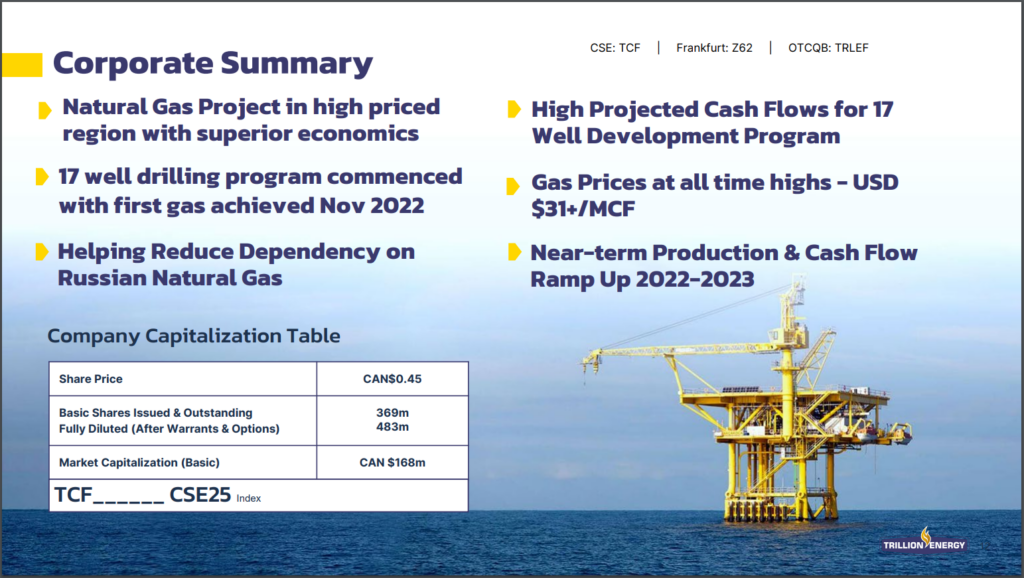

Trillion Energy International Inc. (CSE: TCF) is a Canadian oil and gas exploration company with assets in Turkey and Bulgaria. The Company’s flagship asset is its South Akçakoca Sub-Basin (SASB) offshore natural gas field in the Black Sea off the Turkish coast, which is one of the largest scale natural gas development projects in the region.

The SASB gas field, which already has production infrastructure in place, is currently in the middle of a significant fully funded 20-well development program, which has seen two wells already placed into operation, and a further eleven slated to enter production in 2023.

The Investment Thesis

We base our investment thesis on the following factors:

- The company is undergoing a fully funded 20+ well development program at the SASB gas field that has strong economics.

- Extensive production infrastructure is already in place, with wells from the current program already producing.

- New wells are expected to come online every 45 days through to 2024.

- Blue sky targets exist both on and off the SASB block, with the company also holding exploration assets in Bulgaria.

- Europe is currently amid a gas crisis as a result of geopolitics, increasing demand and positive economics for the project.

- Trillion’s management team is highly experienced in O&G, with CEO Arthur Halleran having founded Canacol Energy.

The Deep Dive views Trillion Energy International as a special situation. It is a producing junior natural gas exploration company operating in Turkey, a stable jurisdiction that is a member of the G20 as well as NATO. The company is well funded, having raised $40 million in 2022, has a very experienced Turkey-based management team, and is amidst a 20+ well development program that is expected to bring a new well into production roughly every 45 days, therefore significantly enhancing the company’s financial profile. With natural gas prices at elevated levels in the region, Trillion appears to be a unique and timely situation for risk investors.

The Projects

Trillion Energy’s flagship project is its 49%-owned South Akçakoca Sub-Basin (SASB) offshore natural gas field in the Black Sea off the Turkish coast, with the remainder owner by the Turkish Petroleum Corporation, or TPAO, which is a state-owned enterprise.

Trillion also holds a 19.6% interest in the producing Cendere oil field located in central Turkey, as well as a 100% interest in a 98,000 acre license in the Vranino 1-11 natural gas license block located in northeastern Bulgaria.

