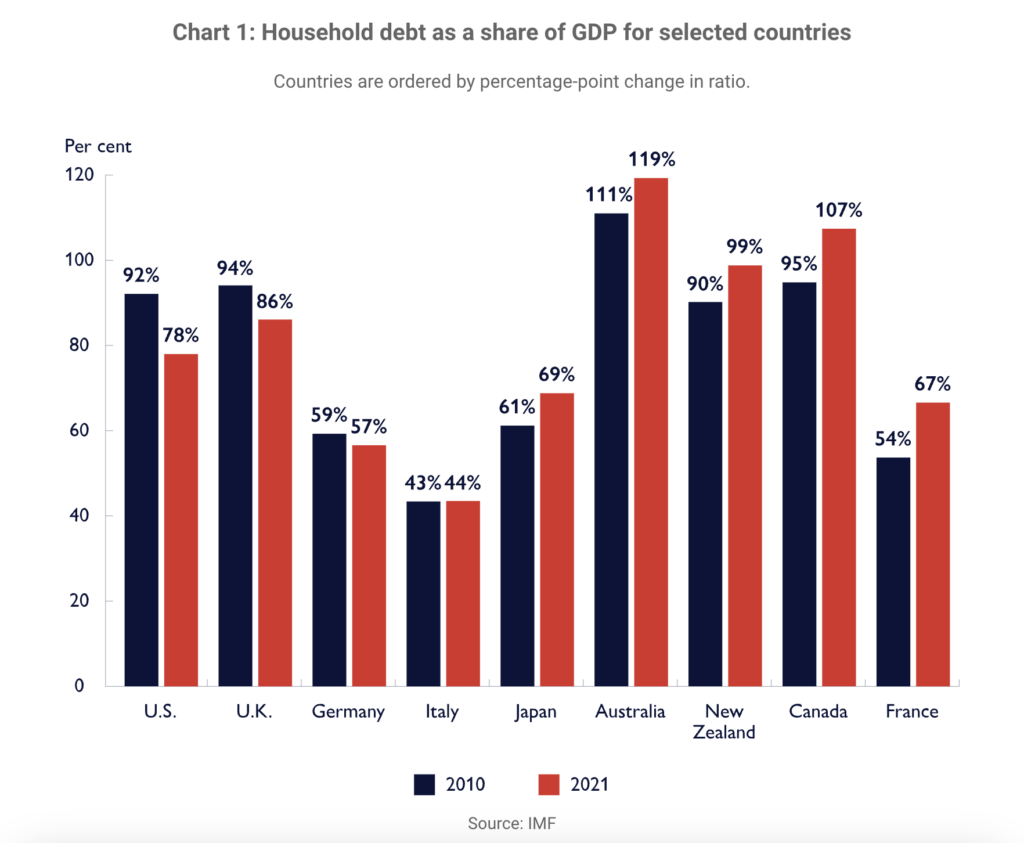

The risks to Canada’s economy remain high as household debt levels continue to grow. In the latest analysis from the Canada Mortgage and Housing Corporation (CMHC), Deputy Chief Economist Aled ab Iorwerth warns that “household debt is a major risk to the Canadian economy.”

The report found that household debt levels in Canada have reached record highs, with the ratio of debt to disposable income now at 186%. This is well above the historical average of 150% and is the highest level of household debt in the G7.

“By contrast, household debt in the U.S. fell from 100% of GDP in 2008 to about 75% in 2021. While U.S. households reduced debt, Canadians increased theirs and this will likely continue to increase unless we address affordability in the housing market.” ab Iorwerth wrote.

The report found that the growth in household debt is being driven by rising housing prices and interest rates — 75% of household debt comes from mortgages.

“Over the last year, interest rates have increased as the Bank of Canada battles inflation,” ab Iorwerth continued. “Over time, these higher interest rates translate into higher mortgage payments for households when those on fixed 5-year terms renew at higher rates.”

The economist warns that high levels of household debt are a major risk to the Canadian economy because they make households more vulnerable to shocks. If interest rates were to rise or if there were a decline in housing prices, many households would find it difficult to make their debt payments. This could lead to a wave of defaults, which could in turn lead to a recession.

Information for this story was found via CMHC, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.