Tesla’s (NASDAQ: TSLA) recent series of price reductions have raised concerns among both investors and enthusiasts, who worry about the potential impact on the company’s profitability and view it as a possible indicator of diminishing demand.

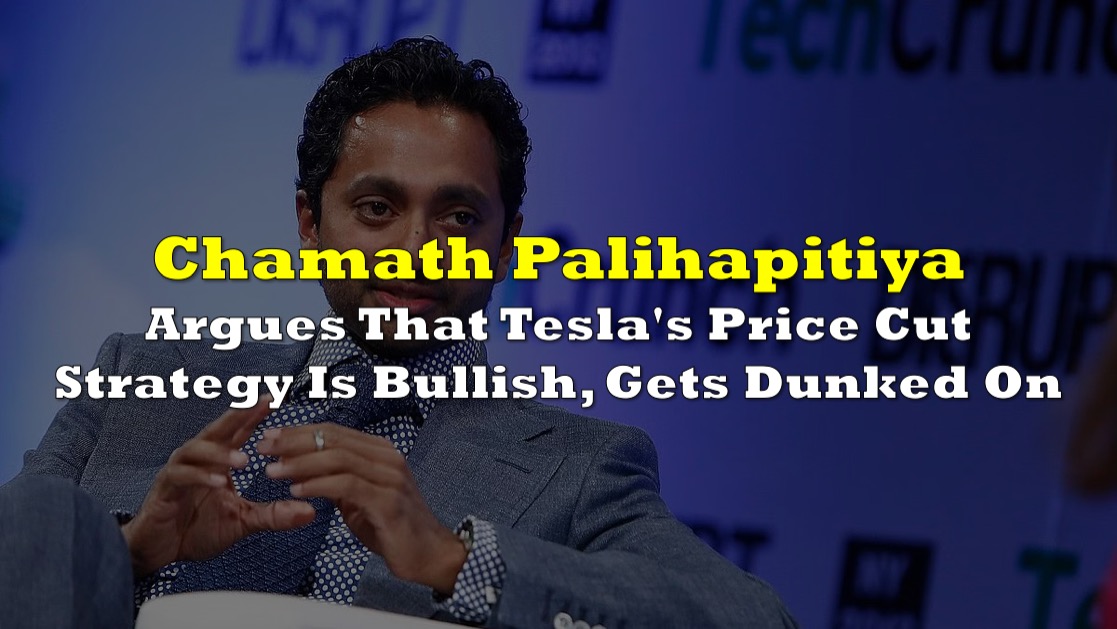

Prominent SPAC investor and venture capitalist Chamath Palihapitiya weighed in on Tesla’s aggressive pricing strategy. He shared a screenshot illustrating the price cuts on Tesla’s Model S and Model X vehicles throughout the year, expressing his surprise at the data.

“I was shocked when I saw this chart. The speed and aggressiveness with which $TSLA is cutting prices is the way to beat the End Boss,” Palihapitiya posted.

I was shocked when I saw this chart.

— Chamath Palihapitiya (@chamath) September 2, 2023

The speed and aggressiveness with which $TSLA is cutting prices is the way to beat the End Boss.

(Rapidly increasing price affordability) x (constantly improving hardware and software) = super maximized market demand

This is a lethal… pic.twitter.com/0tb5cF82Df

According to Palihapitiya, this approach, coupled with the increasing affordability of Tesla vehicles and continuous advancements in hardware and software, is driving “super maximized market demand.”

He emphasized that this combination represents a unique and potent dynamic that has not been observed in modern markets before. While some companies adjust prices periodically or enhance their products, Tesla is distinct in consistently delivering more value for less on substantial purchases.

the model X plaid is now ~$90k.

— Rohun ⛳️ (@RohunJauhar) September 2, 2023

last year it was selling for $150k+

has a car ever been discounted this much, this quickly? pic.twitter.com/cTPrGlS2Vx

“In the arena”

Wealth manager Ram Ahluwalia offered a contrasting perspective, characterizing price reductions as bearish. “Less revenue, earnings and margin and lower return on invested capital,” he added. In contrast, he cited Apple’s decision to raise prices for its next iPhone as evidence of the strength of a dominant position in the market.

Ahluwalia noted, “Buffett-quality businesses tend to raise prices,” emphasizing the correlation between robust companies and the ability to maintain or increase pricing.

In response to concerns about the impact on earnings per car, Palihapitiya argued that the price cuts are not inherently bearish. He pointed out that the focus should be on total earnings, where the company’s strategy has been centered. This suggests that while individual vehicle earnings may decline, the overall earnings picture remains optimistic.

However, Palihapitiya’s comments didn’t go unnoticed, with some referencing his “I’m in the arena” comment.

The first rule of the arena is that you don’t talk about the arena

— BSB 💣 (@StreetBomber) September 3, 2023

Chamath is a fraud that invited unsophisticated people into his arena to fleece them and take their money for his promote

Founders culture is scum pic.twitter.com/Js8X6Iolvg

Chamath’s interpretation of why he got absolutely, mercilessly, shat on for his “Man in the Arena” comment is one of the least self-aware statements in the history of the world and will remain in the bottom ten takes until the heat death of the universe https://t.co/AqW2ycPT8X

— BuccoCapital Guy (@buccocapital) September 1, 2023

It’s worth noting that before sending this tweet and getting nuked in the comments Chamath spent the first 5 minutes of his podcast talking about how he did nothing but drink wine and play poker with his buddies for the previous week.

— fed_speak (@fed_speak) September 2, 2023

“In the arena.” pic.twitter.com/xUpYSblymc

Please stop. The “on one hand” brand of financial journalism is far removed from healthy skepticism when it came to promoters pitching SPAC’s on FinTV to your viewers. Anyone with half a lick of financial sense saw right through Chamath’s two-page “memo’s” in 2021.

— Diogenes (@WallStCynic) August 25, 2023

Palihapitiya earlier this year released his annual letter for 2022 to investors with the overall tone of preaching realism and practicality, emphasizing that “efficiency, risk management, business model fundamentals, and sustained profitability are must-haves.”

“To founders, make no mistake. A company’s success will be judged by its profits and market leadership – not faux ‘profitability’ metrics or your ability to latch your company onto the latest trend or fad,” Palihapitiya wrote.

However, the noted “SPAC king” seems to be missing his strategy regarding that side of the investment space as he talks about the rundown of the year.

Information for this briefing was found via Benzinga and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.