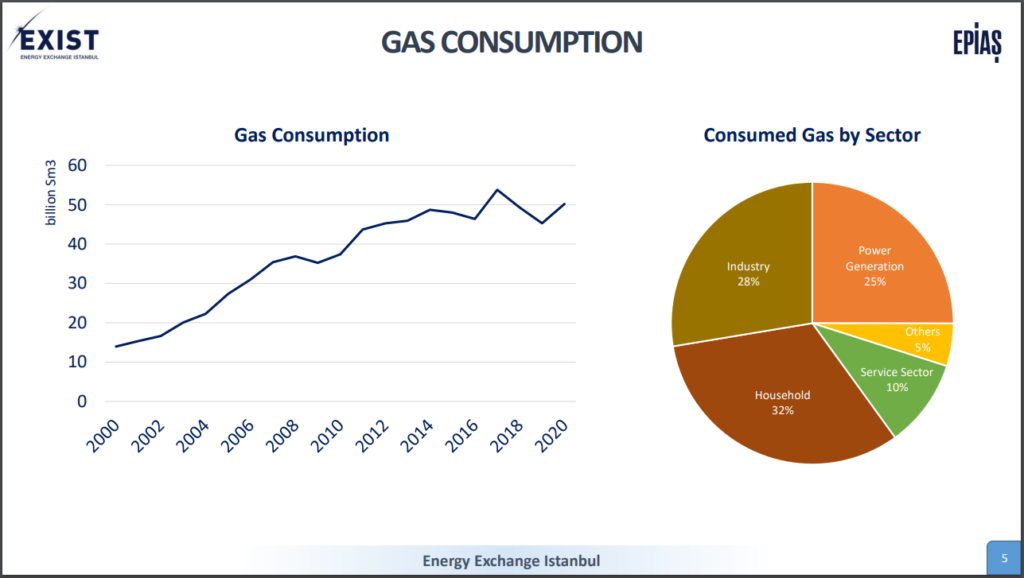

In terms of market opportunity, Turkey is said to consume 50 to 60 billion cubic of metres of natural gas each year, nearly half of which is imported from Russia, while Azerbaijan and Iran are also major suppliers to the country. Consumption in 2020 was pegged at 47.7 billion cubic metres, making it the seventh largest gas consumer globally, while consumption in Turkey rose by 18.8% in 2022, as per Climate Scorecard.

Turkey

The South Akçakoca Sub-Basin (SASB) Project

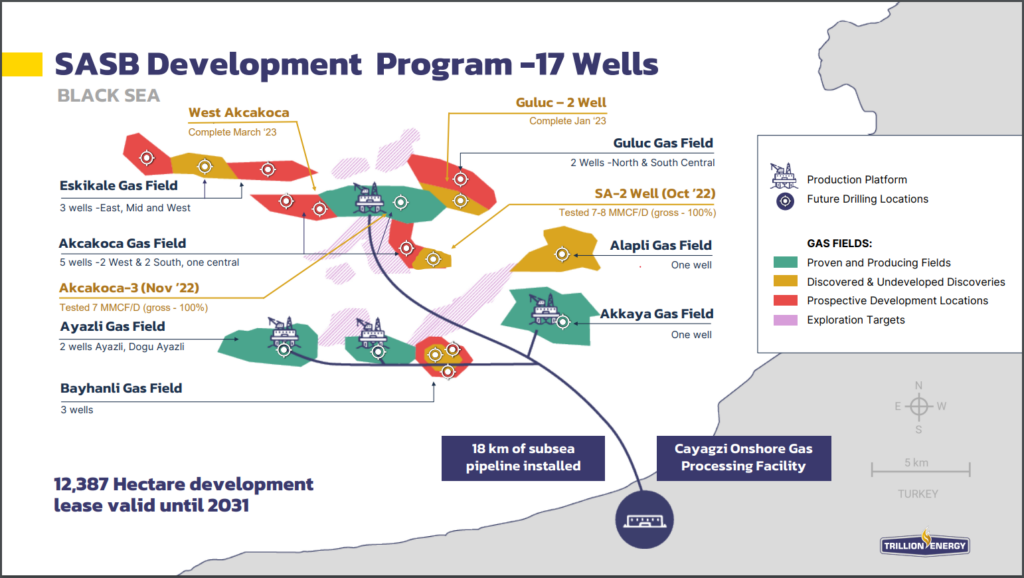

The flagship asset of Trillion, the SASB project is the focal point of the aforementioned 20+ well development program. Originally slated to be 17 wells, the program was expanded in January to include at least an additional three side track wells.

