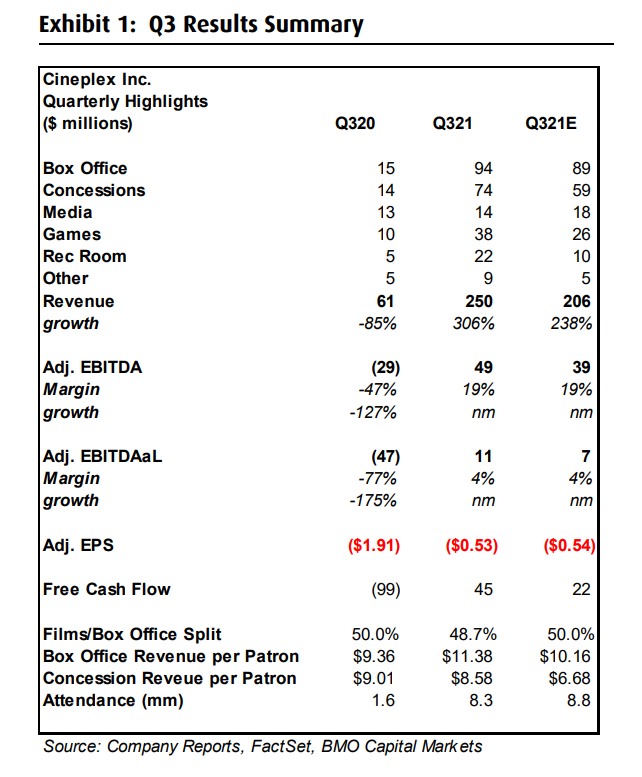

On November 11th, Cineplex Inc. (TSX: CGX) reported its third quarter financial results. The company announced revenues of $250.4 million, up 310% year over year and 286% quarter over quarter.

The company also reported positive gross margins, the first since the pandemic started. Gross margins came in at $115.54 million. The company reported another quarter of negative operating profits of ($24.32) million, better than the ($98.93) million last quarter. Adjusted EBITDA was $1.6 million while earnings per share came in at ($3.58).

Cineplex currently has 7 analysts covering the stock with an average 12-month price target of C$16.79, or a 13% upside to the current stock price. Out of the 7 analysts, 3 have buy ratings and the other 4 have hold ratings. The street high sits at C$20 from Scotiabank while the lowest comes in at C$13.

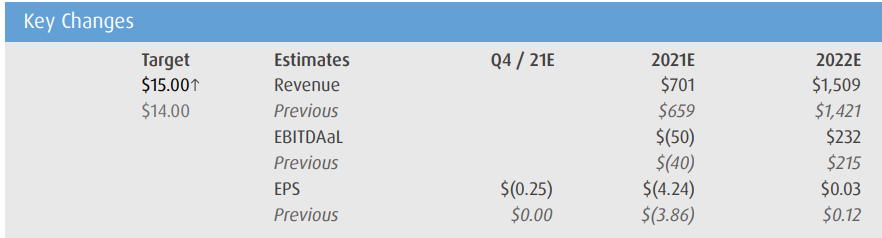

In BMO’s third quarter review, they reiterate their market perform rating but raised their 12-month price target to C$15 from C$14, saying that the company’s operating environment continues to improve into 2022.

BMO says that the company’s results reflect a recovery in the company’s operations, which is aided by a strong film slate with a number of films having their release dates scheduled for the second of 2021.

For the results, Cineplex smashed BMO’s revenue estimate of $206 million, primarily coming from better than expected box office, concession, and rec room revenues while media revenue came in below their estimates. Box office revenues were $94 million, beating both BMO and the consensus estimates, versus the $178 million during the third quarter of 2019. Theatre foodservice revenues were $71 million, beating both consensus and BMO’s estimates.

Below you can see BMO’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.