The Canada Mortgage and Housing Corporation (CMHC), the Crown corporation responsible for administering Canada’s National Housing Act, like any good promoter, knows that the best way to get attention is with a discount.

This column recently reminded its readers that the Act is explicitly built to develop and maintain the station of the mortgage financing and real estate industries in our national economy, and that its objective with respect to housing affordability is one of “promotion.”

So, to promote the existence of low-cost housing in Canada, the CMHC uses its considerable Crown-controlled resources to make ultra-low-rate loans to developers of rental properties, under the Rental Construction Financing Initiative.

READ: Oh Deer! Housing in the Headlights

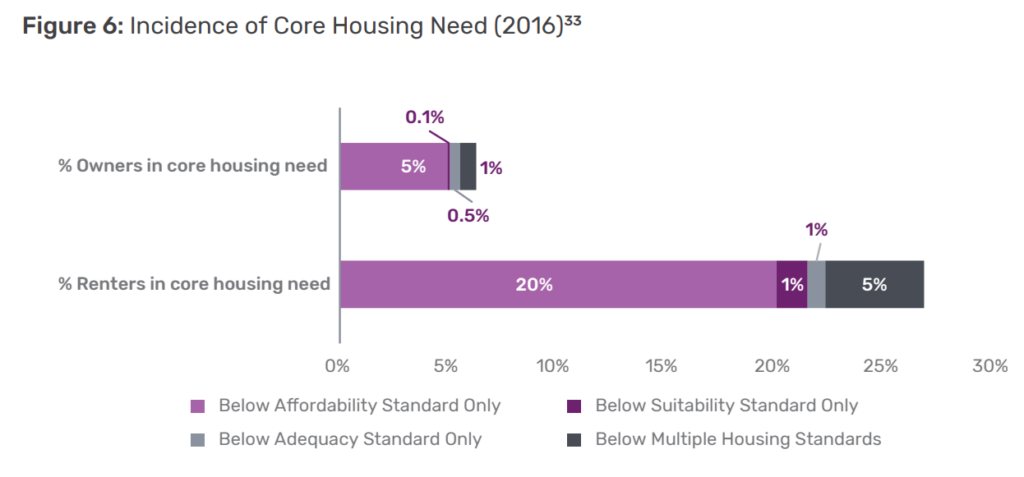

The notion behind this strategy, frequently repeated by the country’s most high-profile housing analysts, and generally accepted by Members of Parliament, urban planners, CMHC executives, and especially by real estate developers, is that Canada’s housing problems can be solved by building more homes. Record homelessness, and the disgusting portion of the median and bottom-tier incomes eaten up by housing costs are a product of there just not being enough houses to go around.

It’s simple supply-side economics! Build enough units, there will be enough to go around, and rental units will get so cheap they’ll be giving away one year leases when you buy a happy meal. At least until they all fill up… but then we can just build more units. Where were we?

The government’s literature on the national housing strategy says that the CMHC, through the RCFI, so far has “committed $13.5 billion to support the creation of 38,266 units, of which 26,987 will be affordable.” The other 11,279 units, implicitly, will be unaffordable, but they’ll be supply nonetheless.

There’s another $12.2 billion to be loaned out as part of the RCFI, and it’s not the only program the CMHC is running to bury the country in (sometimes) affordable housing supply but, at $25 billion, it is the richest, and some fine reporting from Matt Lundy over at the Globe and Mail has uncovered just how little the CMHC wants to talk about it.

“Who? Never mind who. Builders.”

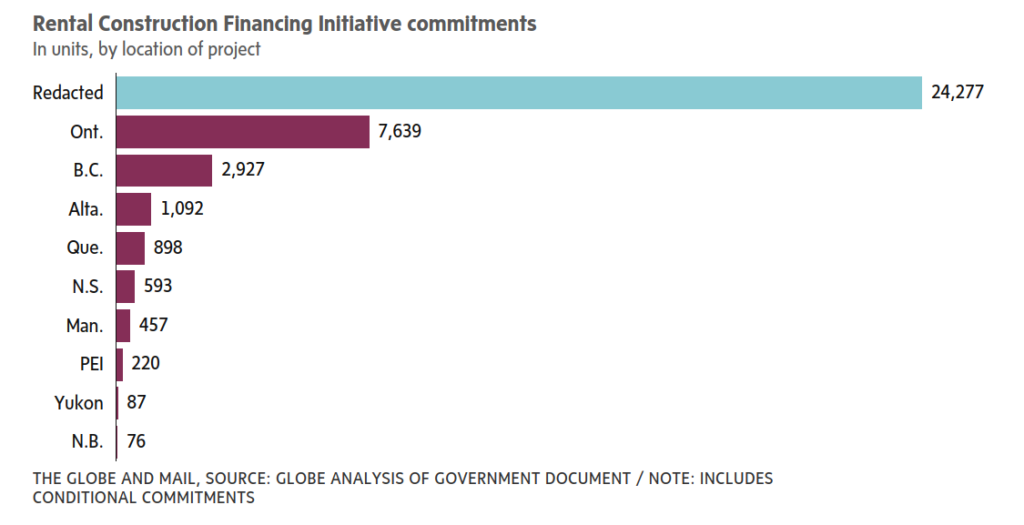

“Privacy concerns,” apparently prevent the CMHC from sharing the specific identities of the borrowers and projects who have received these loan commitments, without the consent of the borrowers. Of the 216 projects being financed, 131 projects comprising 24,277 rental-units-of-the-future were in undisclosed locations. The Globe reports that a 855 unit project that received a $444 million loan commitment is one of the projects whose developers’ identities the CMHC considers top secret enough that it scrubbed all identifying characteristics from the documents provided to The Globe through a freedom of information request.

