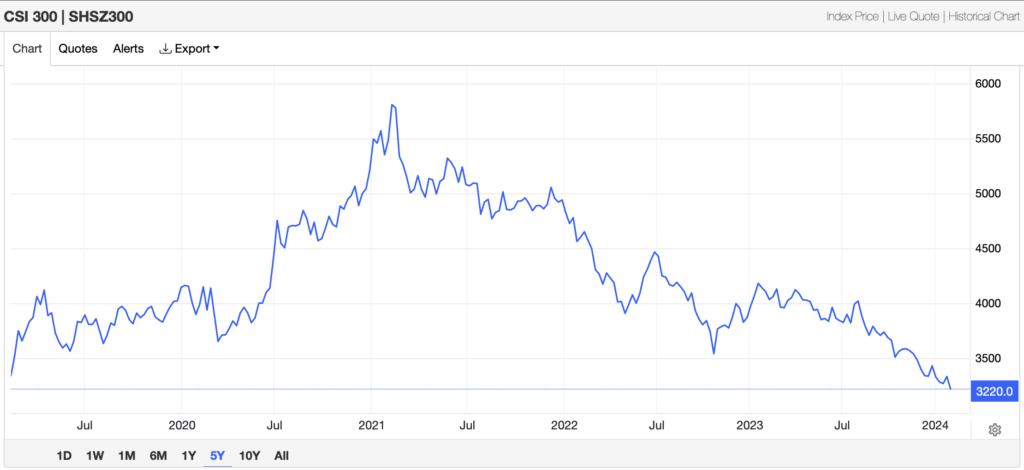

The sell-off in Chinese stocks has deepened, erasing earlier gains driven by optimism over stronger support measures from authorities. The benchmark CSI 300 Index of Chinese mainland shares experienced a decline of as much as 1.3%, temporarily wiping out gains accumulated since January 22 when authorities vowed more robust measures to support the market.

Despite efforts to pare losses, stocks extended their decline following a report indicating China’s factory activity contracted for the fourth consecutive month in January, intensifying concerns about the economy and the ongoing property crisis.

The initial positive momentum was triggered by expectations of a 2 trillion yuan ($278 billion) rescue package and the central bank’s decision to reduce banks’ reserve requirement ratio.

However, the lack of clarity surrounding the stabilization fund and a Hong Kong court’s order for the liquidation of China Evergrande Group have contributed to renewed pessimism among investors.

“Investor sentiment is still extremely bearish on China — any minor rally driven by piecemeal news of government support is likely to be met by more selling,” remarked Vey-Sern Ling, Managing Director at Union Bancaire Privee in Singapore. Ling expressed uncertainty about whether China’s structural issues can be resolved and questioned the leadership’s commitment to prioritizing growth.

READ: Evergrande Ordered To Liquidate: Is Chinese Property Market Price Discovery Coming Soon?

The ongoing gloom is reflected in the CSI 300’s decline of over 5% in January, marking its worst start to a year since 2022. Since the peak reached in 2021, Chinese and Hong Kong stocks have collectively lost $6 trillion in market value. Investors are now urging authorities to implement more assertive measures to curb the downturn.

So banning short selling didn’t fix it?

— Stanphyl Capital (@StanphylCap) January 31, 2024

Huh, how about that? https://t.co/HFWhn3tnyS

The Hang Seng China Enterprises Index, tracking mainland stocks listed in Hong Kong, witnessed a drop of over 1%, bringing it perilously close to erasing all gains made since the announcement of the rescue package. The index is on track for its worst January performance since 2016.

Information for this briefing was found via Caixin Global and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.