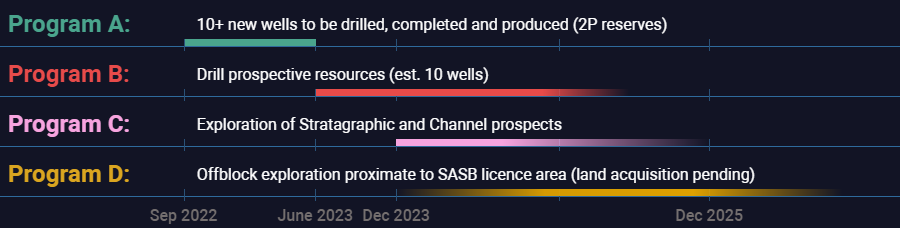

In terms of development, the program is broken up into several phases. The first, Program A, is expected to conclude in mid-2023, with 10+ wells to be drilled, completed, and put into production. The first five of the wells are fully funded through capital raises conducted in 2022, with further development then set to be funded through cash flows from production.

READ: Trillion Energy Adds Three Wells To Multi-Well Development Program

At the conclusion of Program A, Program B will begin, with the company set to drill an estimated ten wells targeting prospective resources through 2024. 2024 will also see the company begin the exploration of stratagraphic and channel prospects, while separately, the company is to conduct off-block exploration proximate to the the SASB license area.

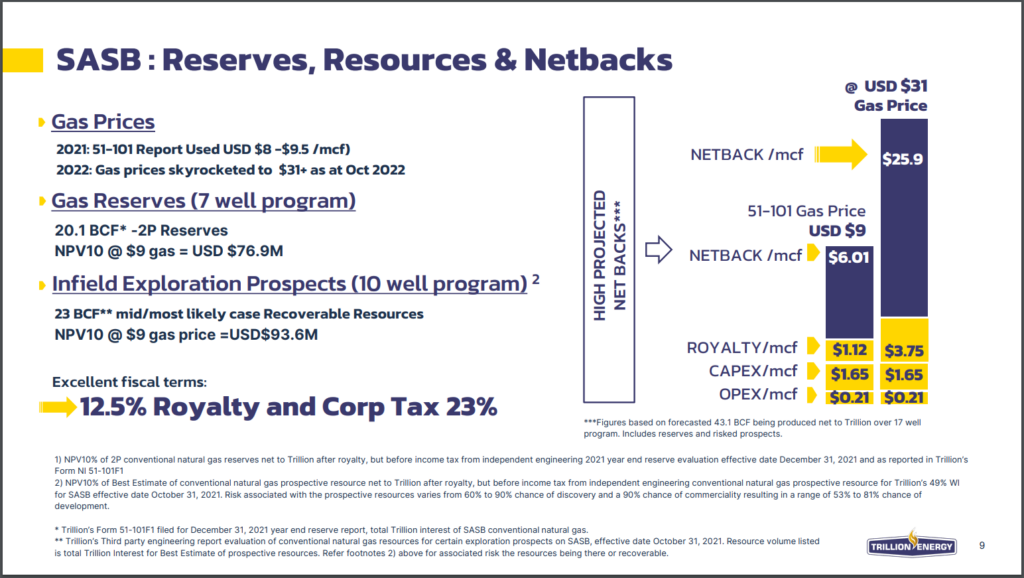

The economics of the SASB Project are enticing with an OPEX of less than USD$1.00/mcf, a 12.5% royalty, and a low corporate tax rate of 23%. With natural gas prices currently well above the ten year average of USD$7/mcf, and low OPEX, Trillion is well positioned to accelerate their financial profile, particularly if they can bring a new well onstream every 45 days over the next two years as they are projecting.

For the month of January, the two wells currently in operation generated revenue of US$2.6 million, following similar December revenues which resulted in US$2.3 million in net gas sales. December marked the first full month of production for the two wells, with each well testing 7-8 MMCF/day.

READ: Trillion Energy: Research Capital Reiterates $1.35 Price Target

GLJ Inc, a consulting firm engaged by Trillion, calculated that the Net Present Value of the 40.2 BCF gas reserves at SASB were valued at USD$243.3 million. This estimate was made based on the average USD$6-7 price range of the past 10 years. At today’s gas prices, this estimate would likely be almost triple that figure, which underscores the leverage Trillion has to higher gas prices.

The SASB field was one of the Black Sea’s first natural gas developments and the shallow water gas field comprises eight discovered fields with only four produced to date. The project’s extensive infrastructure includes four natural gas production platforms that are connected to 18 kilometres of pipeline that transports the natural gas to an onshore natural gas production plant.

