Many high-risk stocks which were crushed in 2022 have soared in January 2023, and Coinbase Global, Inc. (NASDAQ: COIN) has been one of the best-performing of those “discarded” stocks. The shares have soared 73% in the first four weeks of 2023 after plummeting 86% in 2022.

Clearly, Coinbase stock has been boosted by the revival in cryptocurrencies in 2023, which of course is itself linked to investors’ embracing risk and, maybe more importantly, investors’ fear of missing out (FOMO). Coinbase’s January performance is particularly remarkable because investors have decided to ignore negative news that the company has filed with the SEC.

First, on January 10, Coinbase disclosed that key 4Q 2022 financial and operating parameters — such as average transaction revenue per user, sales and marketing expenses, technology and development and G&A expenses — had come in such that the company’s full-year adjusted EBITDA loss will be no more than the US$500 million deficit Coinbase had projected when it released 3Q 2022 earnings.

READ: Coinbase: Investors Shrug Off SEC Risk Amid Crypto Crackdown

This suggests that its 4Q 2022 adjusted EBITDA loss will be no worse than US$253 million, or about twice its 3Q 2022 adjusted EBITDA shortfall, hardly cause for celebration for an entity to which the market ascribes an enterprise value of US$14.5 billion. (Coinbase’s 1Q 2022, 2Q 2022 and 3Q 2022 adjusted EBITDA were positive US$20 million, negative US$151 million, and negative US$116 million, respectively.)

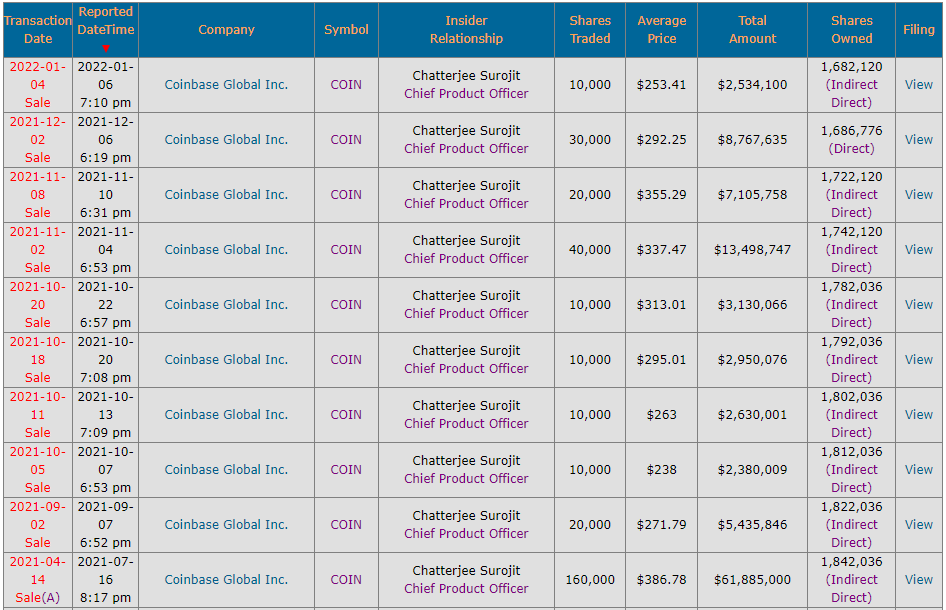

Second, on February 3, Coinbase’s Chief Product Officer (CPO) Surojit Chatterjee, one of the company’s highest-ranking officers, will leave the cryptocurrency trading company. Mr. Chatterjee was hired away from Google about three years ago. He signed a five-year contract and received an annual salary of just under US$1 million.

During his time at the company, Mr. Chatterjee also received a substantial number of stock options with an average exercise price of US$18.71. He exercised most of them and sold the underlying shares in 65 separate transactions, mostly in 2021, pocketing an astounding US$105 million. The departing CPO still owns about 250,000 shares of Coinbase stock currently worth about US$15 million.

After making more than most CEOs in any industry, Mr. Chatterjee, who was neither a founder nor the CEO of Coinbase, retains only a comparatively small stake in the company (US$15 million of stock owned after selling stock worth US$105 million). Such an allocation decision by a cryptocurrency expert who is certainly in a position to know hardly inspires confidence.

Investors should be cautious about establishing positions in Coinbase stock, particularly after its recent rally. Its cash flow is deteriorating quite rapidly, and the market appears not to have factored in significant news that it might judge to be quite relevant in the not-too-distant future.

Coinbase Global, Inc. last traded at US$58.93 on the NASDAQ.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.