Since the idea here is to drive the creation of (sometimes) affordable housing, they don’t give these loans out to just anyone. According to this summary, borrowers have to be qualified builders with experience and money of their own. Projects are only eligible if they’re close enough to transit, built to be accessible, and energy efficient, among other requirements.

Approved borrowers can have up to 100% of the build costs advanced at as low as 2% interest, on a 10 year payback term. But the best and most relevant part is that the borrowers can secure the low-rate loans for the riskiest phase of their projects, without having to give up much or any of the project’s equity as security. The RCFI loans are secured by the borrower’s covenant / guarantee during the construction and “rent-up” phases, and must be transferred to an NHA-approved lender (who will presumably lend against the equity of the finished product) once it’s operating.

“Gettin real tired of you duckin’ me, man…”

It sounds like a pretty good deal, and one reason the CMHC might be keeping the names of certain borrowers and projects on the QT is to keep private lenders like Romspen from chasing them down the street with a bat, shouting “I KNOW YOU GOT THAT CMHC MONEY! YOU’LL COUGH UP SOME LIQUIDITY RIGHT NOW IF YOU KNOW WHAT’S GOOD FOR YOU!”

But the more likely answer is that the projects are in the same spot as the ones that ultimately sunk infamous Ontario mortgage lender Fortress Capital, and the ones that look like they’re in the process of sinking Romspen. Heck, they might be the same projects.

A 10 year term loan for 100% of the construction costs, secured by the borrower’s promise to pay it back, doesn’t make a project financially viable, because the developer isn’t in this to borrow enough to cover their costs. They’re in it to make MONEY!

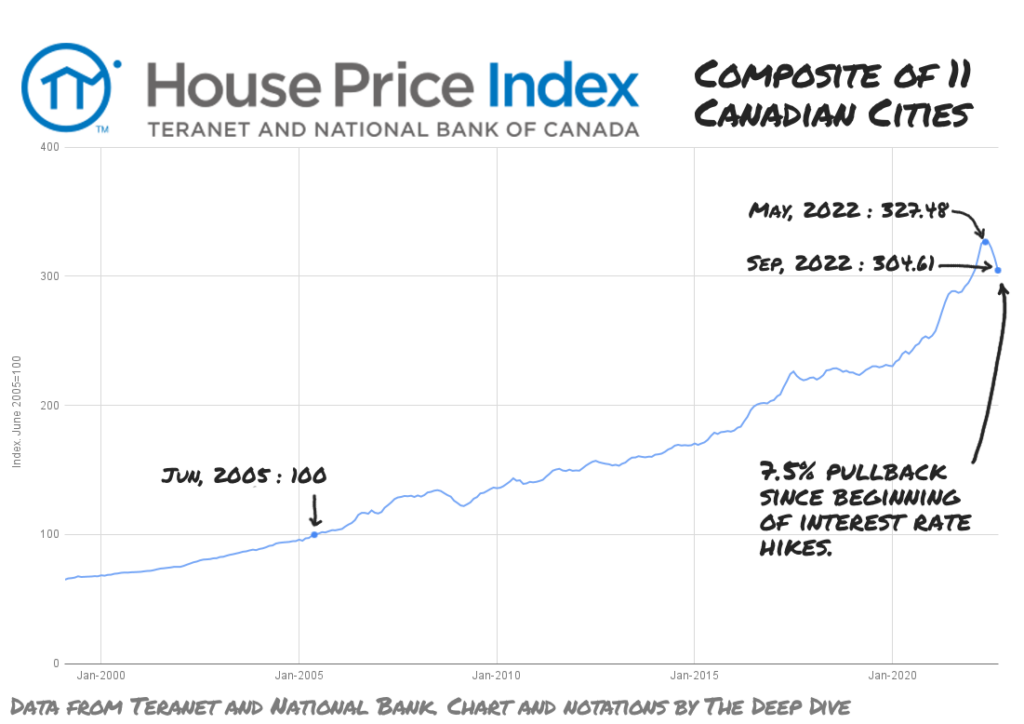

For that to happen, a combination of steady development of the asset and rising equity markets have to improve the project’s value. But the equity market moves both ways, and right now…

… it’s moving the other way. Developers aren’t in the business of owning rental properties, they’re in the business of selling them to landlords. And anyone who’s ever had a landlord knows that they don’t throw money around for the sake of it.

In a softening property market, a project can end up appraised for less than the value of whatever has been borrowed against it in a hurry. And it isn’t as though the CMHC can tell them to step on it, or call the loan. Even if it was secured against the equity, foreclosing wouldn’t get the project built.

The best the CMHC brass down in Ottawa can do is redact the names of the weaker projects and borrowers from the documents that go out to the press on FOI requests, then get on with their primary mission of protecting the housing market and mortgage lending market’s places in the national economy, and hope the affordability promotion works itself out.

Information for this briefing was found via the CMHC, Romspen Investments, The Globe and Mail, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.