READ: Trillion Energy Hits 73 Metres Of Potential Gas Pay In Guluc 2 Well

The production plant has a 75MMcf/day production capacity that can be expanded to produce 150MMcf/day. To date, there has been in excess of US$600 million of CapEx investment at the SASB Project, of which Trillion was responsible for 49%, with the same ratio applying to any future CapEx expenditures. The gas pools have produced 42 BCF from eight wells since development began in 2007, with the redevelopment program slated to substantially increase that figure.

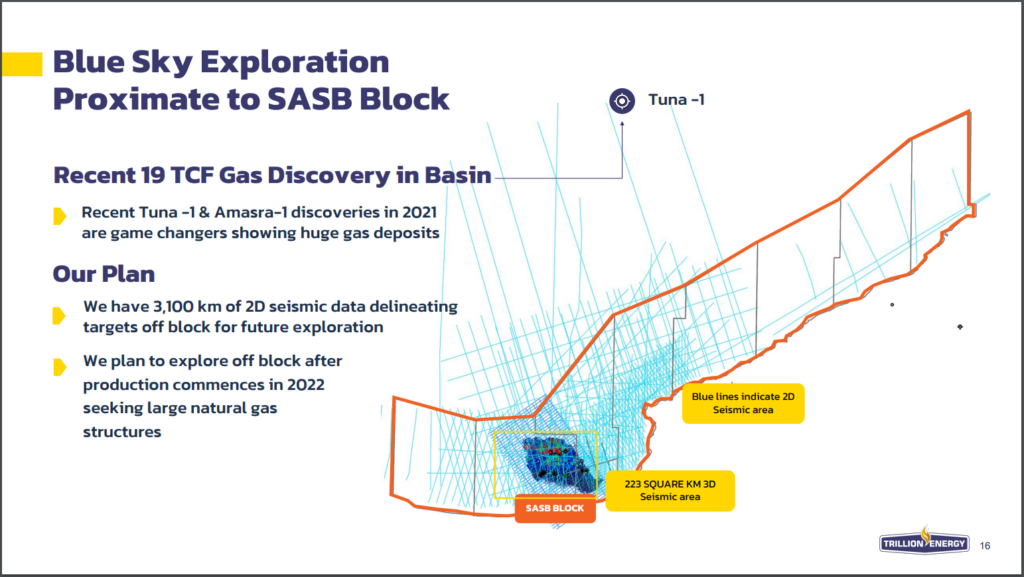

Aside from the current production strategy, Trillion has assembled 3,100 km of 2D seismic data which delineates targets for future exploration, as well data from as geophysical exploration work that indicates there are numerous large discovery prospects for future exploration in the areas surrounding the SASB block, providing Trillion with ongoing blue-sky potential. Adding to Trillion’s blue-sky potential is the 2021 Black Sea discovery of the 19.1 TCF Tuna1 and Amasra-1 gas wells located just 100 miles from the SASB field.

The Cendere Oil Field

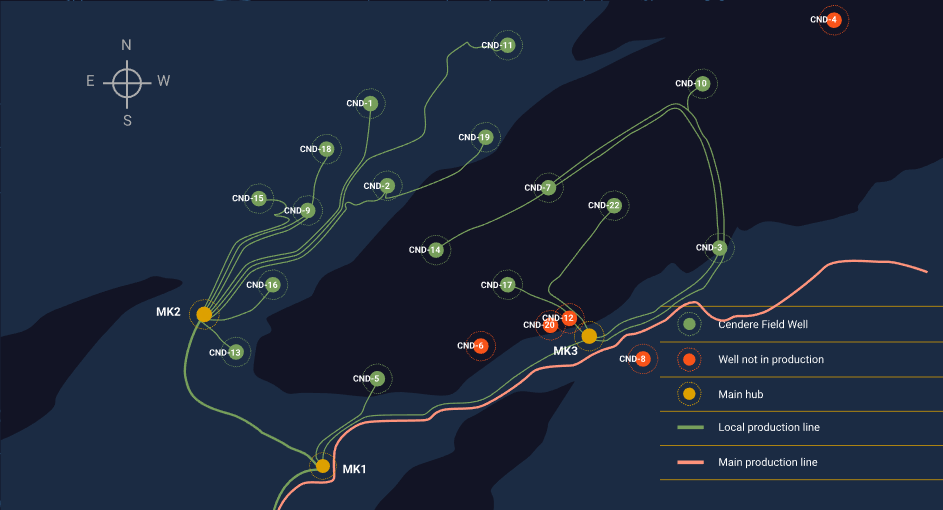

The Cendere onshore oil field is a 25-well long-term, low decline oil field located in South East Turkey. The Cendere Field was first discovered in 1988, and oil production commenced in 1990. Trillion acquired its Cendere position in 2004 and holds 19.6% for all wells except for three wells for which its interest is 9.8%.

