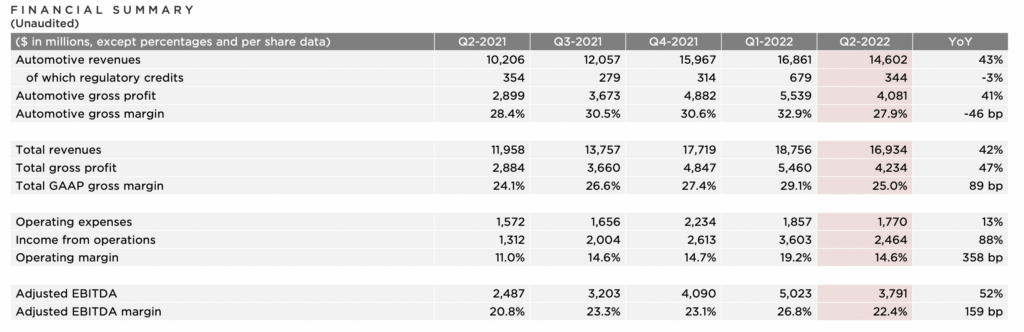

On July 20, Tesla, Inc. (NASDAQ: TSLA) reported adjusted 2Q 2022 EPS of US$2.27, well ahead of analysts’ consensus earnings expectations of US$1.81. However, 2Q 2022 revenue came in a little light of projections: US$16.9 billion versus estimates of around US$17.1 billion.

Below are a few details that affected not only the world’s leading electric vehicle (EV) manufacturer, but have important implications for other companies.

Firstly, Tesla sold about 75% of its Bitcoin holdings in 2Q 2022. “Conversions in Q2 added US$936 million to our balance sheet.” Clearly, Mr. Musk’s actions should not be considered the defining word on the direction of the world’s largest digital currency, but his moves do not set a precedent for this sentiment-driven commodity.

Second, repeating views he has previously expressed, Tesla’s CEO Elon Musk said that the lithium processing business should enjoy extraordinary margins for some time. Tesla’s lithium costs have risen significantly, and Mr. Musk publicly urged entrepreneurs to enter the lithium refining business, saying on the conference call that it is a “license to print money.”

Clearly, this is a positive for established lithium producers such as Albemarle Corporation (NYSE: ALB), but also for start-up manufacturers like Lithium Americas Corp. NYSE: LAC). As an aside, Lithium Americas noted on July 20 that federal court briefings on environmental groups’ appeal of the Bureau of Land Management’s approval of its Thacker Pass lithium project in Nevada are scheduled to conclude August 11. Oral arguments and a final decision are expected to follow shortly thereafter.

Tesla’s automotive gross margin meanwhile fell to 27.9% in 2Q 2022. That ratio was above 30% in the prior three quarters. Supply chain issues and inflation affected the company in this period. It is difficult not to think that if these issues had a notable effect on Tesla’s results, they could have an even bigger impact on start-up EV makers like Lucid Group, Inc. (NASDAQ: LCID) and Rivian Automotive (NASDAQ: RIVN).

(As an aside, Tesla continues to sell a significant amount of regulatory credits that it gets for free from various states and carry a 100% profit margin. The company sold US$344 million of those credits in 2Q 2022. The sales represented 9% of Tesla’s EBITDA in the quarter.)

Finally, Mr. Musk said on the analysts’ conference call that he hoped to begin delivering the Cybertruck in mid-2023. The Cybertruck, which has a futuristic, angular design and was originally announced in the fall of 2019, could provide tough competition for other start-up electric truck makers like Rivian and Lordstown Motors Corp. (NASDAQ: RIDE).

Tesla Inc. last traded at US$816.73 on the NASDAQ.

Information for this briefing was found via the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.