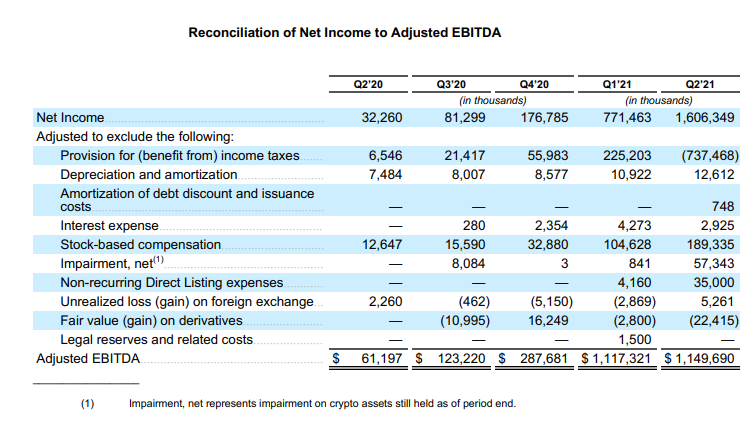

On August 10, Coinbase Global, Inc. (NASDAQ: COIN), which operates the world’s largest cryptocurrency trading platform, reported solid 2Q 2021 results. On a fully diluted basis, Coinbase EPS in the quarter was US$6.42 per share. Adjusted EBITDA in 2Q 2021 totaled US$1.15 billion. Clearly, the company has established an extraordinary business, but investors should be aware of several valuation issues for the stock.

First, 1Q 2021 and 2Q 2021 were extremely active trading quarters for cryptocurrencies. Bitcoin, Ethereum and others soared through early May as investors became more emboldened about the prospects for digital currencies, and then the cryptocurrencies turned down just as quickly as investor confidence plummeted. In turn, trading volume on Coinbase rocketed to US$335 billion in 1Q 2021, and then to an even stronger US$462 billion in 2Q 2021 from US$89 billion in 4Q 2020.

| (in millions of U.S. dollars, except otherwise noted) | July 2021 | 2Q 2021 | 1Q 2021 | 4Q 2020 |

| Monthly Transacting Users (Mill.) | 6.3 | 8.8 | 6.1 | 2.8 |

| Retail Trading Volume | $145,000 | $120,000 | $32,000 | |

| Institutional Trading Volume | $317,000 | $215,000 | $57,000 | |

| Trading Volume | $57,000 | $462,000 | $335,000 | $89,000 |

| Retail Assets on Platform | $88,000 | $101,000 | $45,000 | |

| Institutional Assets on Platform | $92,000 | $122,000 | $45,000 | |

| Total Assets on Platform | $180,000 | $223,000 | $90,000 | |

| Total Market Capitalization of All Crypto Assets | $1,610,000 | $1,980,000 | ||

| % on Coinbase Platform | 11.2% | 11.3% | ||

| Transaction Revenue | $1,930 | $1,541 | $476 | |

| Subscription/Services Revenue | $102 | $56 | $21 | |

| Net Revenue | $2,033 | $1,597 | $497 | |

| Adjusted EBITDA | $1,150 | $1,117 | $288 | |

| Net Income | $1,606 | $771 | $177 | |

| Cash, Including Digital Assets | $4,366 | $1,983 | $1,062 | |

| Debt – Period End | $1,520 | $118 | $108 | |

| Shares Outstanding (Millions) | 209.9 | 85.7 | 73.1 |

Against this backdrop of very robust trading volume, Coinbase recorded adjusted EBITDA of US$1.15 billion in 2Q 2021, which was surprisingly up just marginally from US$1.12 billion in 1Q 2021. In July 2021, which represented a much less heated crypto environment, total trading volume on Coinbase plunged around 60% to US$57 billion from an average US$154 billion per month pace in 2Q 2021.

Based on all this, an investor must consider if Coinbase’s 2Q 2021 adjusted EBITDA represented something close to peak EBITDA power.

Second, Coinbase’s enterprise value is around US$65 billion. If we annualize the company’s 2Q 2021 adjusted EBITDA, Coinbase trades at an EV-to-EBITDA ratio of about 14.1x (US$65 billion divided by US$4.6 billion).

To put this in perspective, Facebook and Google — companies with much steadier operations and dominant market shares in their businesses – trade at EV-to-EBITDA ratios of 18.5x and 19.4x, respectively. Perhaps Coinbase’s EV-to-cash flow ratio, which could reflect peak cash flow, should trade at a steeper discount to those two companies.

Finally, US$180 billion of crypto assets were held on Coinbase’s platform as of June 30, 2021. This represents 11.2% of the approximate US$1.61 trillion market value of all digital currencies. Given the generally non-proprietary nature of Coinbase’s financial markets technology, it seems likely that competitors will in time break in and take some of Coinbase’s market share.

To demonstrate the likelihood of this, consider Vanguard, which is the dominant force in what has been for years the most popular type of investing — index funds which match the performance of market indices like the S&P 500. Vanguard has about US$6.2 trillion of global assets under management. This comprises about 6% of total global assets under management of US$103 trillion (according to the Boston Consulting Group).

Coinbase has built an impressive cryptocurrency trading business, and the company has reported impressive earnings results in the two quarters since it became a public company. However, its valuation could be at least somewhat stretched in comparison with other fast-growing companies with dominant market shares.

Coinbase Global, Inc. last traded at US$261.25 on the NASDAQ.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.