Cendere is operated by Turkey’s State-owned oil and gas company, TPAO. The field is a mature, stable, long term/low decline oil producer that consistently produces 130 bopd (barrels oil per day) net to Trillion. The field is located in the South East Anatolian Basin. There are 20 well pads at Cendere, which house 16 producing wells that cover an area of approximately 15 square kilometres. Produced oil is delivered to the TPAO Karakus processing facility and then is transported onwards to the BOTAS-operated oil pipeline.

Cendere has long term production reserves out to 2026, and it is estimated that there is 1.27 million stb (stock tank barrel per cubic foot) (0.234 million stb net to Trillion) that remains to be produced. While the current production rate is 115 bopd, the company and its partner are evaluating horizontal and vertical wells for a potential field extension and increased levels of production.

The asset is said to currently generate US$120,000 to US$140,000 per month in cash flow after operating costs.

Bulgaria

Vranino 1.1

The Vranino asset consists of an exploration license covering 98,205 acres in northeastern Bulgaria. The region itself has seen over 200 wells drilled to date, with Trillion’s property said to consist of 60 stacked gas charged coal seams, which range at depths from 1,300 to 2,100 metres. Gas connections are meanwhile said to be within 15 kilometres of the block.

The Vranino 1-11 coalbed methane gas project in Bulgaria has taken on an increased level of importance due to Russia cutting off gas supplies to Bulgaria after it invaded Ukraine, with the nation previously providing Bulgaria with 90% of its gas supplies. Trillion is now accelerating its exploration activities by planning to drill five new wells at Vranino to capitalize on high natural gas prices.

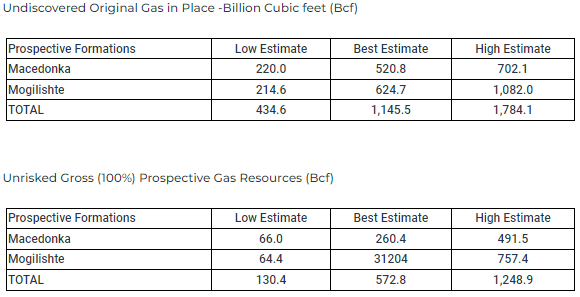

Last April, Trillion provided an update on the project and referred to having engaged Netherland Sewell & Associates to provide an assessment of the potential gas reserves at Vranino. The report produced by the engineering firm estimated undiscovered gas resources to be 1,145 Bcf on a best estimate basis, with the low estimate being 434.6 Bcf, and the highest estimate being 1,784 Bcf.

The company is said to have held meetings with the Bulgarian government to prepare the necessary environmental reports and permitting to conduct a five-well exploration program on the field. This could enable Bulgaria to increase its own domestic gas production to counter the supply disruptions by Russia.

The Management Team

Dr. Arthur Halleran – President, CEO and Director

Dr. Halleran holds a Ph.D. in Geology from the University of Calgary and has served as a director of Trillion Energy since October, 2011. He has 40 years of international petroleum exploration and development experience and has been involved in oil and gas projects in Canada, Colombia, Egypt, India, Guinea, Sierra Leone, Sudan, Suriname, Chile, Brazil, Bulgaria, Turkey, Pakistan, Peru, Tunisia, Trinidad Tobago, Argentina, Ecuador and Guyana. Dr. Halleran has worked for Petro-Canada, Chevron, Rally Energy, Canacol Energy and United Hydrocarbon International Corp. He was the founder of Canacol Energy Ltd., which made a billion-dollar natural gas discovery in Colombia.

Kubilay Yildirim – General Manager (Turkey), Director

Mr. Yildirim has a degree in Petroleum and Natural Gas Engineering from Middle East Technical University and an MBA from Bilgi University in Istanbul. He has spent most of 24-year career with Trillion Energy and its predecessor companies and has extensive experience in drilling, production, seismic acquisition and logistics for both onshore and offshore projects in Turkey. Prior to his appointment to General Manage in 2009, Mr. Yildirim was also involved in sales and divestitures of assets and served in a significant number of managerial positions.

