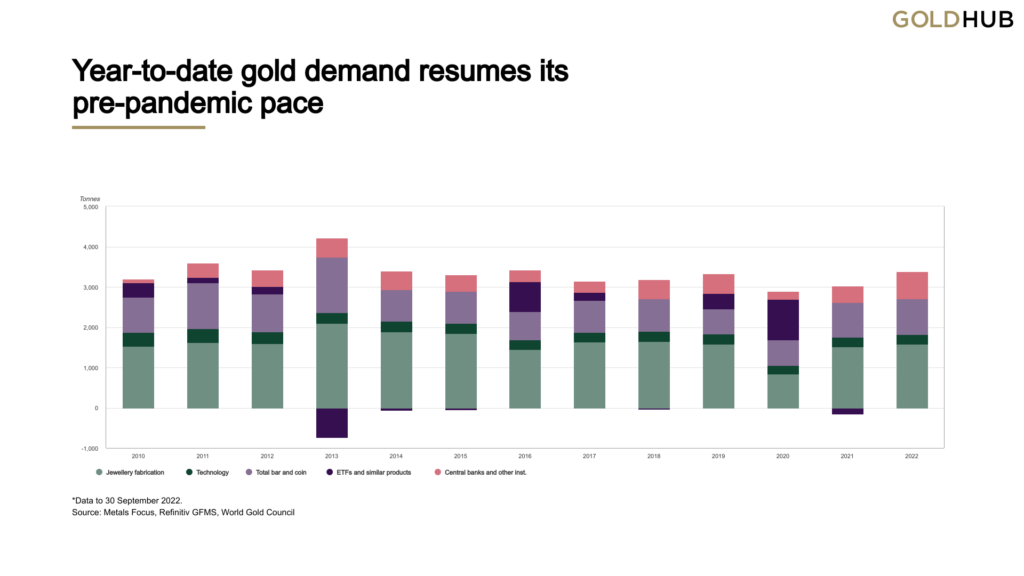

The demand for the precious metal, according to the WGC, has returned to pre-pandemic levels. Purchases amounted to a record-breaking total of almost 400 tons, marking a 300% jump year-over-year. Year-to-date central bank purchases are at 673 tons, already more than any annual total since 1967, when the US dollar was still backed by the precious metal.

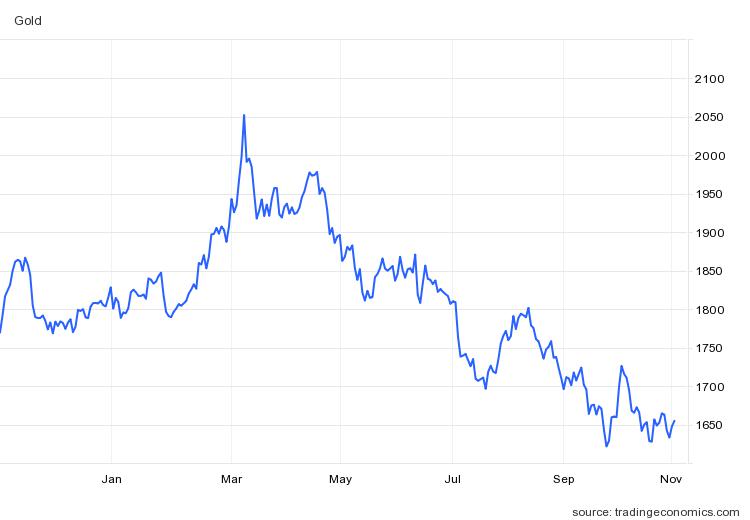

Gold prices however have been falling since it peaked at over $2000 an ounce due to aggressive tightening by the US Federal Reserve that’s been boosting the dollar and US Treasury yields.

This also impacts gold-backed ETFs — analysts say that they see strong gold-backed ETF outflows weighing on the price until the Fed pivots.

Information for this briefing was found via WGC, Kitco News, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.