David Thompson Ph.D. – Chief Financial Officer and Director

Dr. Thompson holds a Ph.D. from the University of London and has been a Certified Management Accountant since 1998. He has over 30 years of financial experience in the oil and gas industry. Dr. Thompson was the founder of a Bermuda-based oil trading company and was responsible for its Turkmenistan production operations in the offshore Dzheitune (Lam) and Dzhygalybeg (Zhdanov) oil fields in the Caspian Sea, which discovered producing reserves of 365M barrels oil and 2 TCF gas and successfully raised over $100M in equity. He is Managing Director of AMS Limited, a Bermuda based Management Company and has served in a number of senior financial executive roles at several publicly-traded oil and gas companies.

Dr. Barry Wood – Director

Dr. Wood holds a D. Phil from Oxford University and is a member of the Geological Society of London, The Petroleum Exploration Society of Great Britain and the American Association of Petroleum Geologists. He has over 45 years of extensive experience in the upstream oil and gas industry, having spent most of his career with oil giants Shell Canada and Marathon International Oil Company. During his 16-year tenure at Marathon, Dr. Wood directed asset evaluations across Southeast Asia and the Afro/Arabian regions, and drilling campaigns in Egypt and Syria. In 1998 he founded PetroQuest International SA, a private exploration and advisory firm which he led to new exploration opportunities in Tanzania, Syria and Egypt through the application of his research in reservoir formation. Dr. Wood has also served as a senior advisor with a variety of international oil and gas companies.

The Risks

From our view the following risks are worth considering.

- Price of Natural Gas. Just as natural gas prices can be a catalyst, a potential decline in price would have a negative impact on gas exploration stocks and other commodities.

- Jurisdictional Risk. Turkey is a very natural resource friendly jurisdiction with favourable legal and royalty structures. However, Turkey is located in a geopolitically charged region, with ongoing conflicts in Ukraine and Syria.

- Market Sentiment. Markets can fluctuate wildly as investor expectations can change rapidly depending on the two most common drivers; fear and greed. With the global economy under pressure, this could lead to increasing market volatility.

- Development hiccups. Unforeseen issues could arise amid the current development program. If new wells cannot be successfully brought into production, this could negatively impact the Company’s cash flow and revenues over time and potentially reduce the economic viability of the project.

The Catalysts

Some of the potential catalysts we see that could have an impact on the share price include:

- The price of Natural Gas. The most obvious variable for any natural gas explorer, developer, or producer is the price of natural gas. As the price of natural gas rises so does the net asset value of projects rise, which increases shareholder value.

- The results of continued development. Trillion is currently midway through a multi-well development program that will see a new well going into production every 45 days for the next two years. Barring any unforeseen issues, this should positive impact the financial profile of Trillion Energy.

- Potential future Merger and Acquisition Activity. Due to Trillion management’s extensive experience, expertise, and credibility in Turkey, it has the ability to expand its acreage holdings in the Black Sea, if ongoing exploration work deems it appropriate to do so. Any additional meaningful discoveries could lead to an opportunity for a take out or joint-venture by a larger entity looking to expand into Turkey.

- Potential for moving onto a more senior stock exchange. As Trillion becomes a larger and more consistent producer, it can lead to greater interest from larger investors such as mutual funds and could lead to the company getting listed on a more senior stock exchange, which can provide access to larger capital pools for future expansion or other projects.

- Blue sky prospects. Trillion currently has blue sky prospects for further exploration at its SASB gas field, as well as the potential development of its Bulgarian assets, which could provide further value to the company.

In Conclusion

At the Deep Dive, we like the prospects for natural gas in Turkey, partially as a result of the Russia-Ukraine conflict that has disrupted energy supplies that much of Europe has been dependent on. Turkey is in an ideal position to capitalize on the situation due to its proximity to European markets to help export natural gas to Europe.

While the Russia-Ukraine conflict has elevated the regional risk, we believe that Turkey’s status as a NATO and EU member state gives it a level of insulation. It also strategically controls the only route from the Black Sea to world markets.

Trillion Energy is now producing natural gas and taking advantage of current high prices that could persist for a prolonged period. This has elevated the company from an exploration company to producer status in a relatively short period of time, with further development to serve as a continued catalyst as the firms production profile grows.

FULL DISCLOSURE: Trillion Energy is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Trillion Energy on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.